Frasers Commercial Trust (FCOT) Fundamental Analysis base on Investor Meeting on June 20-2015.

- Last Done Price = $1.455

- Market Cap = $2.75 B

- NAV = $1.55

- Price / NAV = 0.94 (6% Discount)

- Price / NAV (High) = 1.02

- Price / NAV (Low) = 0.60

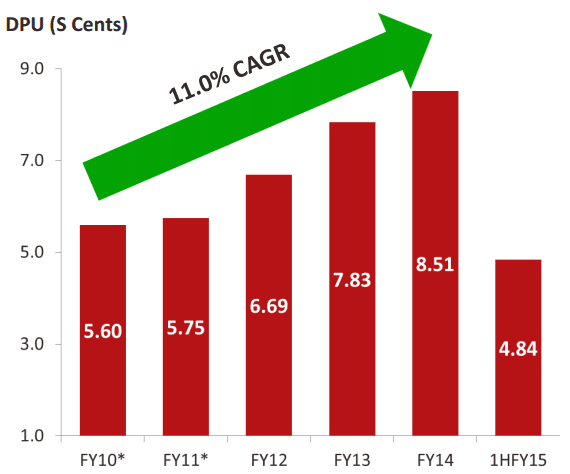

- Distribution Yield = 6.29%

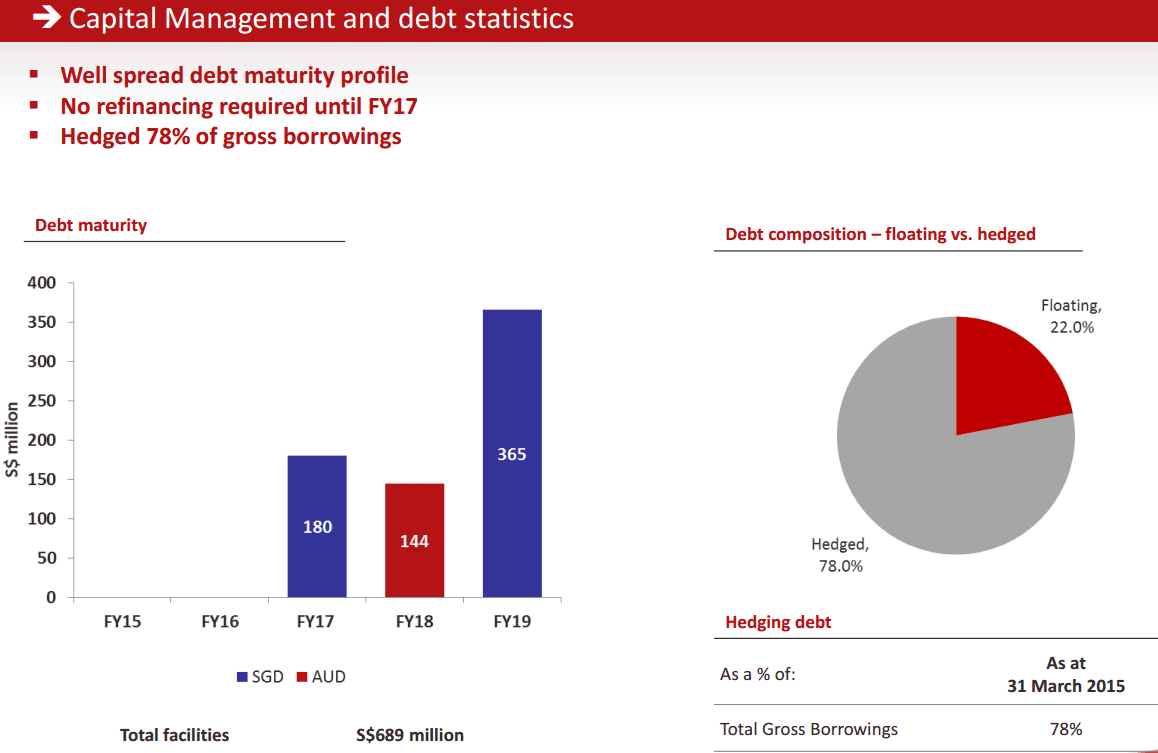

- Gearing Ratio = 37.2%

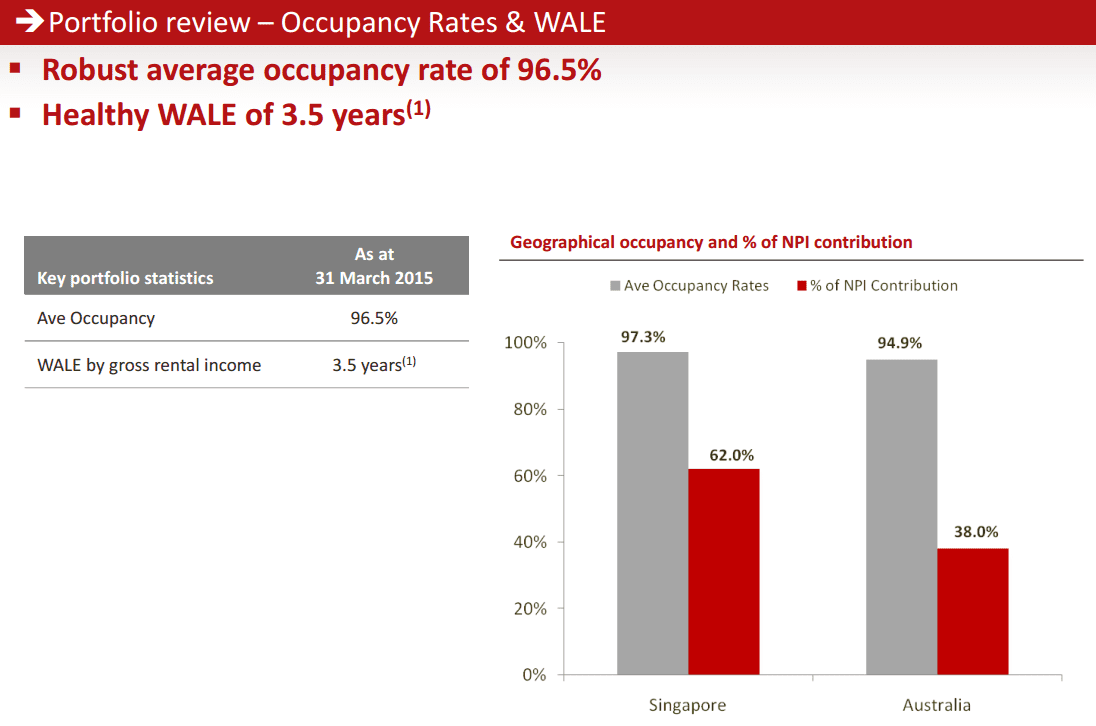

- WALE = 3.5 Years

- Occupancy Rate = 96.5%

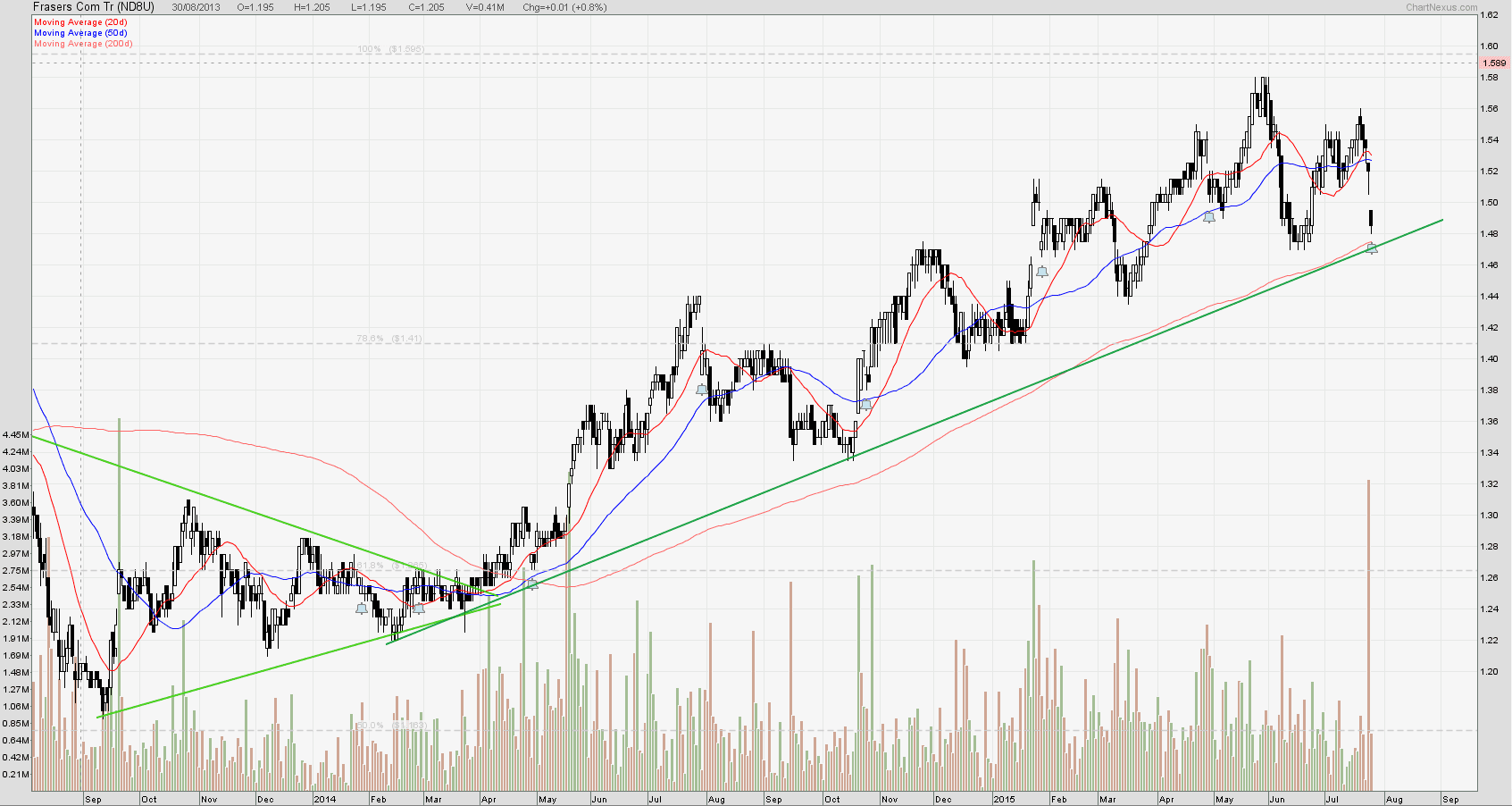

Frasers Commercial Trust Technical Analysis

Frasers Commercial Trust (FCOT) is still trading above the 200D SMA support and still maintain a long term up trend. However, investors have to be cautious because a Head and Shoulder (trend reversal) chart pattern is in formation. Watch whether FCOT can stay above 200D SMA support.

Check out Singapore REIT Course Detail here to learn how to conduct Trend Analysis & Fundamental Analysis for Singapore REIT. https://mystocksinvesting.com/course/singapore-reits-investing/