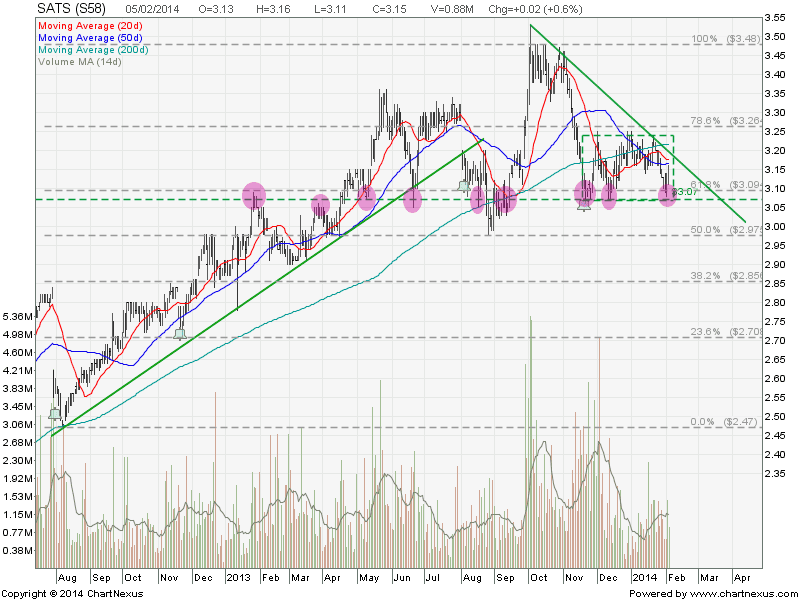

SATS is holding well during the January 2014 worldwide sell off. The key question is: How Long can SATS continue to hold and avoid being sold off?

Base on the chart, SATS is currently trading in a Rectangle and also the Descending Triangle with a crucial resistance turned support zone between $3.07 and $3.10. This support zone coincides with the 61.8% Fibonacci Retracement Level. Upside is very limited as there are many resistances (20D, 50D, 200D SMA), Rectangles resistance and the Descending Triangle resistance from $3.16 to $3.24.

Original post by Marubozu from My Stocks Investing Journey.

Fundamental Data for SATS

| Current P/E Ratio (ttm) | 18.7500 |

|---|---|

| Estimated P/E(03/2014) | 16.7553 |

| Relative P/E vs. FSSTI | 1.4917 |

| Earnings Per Share (SGD) (ttm) | 0.1680 |

| Est. EPS (SGD) (03/2014) | 0.1880 |

| Est. PEG Ratio | 1.7656 |

| Market Cap (M SGD) | 3,532.90 |

| Shares Outstanding (M) | 1,121.56 |

| 30 Day Average Volume | 916,733 |

| Price/Book (mrq) | 2.5450 |

| Price/Sale (ttm) | 1.9475 |

| Dividend Indicated Gross Yield | 3.49% |

| Cash Dividend (SGD) | 0.0500 |

| Dividend Ex-Date | 11/19/2013 |

| 5 Year Dividend Growth | 1.39% |

| Next Earnings Announcement | 02/11/2014 |

..

VALUATION RATIOS

| Company | Industry | Sector | |

|---|---|---|---|

| P/E Ratio (TTM) | 17.31 | 19.48 | 1,065.88 |

| P/E High – Last 5 Yrs. | 16.87 | 104.42 | 43.28 |

| P/E Low – Last 5 Yrs. | 8.90 | 30.42 | 10.59 |

Summary

Fundamentally SATS is not cheap base on PE Ratio as current PE (TTM) is at the high end of PE High for the last 5 years. Dividend yield at 3.49% is not very attractive as there are other blue chip stocks or REIT with more attractive dividend yield.

Technically SATS upside is capped by the down trend line and there is a danger of breaking the crucial support. It is expected more selling to come if the support is broken. Good candidate to short with price target of $2.90 (Rectangle) and $2.70 (Descending Triangle).