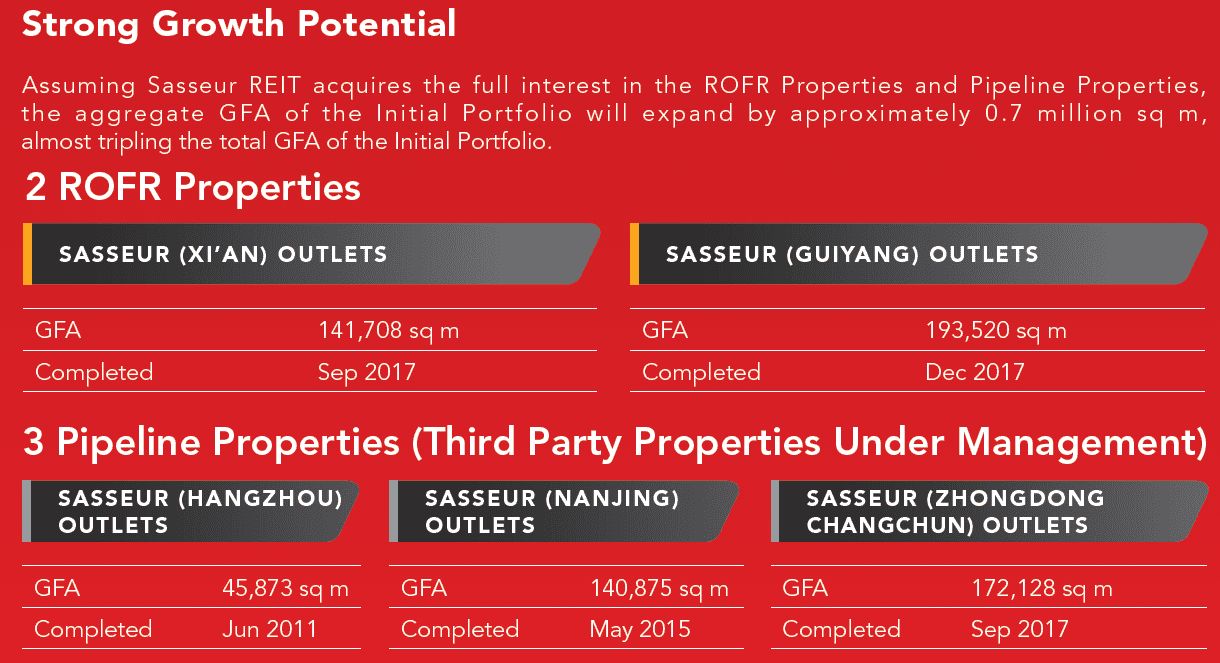

OVERVIEW OF SASSEUR REIT

Sasseur REIT is a Singapore real estate investment trust (“REIT”) with an initial portfolio comprising four retail outlet malls located in thePeople’s Republic of China (“PRC”) (the “Initial Portfolio”), offering

investors the opportunity to invest in the country’s fast-growing retail outlet mall sector.

Sasseur REIT’s investment strategy is to invest principally, directly or indirectly, in a diversified portfolio of income-producing real estate, which is used primarily for retail outlet mall purposes, as well as real estate related assets in relation to the foregoing, with an initial focus on Asia.

Sasseur REIT launches IPO for $396m

See Sasseur REIT IPO Prospectus here. (748 pages)

- Type = Outlet Retail Malls (China)

- Sponsor = Sasseur Cayman Holding Limited (55%)

- Total Unit Offered = 266,562,500

- Portfolio = 4 (Chongqing, Bishan, Hefei, Kunming)

