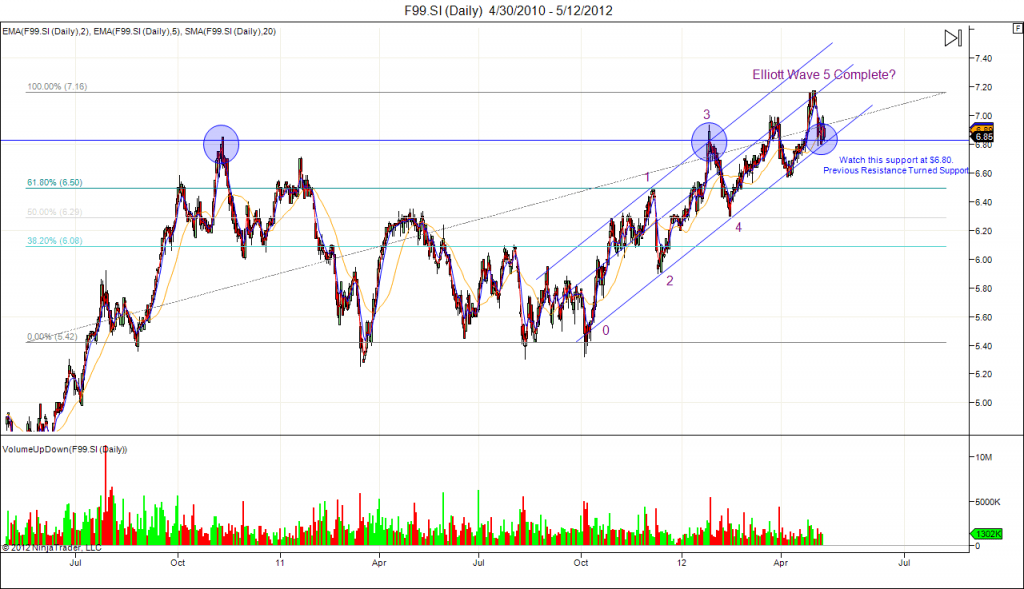

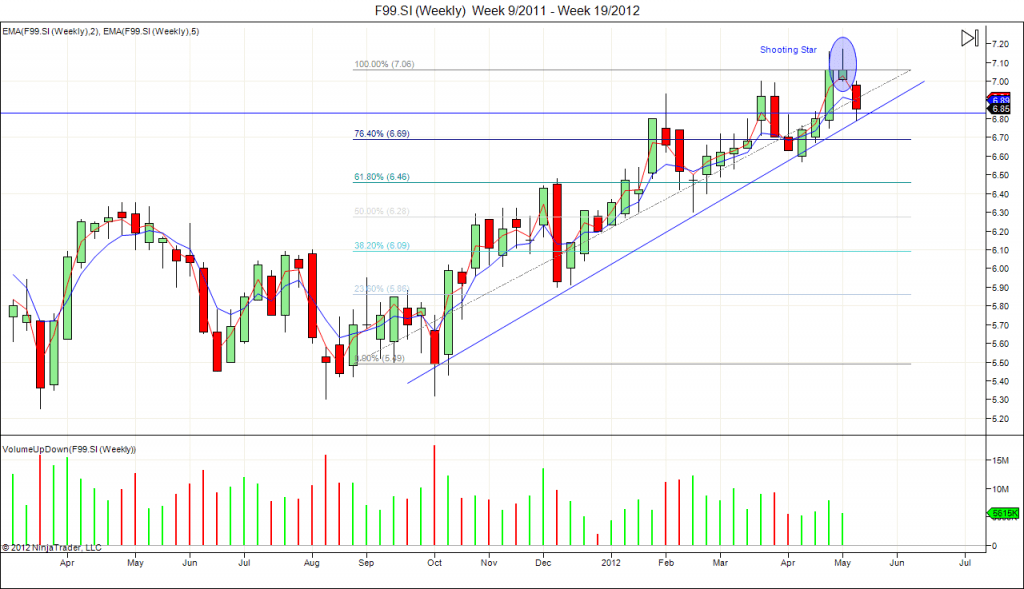

Capitaland: Elliott Wave 5 Now?

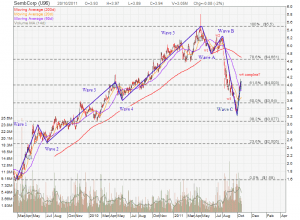

Capitaland has been following a nice Elliott Wave with nice Fibonacci Retracement (61.8%, 161.8%). There is a change to have an almost perfect Elliott Wave 1-5 pattern if Capitaland can stay above the 20D SMA to reach the 261.8% target of $3.31. Alternatively, if Capitaland break the uptrend channel support & 20D SMA at about $3.00, the Elliott Wave has to be redrawn to be Wave C.

- Immediate Resistance to watch: $3.15

- Immediate Support to watch: $3.00

Key Statistics for CAPL

| Current P/E Ratio (ttm) | 12.1344 |

|---|---|

| Estimated P/E (12/2012 ) | 21.4685 |

| Earnings Per Share (SGD) (ttm) | 0.2530 |

| Est. EPS (SGD) (12/2012) | 0.1430 |

| Est. PEG Ratio | 0.7878 |

| Market Cap (M SGD) | 13,048.96 |

| Shares Outstanding (M) | 4,250.47 |

| Enterprise Value (M SGD) (ttm) | 25,638.30 |

| Enterprise Value/EBITDA (ttm) | 35.08 |

| Price/Book (mrq) | 0.8632 |

| Price/Sale (ttm) | 4.1151 |

| Dividend Indicated Gross Yield | 1.9544 |

| Next Earnings Announcement | 10/19/2012 |