Weekly Inter Market Analysis Dec 31-2016

See previous week Weekly Inter Market Analysis.

Original post from https://mystocksinvesting.com

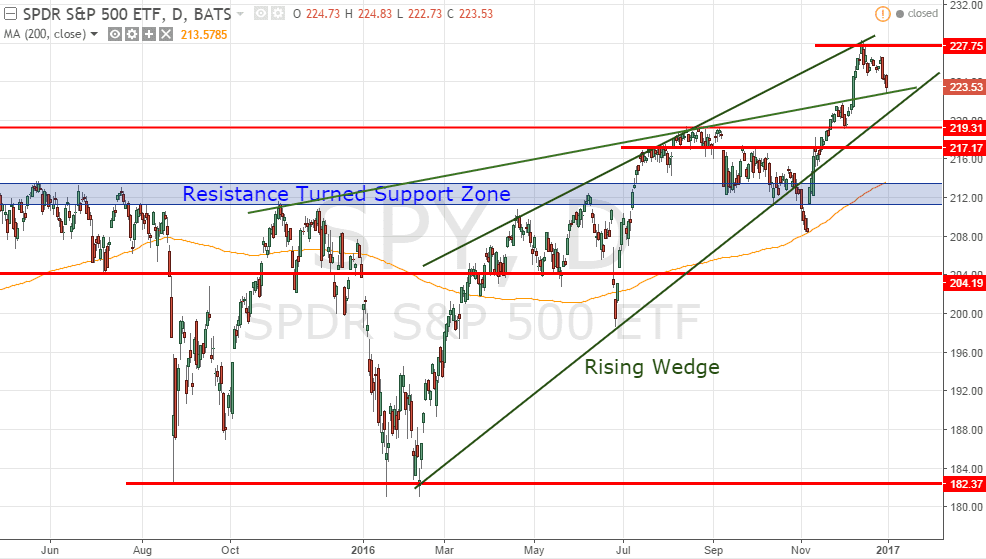

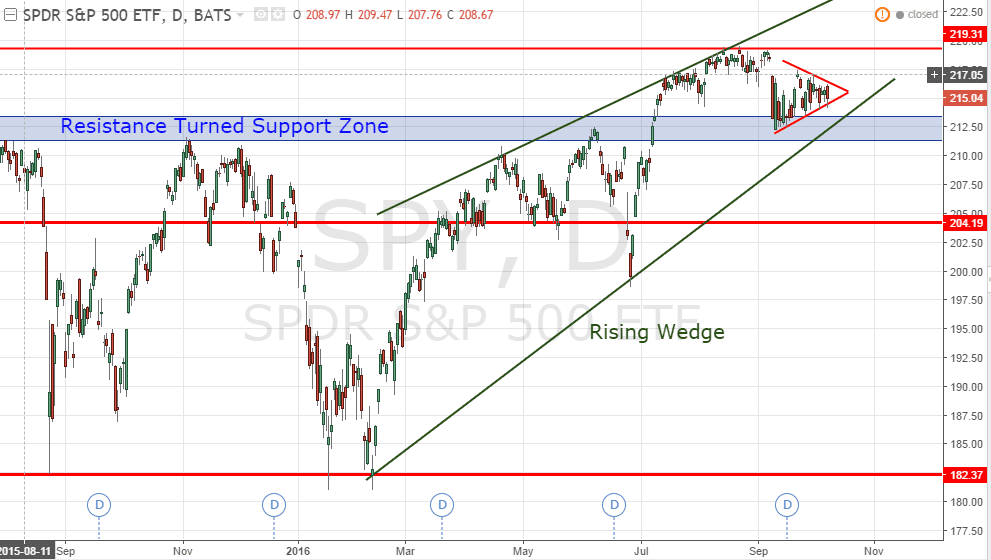

SPY (SPDR S&P500 ETF)

Profit taking after SPY reached the all time high of 227.75 entering into 2017. A healthy retracement is needed for SPY to move higher. Take note that the bullish between Nov to April seasonal cycle is going to start.

- Immediate resistance – 227.75

- Immediate support: about 219-220. (have to turn to support for SPY to move higher)

- Resistance turned support zone: 211-213.

