Key US Market Indices Review: Reversal At Sight!

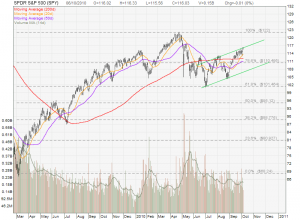

All three key US Market Indices (Dow Jones, S&P500, NASDAQ) are hitting the uptrend channel resistance. Immediate support is the 20D MA. If these three Moving Average supports are broken, these market indices will be sent to the uptrend support. This month is the month of October when most crashes happen in this month historically. Earning season is starting soon when the companys report last quater earning. I expect lots of earning downgrade because I am seeing slowing down in economy for the next two quarters.

Dow Jones Industrial

S&P500 (SPY)

NASDAQ

Sept has been a bullish month, What goes up must come down…. I may be wrong but I will not lose money if I am taking a safety first , wait and see approach without committing any additional money in the market.

Sept has been a bullish month, What goes up must come down…. I may be wrong but I will not lose money if I am taking a safety first , wait and see approach without committing any additional money in the market.

Trade with extreme cautious!