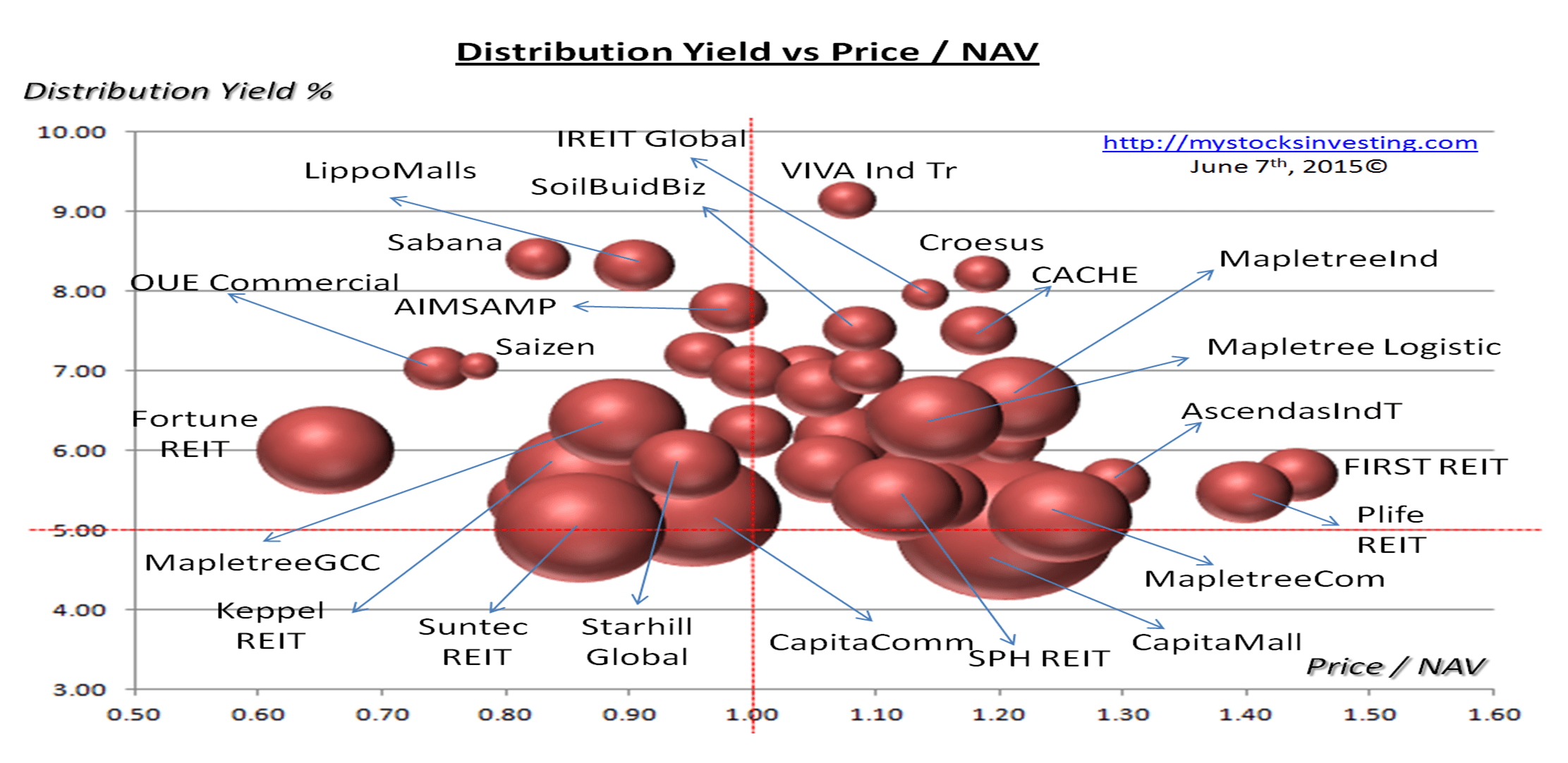

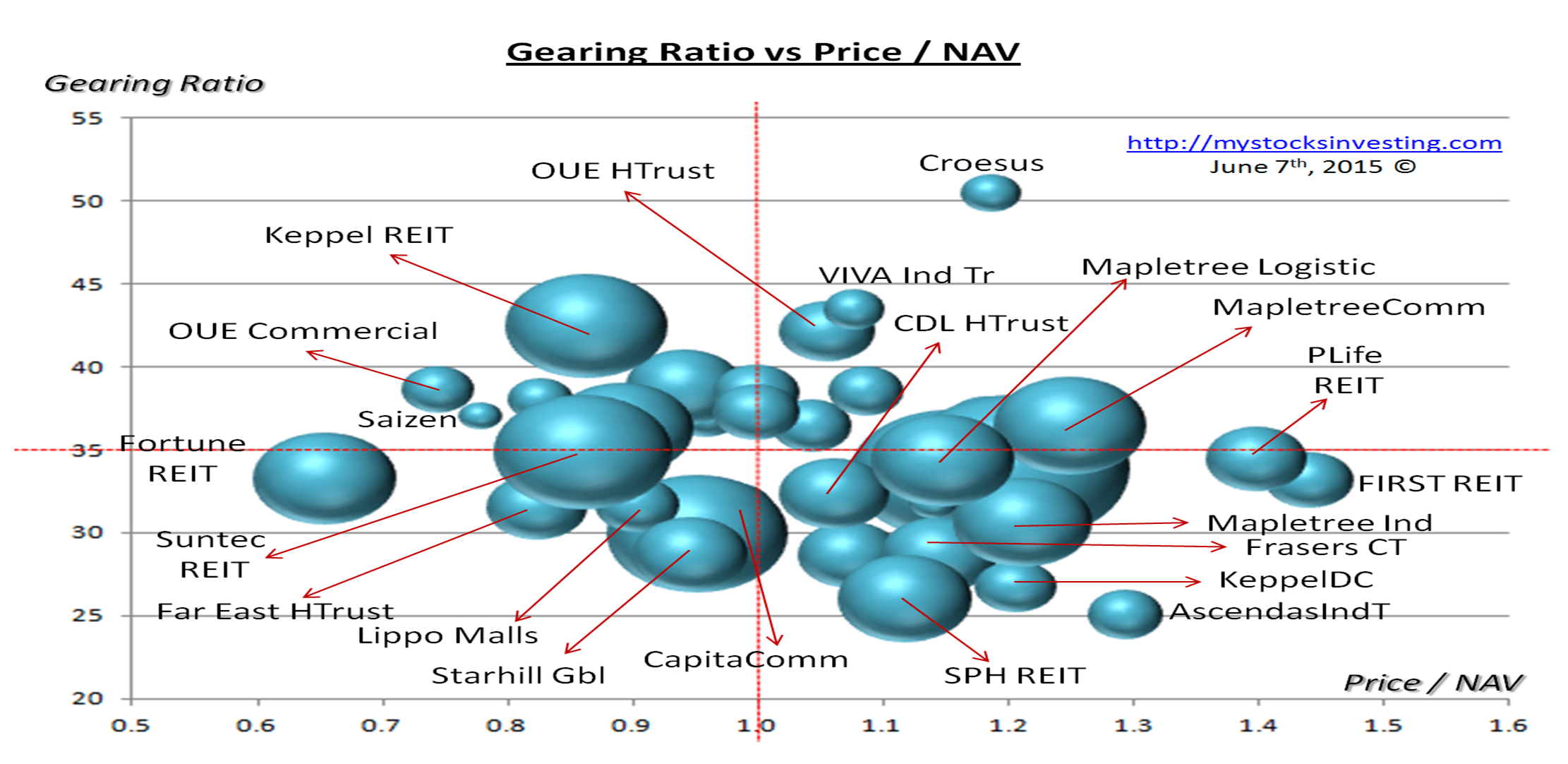

Bubble chart derived from June 1 Singapore REITs Fundamental Comparison Table.

These Bubble Charts are used to show the “relative” position compare to other Singapore REITs.

Two visual bubble charts to pick and avoid:

- Undervalue Singapore REITs with High Distribution Yield (Value Pick)

- Overvalue Singapore REITs with High Gearing Ratio (Risk Avoidance)

See last Singapore REIT Bubble Charts here to see the relative movement.

Still don’t understand how to use the Singapore REIT Bubble Chart? Find out how to use Bubble Charts to do Singapore REIT Selection here and understand the meaning of Price/NAV, Distribution Yield and Gearing Ratio here.