- 200D SMA support (trending up): about 213.5

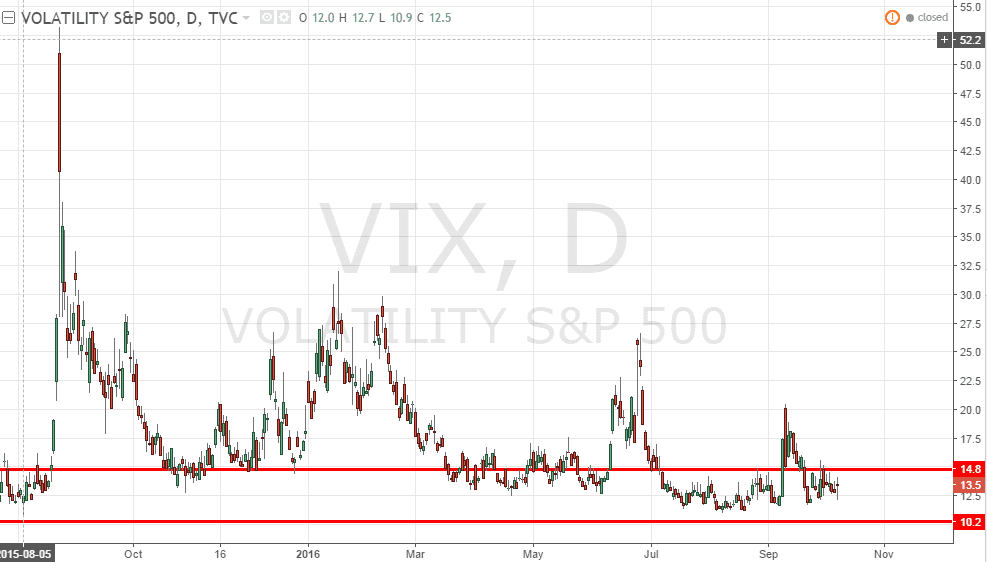

VIX

VIX continues to stay within the complacent zone at 14.0. No fear entering into 2017.

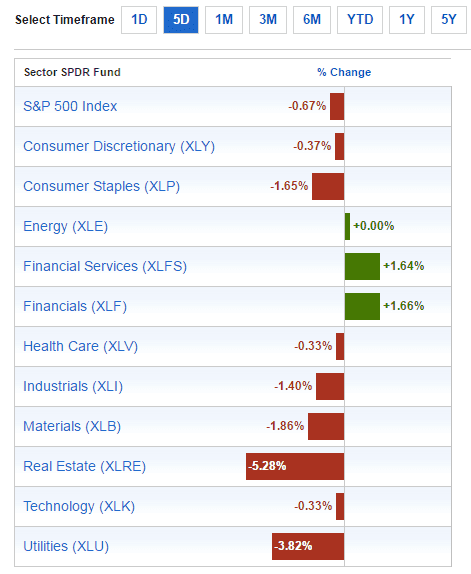

Sector Performance (SPDR Sector ETF)

- Best Sectors: Real Estate (XLRE) +1.38%

- Worst Sector: Financial (XLF) -1.44%.

