Brexit: Where are the Opportunities?

It was a Black Friday of the whole world market sell off due to Brexit. I received many questions from my friends, my students and my readers on what to do next. I list down some of the common questions here and list down my humble opinions.

Common Questions:

- Will the Stock Market Crash?

- Should I sell my stocks?

- Should I buy Sterling Pound now?

- Where are the investing opportunities for this Brexit?

Frankly speaking, I do not have the answers as I am not the fortune teller. Basically what I am doing now is Trade Base on What I See & Invest Base on My Objectives. I will be sharing what I see in the current movement of the financial market and where are the investing or trading opportunities. By the way, opportunities are everywhere as long as the Price Moves. It is not a rocket science! The key thing is how and where to find them.

Disclaimers: I have trading or investing positions in Gold, Silver, Crude Oil, VIX, S&P500 Futures, GBP/JPY and Singapore REITs. My views and analysis can be biased. All analysis here are my own view and do not constitute any Buy or Sell recommendation. I am not responsible for any profits or losses if you take any position base on the analysis here.

(1) World Equity Market Sell off and VIX Spiked

(2) GBP Plunged

(3) USD and JPY rallied

(4) Funds exit from equity and flight to safety to Bonds & Gold

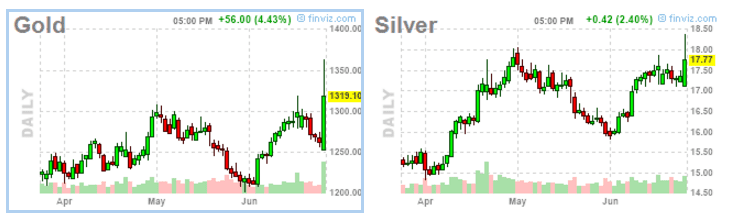

(5) Gold & Silver Rallied as both are correlated

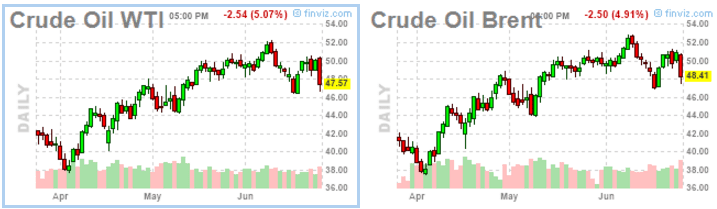

(6) Crude Oil slumped as it has inverse relationship with USD

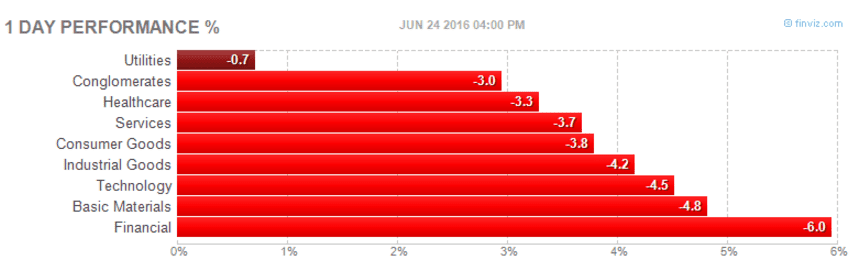

(7) Financial Sector has the worst hit

(8) STI Sell off

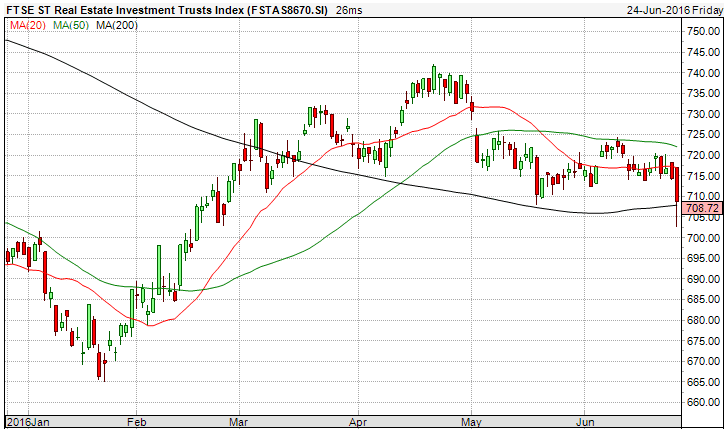

(9) Singapore REIT Index is just sitting on the neckline support of a Head and Shoulder reversal pattern. See Singapore REIT Fundamental Analysis table for potential investing opportunities for passive income.

My Views:

There are a lot of investing or trading opportunities out there, why continue to fall in love in the stocks if the funds exit from equity market to other financial instruments like Forex, Gold, Bonds, etc? The objective is to make money from our investment but not to have a love affair with the stocks. Some of the strategies we can take advantage from this Brexit:

- Trade on Rebound due to the knee jerk

- Wait for the establishment of the new trend as Fund Managers will be re-balancing their portfolio due to this new development. Trade with the trend.

- Be extremely careful with US equity market because it is at the market top

- Position ourselves in the “flight to safety” type of financial instruments like Gold and Bonds if the stock market does crash

- Watch the Euro as Europe will be in a mess and have high risk of dis-integration of United Kingdom and European Union. See The U.K. has voted for Brexit — what happens next?

Still do not know what to do? You can approach me for the Private Portfolio Review if you need help.

You can also send me an email marubozu@mystocksinvesting.com if you need help in building up your own investment portfolio but do not know where to start.