Crude Oil have reached the critical resistance turned support (at about $43 from the chart) after entering into a Bear Market. The recent plunge for oil into bear-market territory, defined as a drop from a recent peak of at least 20%, comes as a consortium led by the Organization of the Petroleum Exporting Countries have failed to stabilize prices, despite a recently reupped pact to limit production until March 2018.

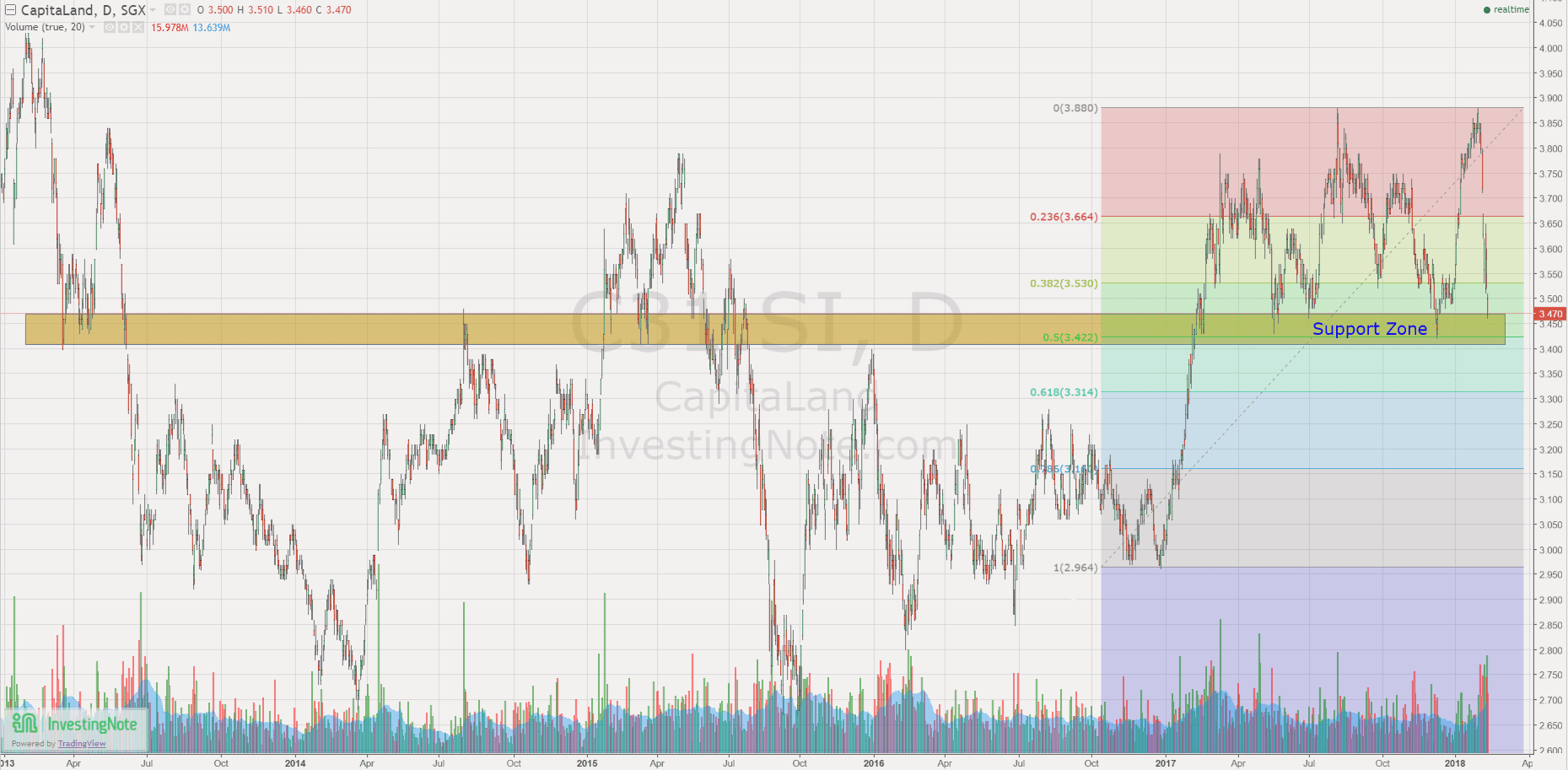