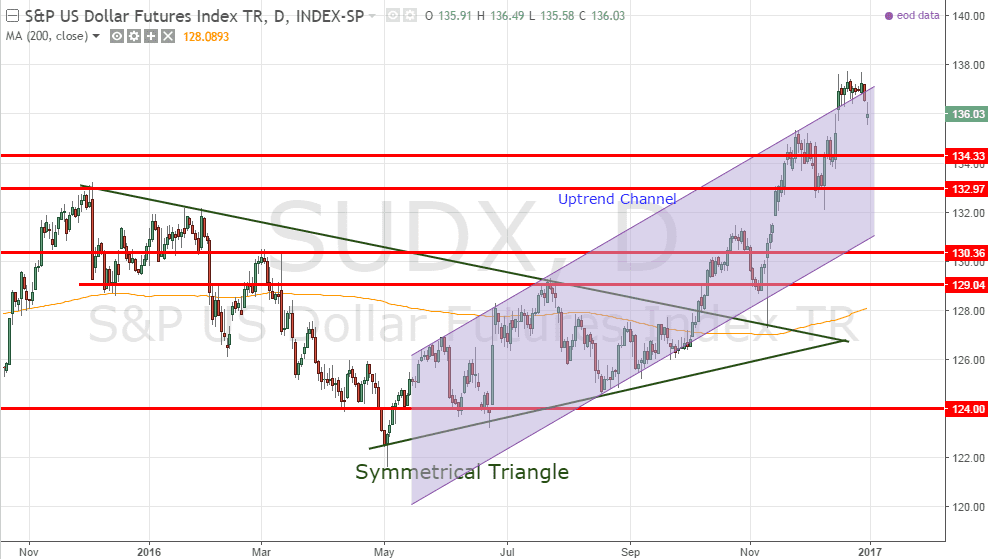

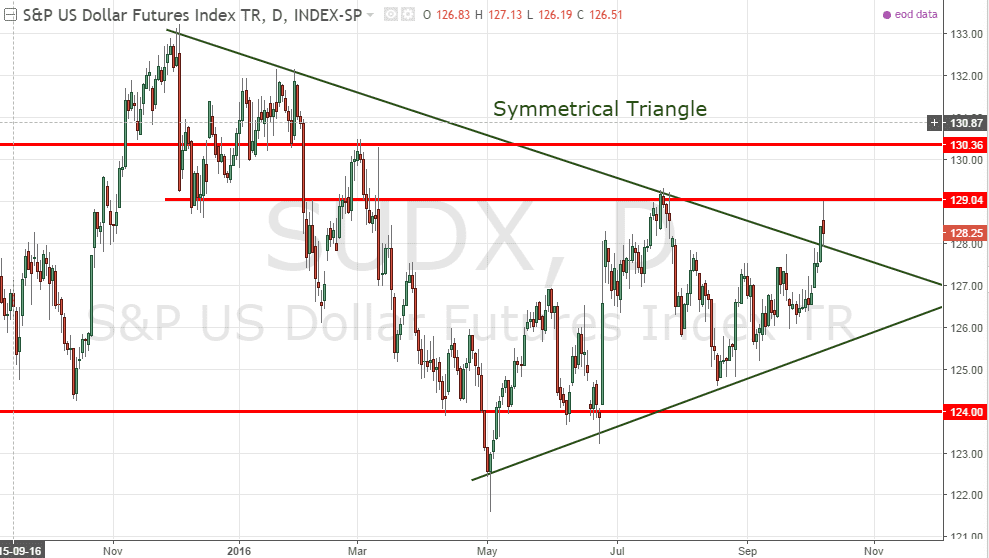

SUDX (S&P US Dollar Futures Index)

SUDX is currently facing resistance at about 138 and currently take a breather. The trend remains up for US Dollar.

FXE (Currency Shares Euro ETF)

FXE rebounded from the support at around 100.65 but is still trading within a down trend channel. A Shooting Star candlestick is formed at the down trend channel resistance, a potential reversal in the coming weeks.

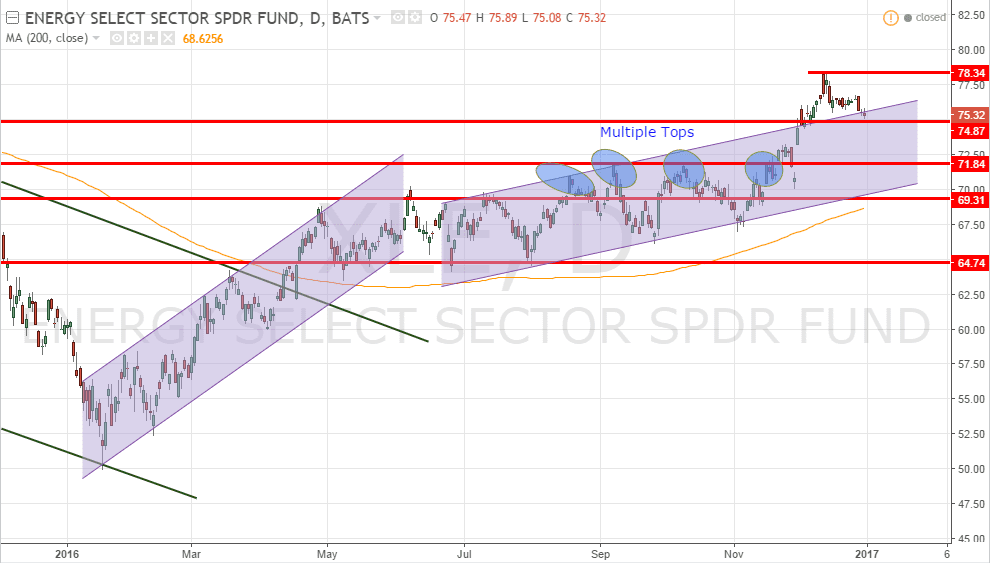

XLE (SPDR Energy Sector ETF)

XLE is currently retracing after hitting the recent high of 78.34. If XLE can find the support at 74.87 or 71.84, the bull has strength to move XLE higher.

