Marked BUBBLE in black! Amazingly people is willing to overpay > 70% of the value to invest in First REIT and Parkway Life REIT.

Compare to last month SREIT comparison table:

- Price/NAV increases from 1.20 to 1.22

- Dividend Yield drops from 5.34% to 4.97%

- Gearing Ratio drops from 33.15% to 32.92%

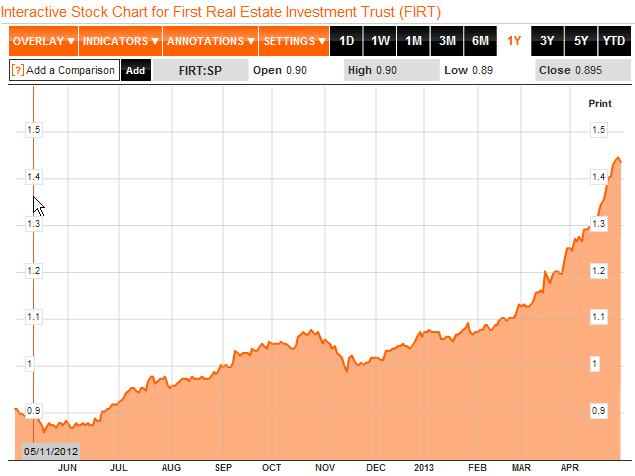

First REIT chart shows Parabolic Curve.

Parkway REIT is at almost historical high.

Doing Fundamental Analysis of Singapore REIT is relatively easier than stock. If you are interested to learn how to do research on Singapore REIT and also time the entry / exit by learning the simple Trend Analysis, you may want to check out my 1st public tutorial “How to pick Singapore REIT for Dividend Investing” .