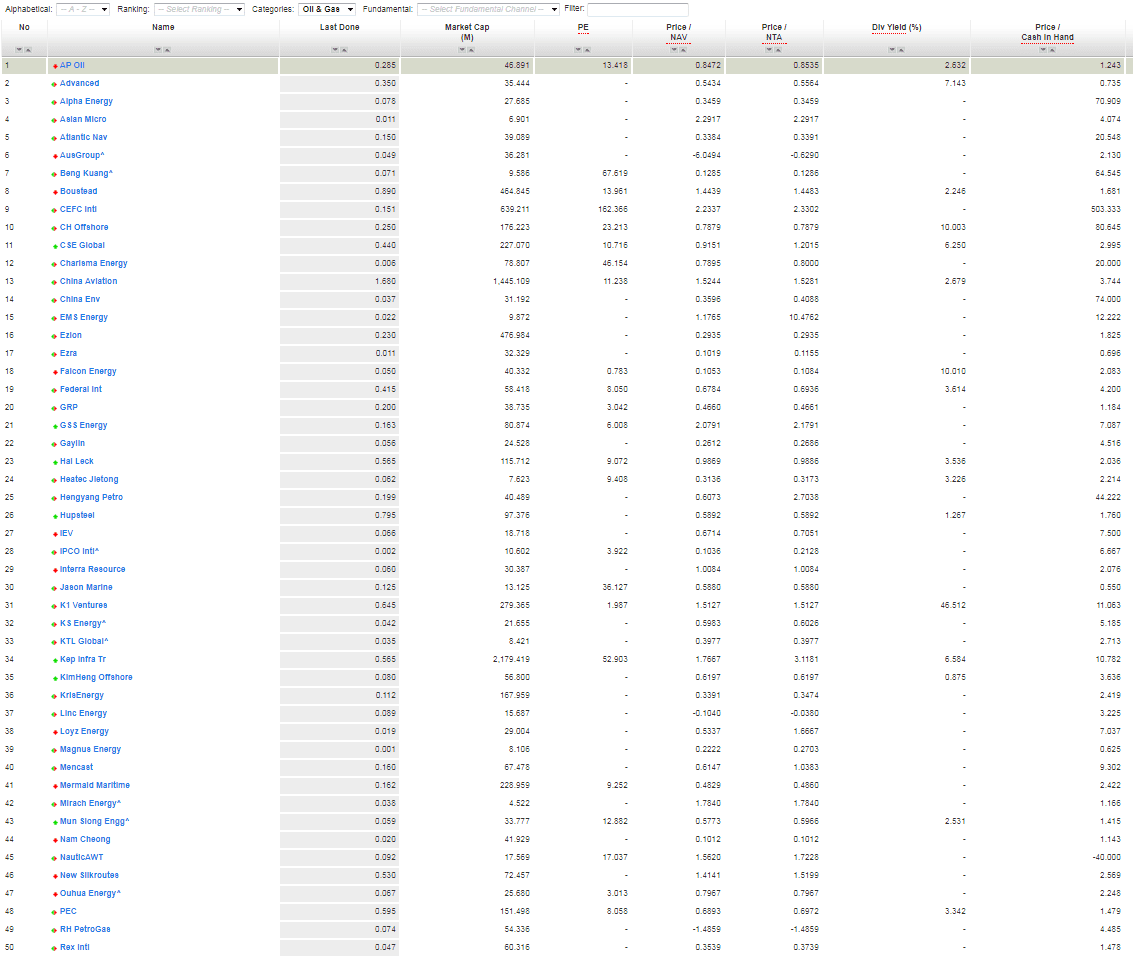

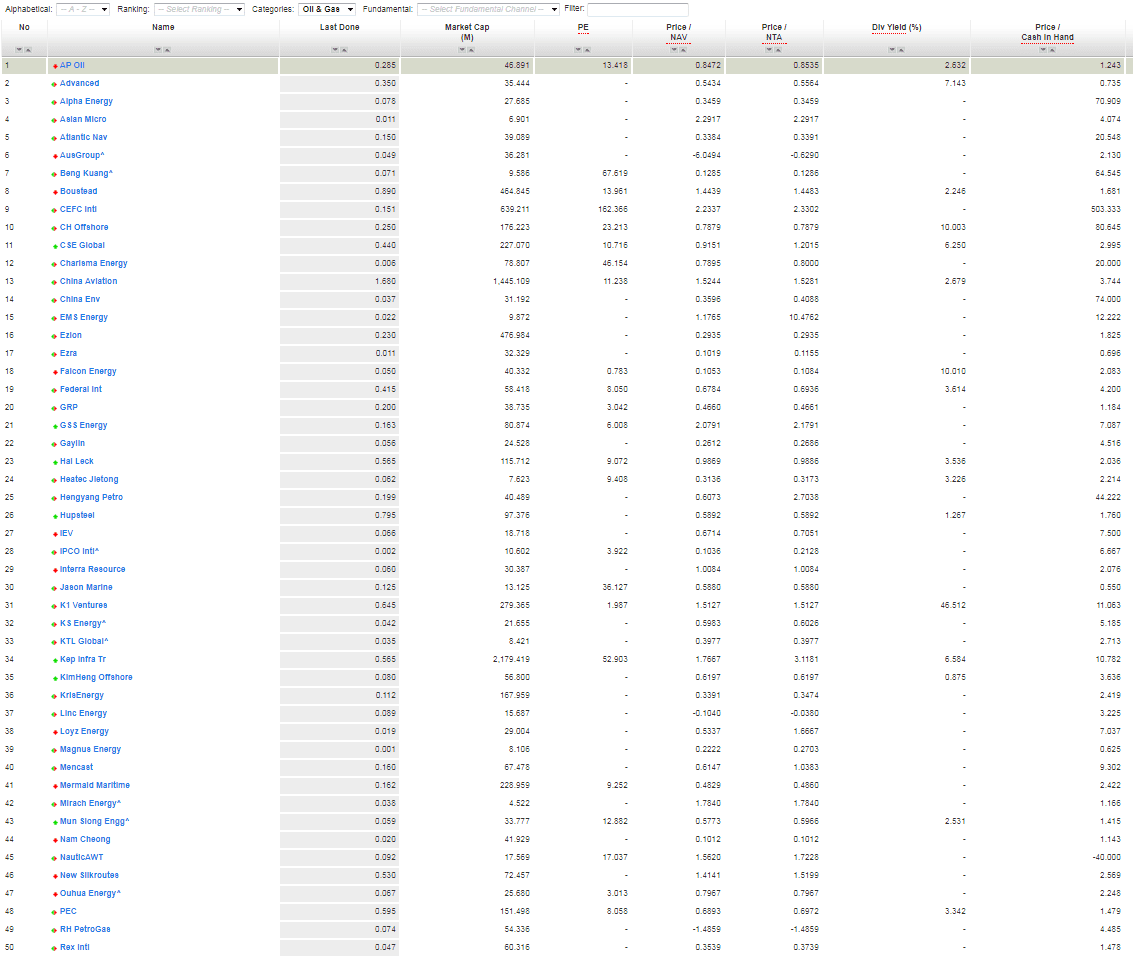

If this $43 support holds, a Dead Cat Bounce to the down trend channel resistance is expected. Dead Cat Bounce is an opportunity to get out in the bear market. If you are holding all oil & gas sensitive stocks and corporate bonds in Singapore like Keppel Corp, SembCorp and other 50 stocks I have screened using ShareInvestor, prepare for the rough ride if the Crude Oil break the $43 critical support and further