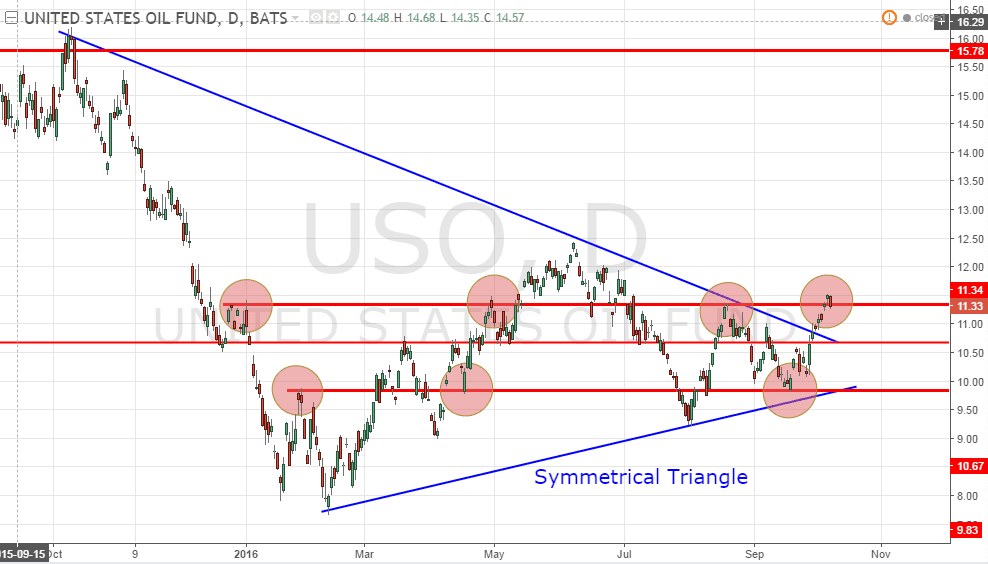

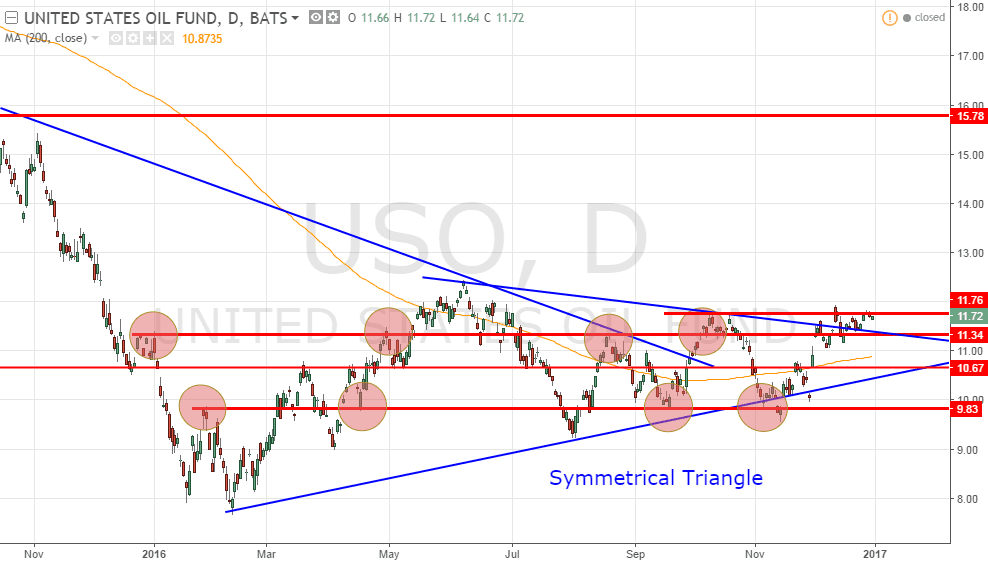

USO (United States Oil Fund)

USO is currently facing the rectangle resistance zone. USO is still trading side way until a more convincing breakout.

