Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 640.40 to 630.80 (-1.50%) compared to last month’s update. The REIT Index is currently forming a big descending triangle and seems like forming a base close to 620-630 support zone.

- Short-term direction: Down

- Medium-term direction: Sideways

- Long-term direction: Down

- Immediate Support at 623

- Immediate Resistance at 20D SMA, followed by 50D SMA

FTSE REIT Index Chart (2 years)

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on June 2nd, 2024.

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- REITs with yellow highlights have the latest Q1 2024 values.

- I have introduced weighted average (weighted by market cap) to the financial ratios, in addition to the existing simple average ratios. This is another perspective where smaller market cap REITs do not disproportionately affect the average ratios.

Data from REITsavvy Screener. https://screener.reitsavvy.com/

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of July 5th, 2024.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs are referenced to SG Gov Bond Yield.

As of May 2024, all REITs’ Yield Spread will be referenced to SG Gov Bond Yields, regardless of trading currency.

Price/NAV Ratios Overview

- Price/NAV decreased to 0.77 (Weighted Average: 0.77)

- Decreased from 0.78 in June 2024.

- Singapore Overall REIT sector is undervalued now.

- Price/NAV increased due to NAV trending downwards from the latest Q4 2023 update.

- Most overvalued REITs (based on Price/NAV)

EC World REIT 2.15 ParkwayLife REIT 1.55 Keppel DC REIT 1.34 Mapletree Industrial Tr 1.20 Capitaland Ascendas REIT 1.16 AIMS APAC REIT 0.96 - Only 5 REITs are overvalued now based on Price/NAV value.

- Most undervalued REITs (based on Price/NAV)

Prime US REIT 0.19 Manulife US REIT 0.19 Keppel Pacific Oak US REIT 0.19 Lippo Malls Indonesia Retail Trust 0.27 ARA Hospitality Trust 0.40 OUE REIT 0.43

Distribution Yields Overview

- TTM Distribution Yield increased to 8.05%. (Weighted Average increased to 6.63%)

- Increased from 7.88% in June 2024. (Weighted Average was 6.51%)

- 22 of 40 Singapore REITs have ttm distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- 8 REITs have a ttm yield of over 10%!

- Highest Distribution Yield REITs (ttm)

Prime US REIT 23.98 Keppel Pacific Oak US REIT 18.80 Elite Commercial REIT 12.86 United Hampshire REIT 12.13 ARA Hospitality Trust 12.04 IREIT Global 11.85 Reminder that these yield numbers are based on current prices.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread widened to 4.82%. (Weighted Average remained almost the same at 3.93%)

- Widened from 4.52% in June 2024. (Weighted Average was 3.92%)

- From May 2024 onwards, all my yield spread measurements are now in relation to SG Gov Bond Yields, no longer a mix with US Gov Bond Yields.

Gearing Ratios Overview

- Gearing Ratio remained at 39.21%. (Weighted Average: 38.26%)

- Remained at 39.21% in June 2024. (Weighted Average: 38.25%)

- Gearing Ratios are updated quarterly. Therefore there are no gearing ratio updates this month.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

EC World REIT 57.2 Manulife US REIT 56.7 Prime US REIT 48.1 ARA Hospitality Trust 44.1 Lippo Malls Indonesia Retail Trust 43.7 Keppel Pacific Oak US REIT 43.0 MUST and EC World REIT’s gearing ratio has exceeded MAS’s gearing limit of 50%. However the aggregate leverage limit is not considered to be breached if exceeding the limit is due to circumstances beyond the control of the REIT Manager.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation decreased by 1.85% to S$84.39 Billion.

- Decreased from S$85.98 Billion in June 2024.

- Biggest Market Capitalisation REITs (S$m):

Capitaland Integrated Commercial Trust 13233.50 Capitaland Ascendas REIT 11169.00 Mapletree Pan Asia Commercial Trust 6408.66 Mapletree Logistics Tr 6392.32 Mapletree Industrial Tr 5981.85 Frasers Centrepoint Trust 3701.52 Mapletree Pan Asia Commercial Trust overtook Mapletree Logistics Trust this month in market cap!

- Smallest Market Capitalisation REITs (S$m):

Manulife US REIT 115.92 Elite Commercial REIT 118.33 Lippo Malls Indonesia Retail Trust 130.83 Prime US REIT 134.47 Keppel Pacific Oak US REIT 138.32 ARA Hospitality Trust 164.79

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, scroll down for more information on the REITs courses.