downside is expected. It is time to review your portfolio what is your exposure to the energy and Oil & Gas sector, and re-balance or hedge your portfolio if necessary.

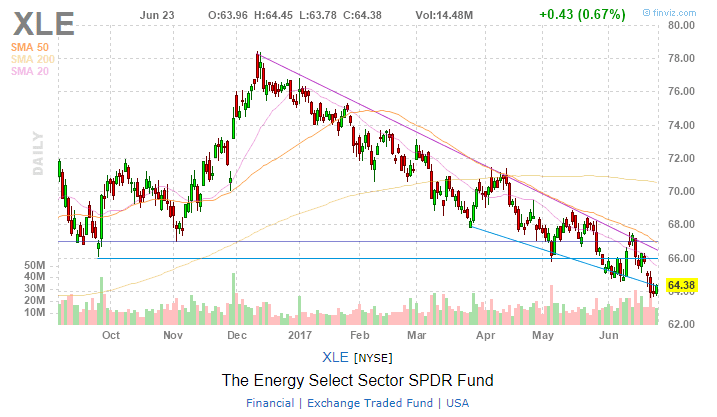

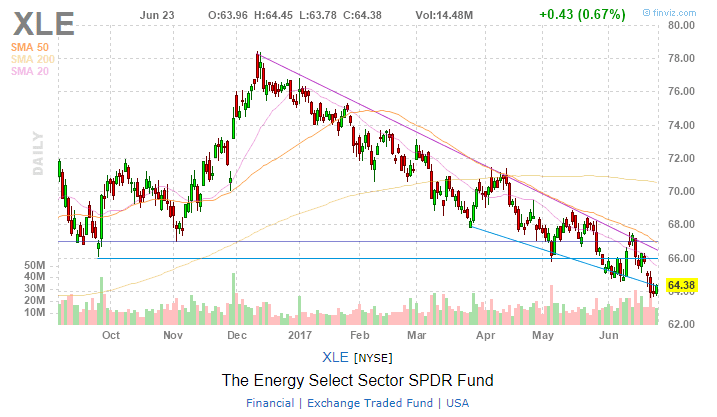

Energy Sector ETF (XLE) is also trading in a clear down trend.

Last word: Trade & Invest based on what you see, NOT based on what you think, what you hope and what you hear.

Start review your portfolio NOW !

Safe investing!