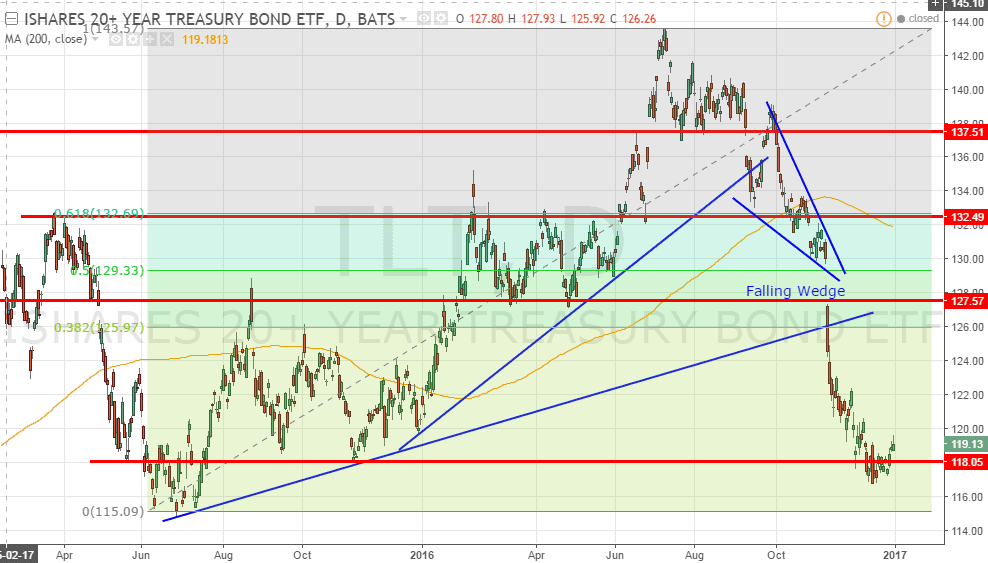

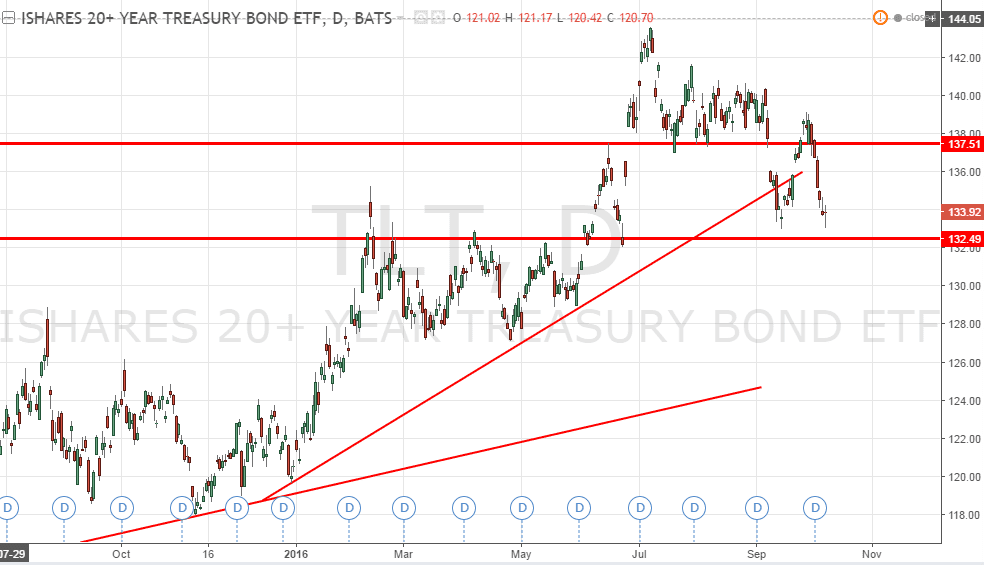

TLT (iShares 20+ Years Treasury Bond ETF)

TLT is finding support at 117-118. Wait for the reversal and re-look at the bond market for bargain hunting. Some of the bonds can be very attractive after the recent sell off.