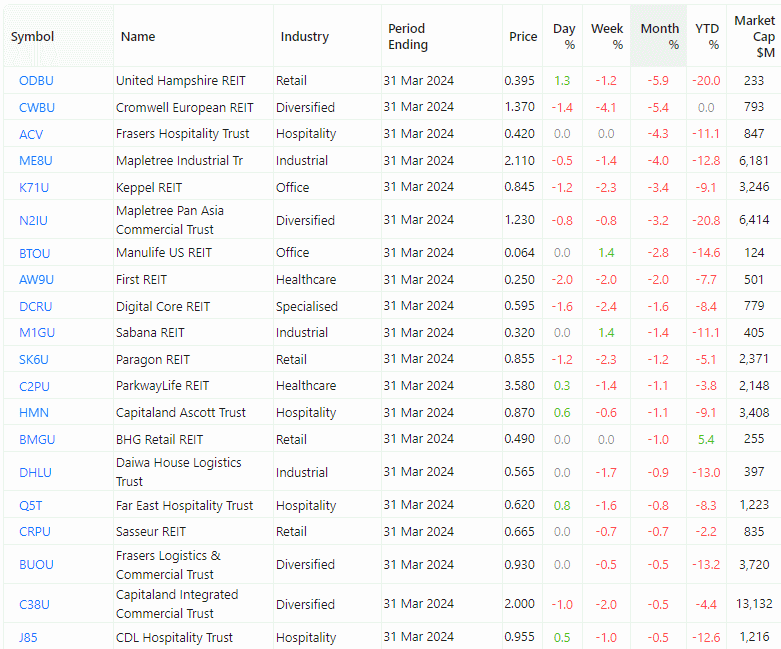

Top 20 Best Performers of June 2024

Source: https://screener.reitsavvy.com/

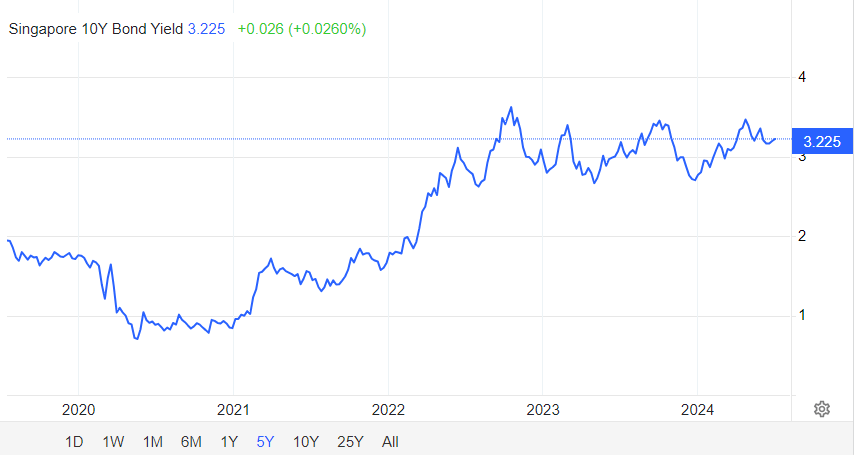

SG 10 Year Government Bond Yield

- SG 10 Year: 3.23% (decreased from 3.39%)

Summary

The index is currently consolidating within a descending triangle waiting for the breakout with the immediate support zone between 620-630.

S-REIT sector is currently trading close to COVID low, which considered a good entry points again based on the current chart pattern, valuation, DPU yield and projected interest rate movement. Current yield @6.5% with 20-30% upside potential based on fair book valuation.

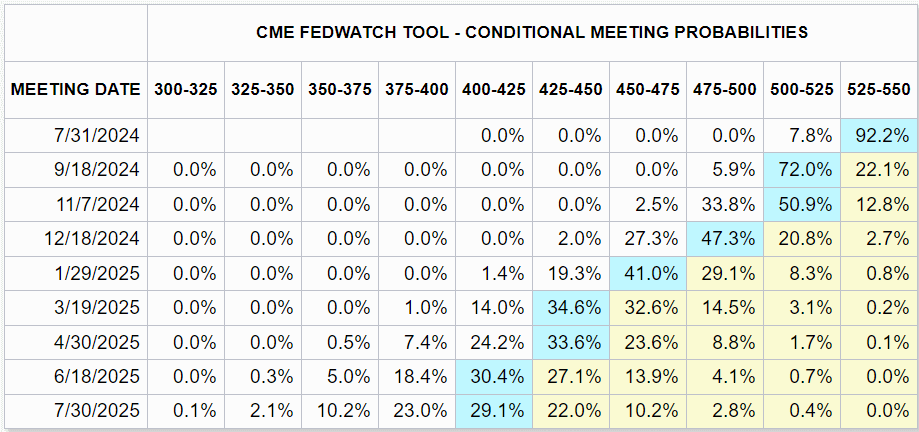

The cut in US Interest Rate and the drop in US 10 Years Bond Yield would be the key catalysts to kick start the Singapore REIT sectors again. Until that happens, investors need to continue to wait patiently while collecting the dividend. Patience is needed at the moment for REITs investors.

US 10 Year Risk Free Rate

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement