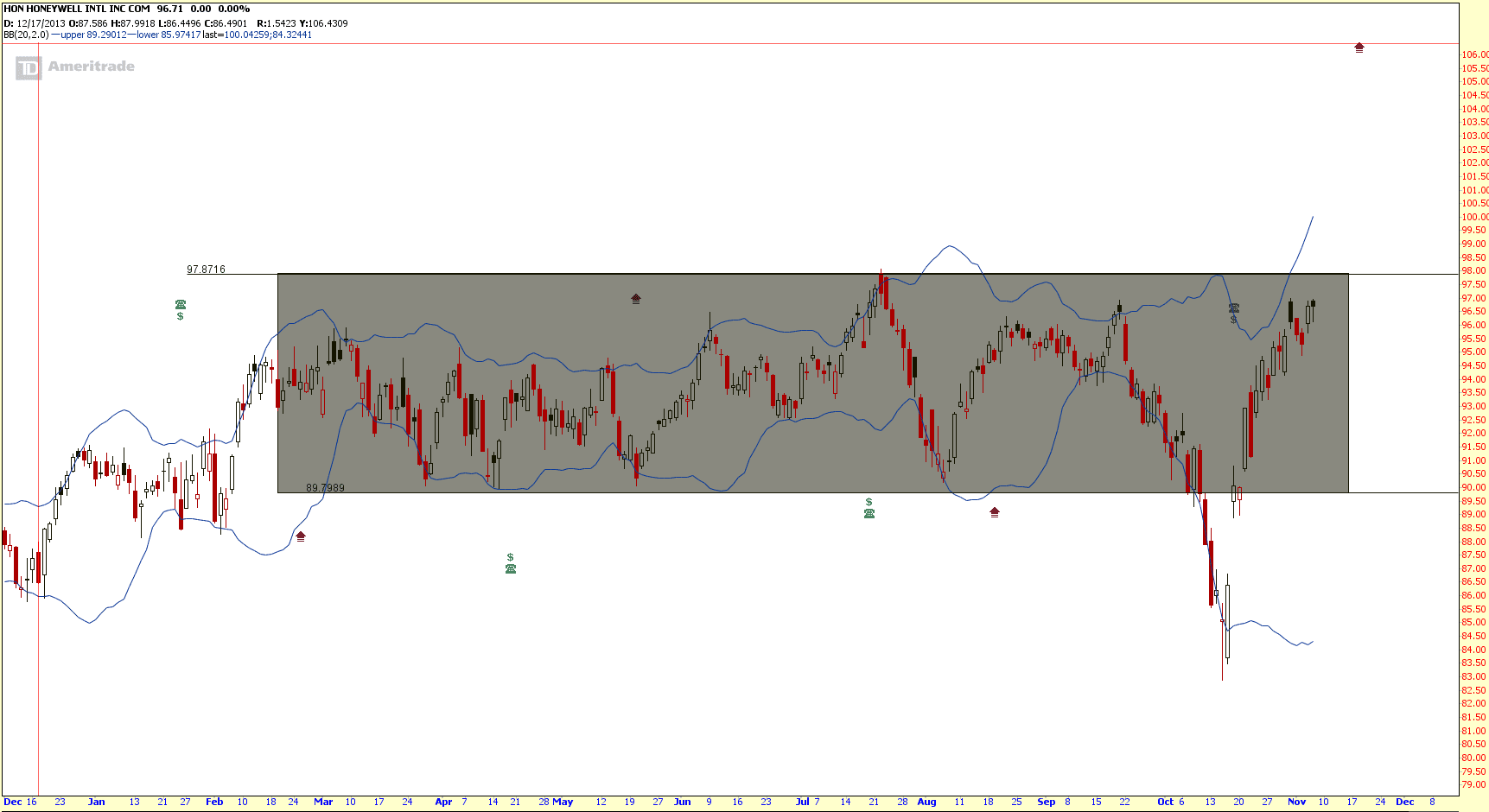

Honeywell (HON): Shorting Opportunity!

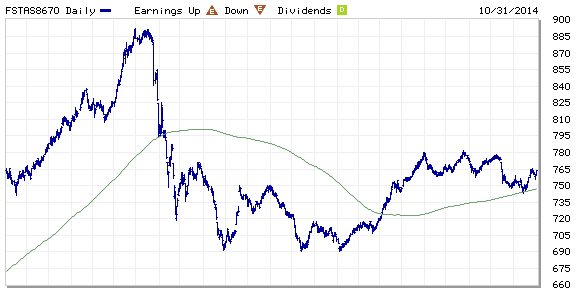

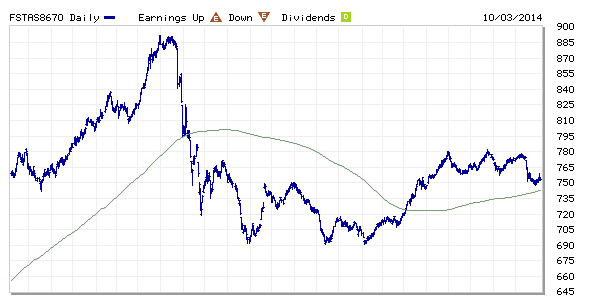

Honeywell is currently trading within the range between $90 and $98. HON is facing the Rectangle resistance with a Hanging Man.

A few ways to short sell US stocks:

- Long Put Option – Almost unlimited profit (when stock price reaches zero) with maximum loss defined but time sensitive.

- Short using CFD (Contract for Difference) – Almost unlimited profit (when stock price reaches zero) but unlimited losses also (when the stock price goes up to infinity theoretically)

- Short Vertical Call Spread – Limited Profit Limited Loss.

Note: When the stock market is at the high (especially now at historical high), it is essential for everyone to learn how to short sell safely. Short selling is a very important skill for a trader and investor (to hedge the portfolio which already making money).

Original Post by Marubozu My Stocks Investing Journey