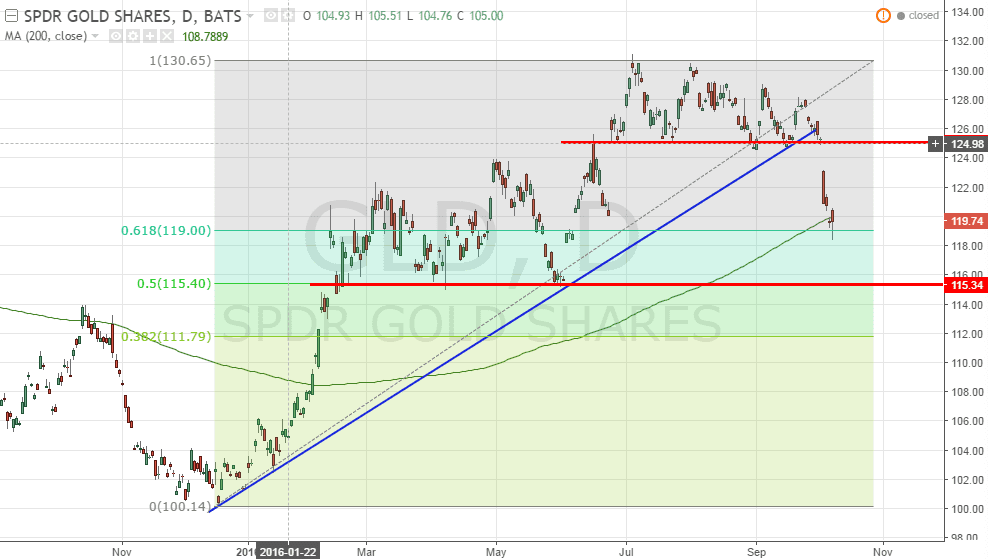

GLD (SPDR Gold Shares)

GLD is rebounding from the support at about 107 after the huge sell off. Will it rebound strongly from here entering into 2017?

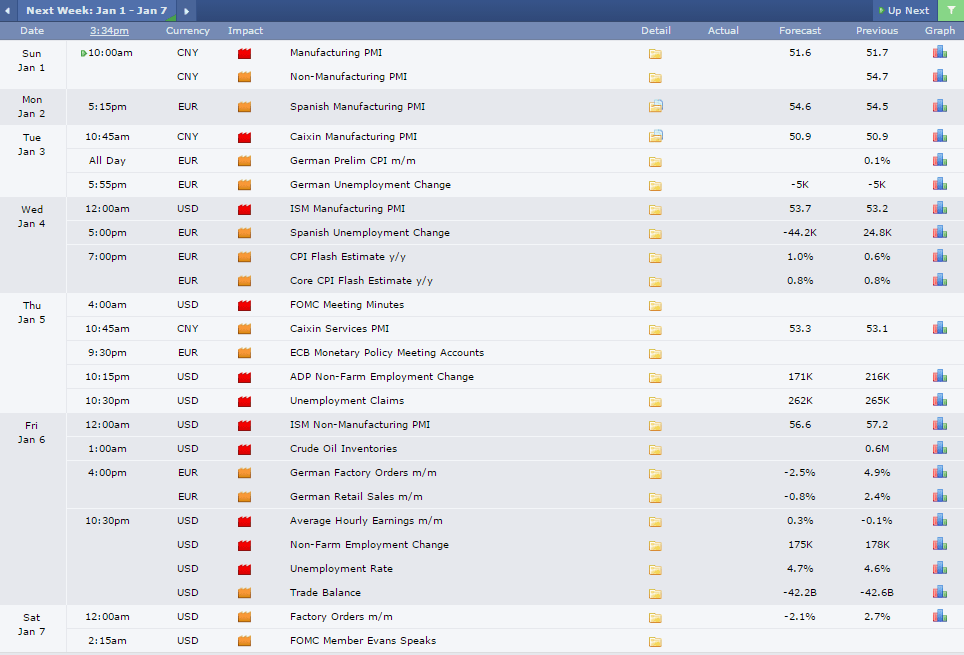

Next Week Economic Calendar

Key events:

- China Manufacturing PMI on Jan 1 (Sunday). Take note that China Manufacturing PMI has been in expansion mode for 3 months continuously.

- US Manufacturing PMI on Jan 4 (Wednesday).

- FOMC Meeting Minutes on Jan 5 (Wednesday)

- Crude Oil Inventories on Jan 6 (Friday)

- US Unemployment Rate on Jan 6 (Friday)

See upcoming Events here. https://mystocksinvesting.com/events/