- Portfolio Size = S$1.5 Billion

- IPO Offer Price = S$0.80

- Market Cap = S$944.2 Million

- Net Asset Value =$921,847,000

- Number of units in issue = 1,192,333,000

- NAV per unit = $0.7731

- Price / NAV = 1.0347

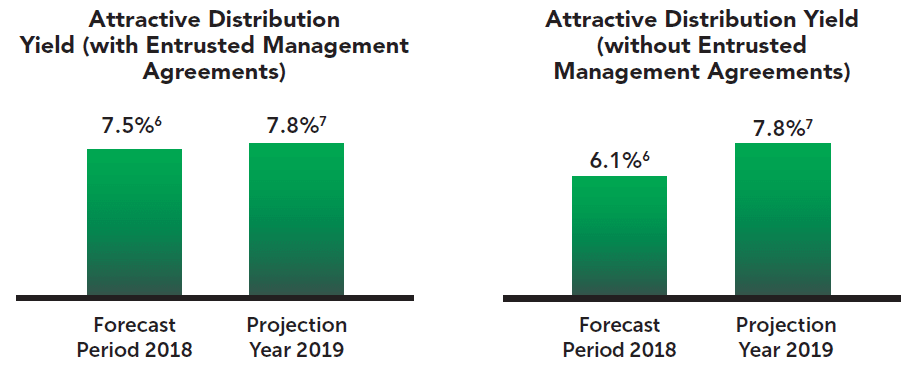

- Distribution Yield = 7.5% (2018), 7.8% (2019)

- Distribution Policy = 100% until 2019. Semi Annual Payout.

- WALE (Property Income) = 1.2 Years

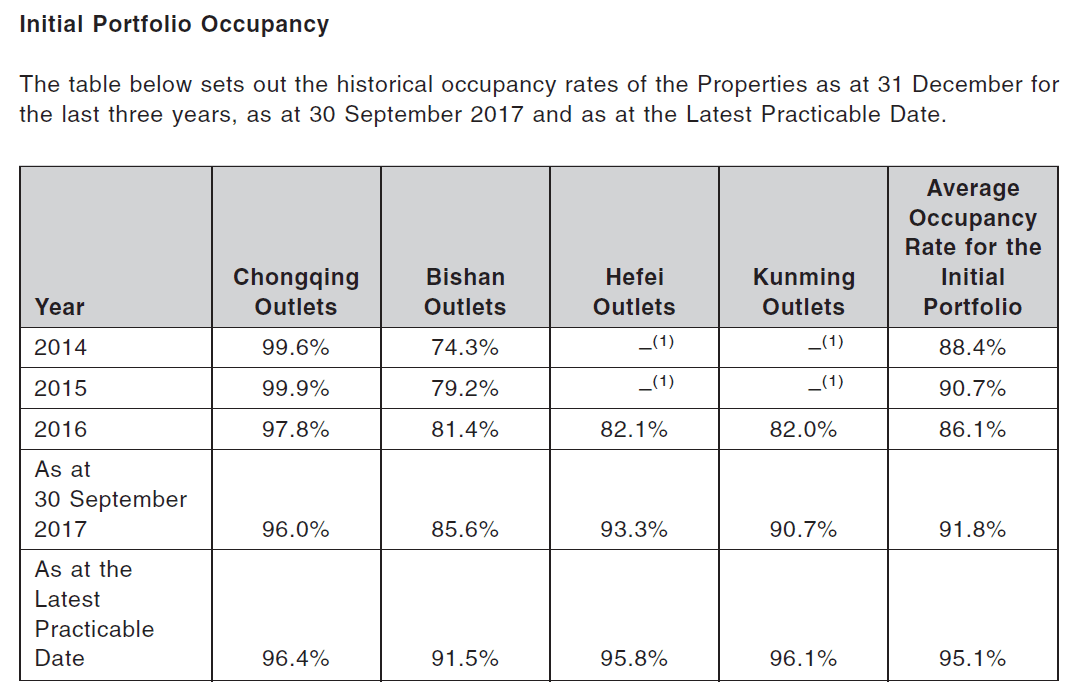

- Occupancy Rate = 95.1%

- Gearing Ratio = 38.5% (calculated value from balance sheet)

- Plan Listing: Mar 28, 2018

Compare to other Singapore REITs here.

DPU Forecast

Top 10 Tenants & Income by Sectors

Occupancy Rate

Sasseur REIT Structure

Lease Structure and Lease Expiry Profile