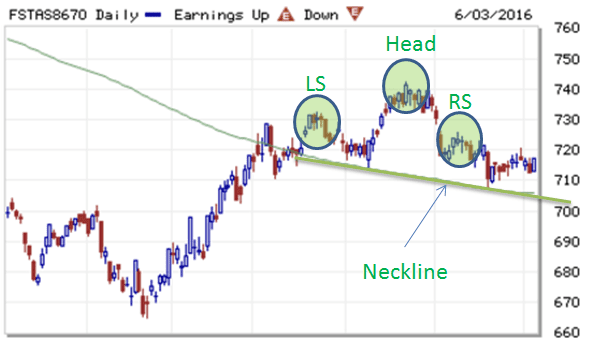

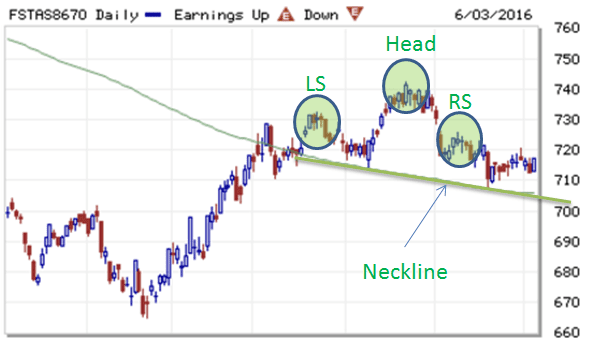

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreases from 734.98 to 717.26 (-2.41%) compare to last post on Singapore REIT Fundamental Comparison Table on May 1, 2016. The index is just barely staying above 200D SMA (but sloping down) and forming a Head and Shoulder (a potential reversal pattern) with 200D SMA acts as the neckline support. Breaking this neckline support will probably send the index down to 660-670 region. SGX S-REIT (REIT.SI) Index decreases from 1127.56 to 1102.94 (-2.18%)

- Price/NAV decreases from 0.965 to 0.948 (Singapore Overall REIT sector is under value now)

- Distribution Yield increases from 7.1% to 7.25% (take note that this is lagging number). More than half of Singapore REITs (20 out of 38) have Distribution Yield > 7%. Current yield is attractive (for certain REITs only) but dangerous to make investing decision purely base on the yield. Past performance does NOT equal to future performance.

- Gearing Ratio decreases from 34.92% to 34.76%. 24 out of 38 have Gearing Ratio more than 35%.

- Most overvalue is Parkway Life (Price/NAV = 1.467), followed by Ascendas iTrust (Price/NAV = 1.399).

- Most undervalue (base on NAV) is Far East HTrust (Price/NAV = 0.656), Fortune REIT (Price/NAV = 0.676), followed by Sabana REIT (Price/NAV = 0.695).

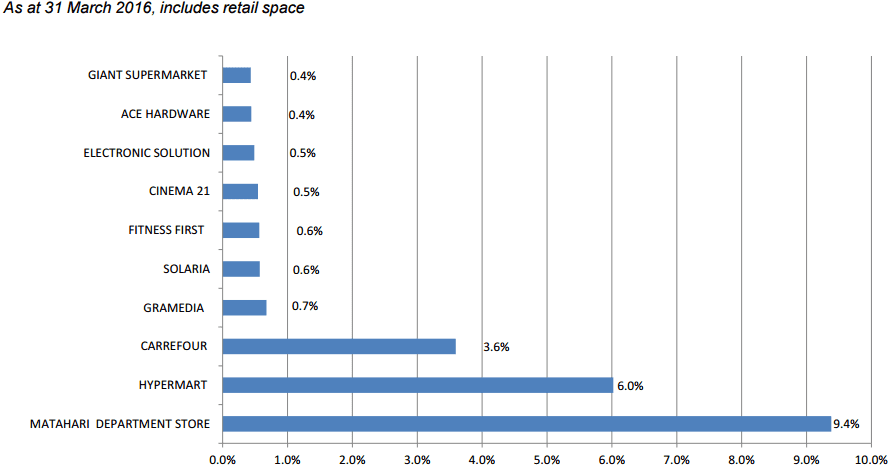

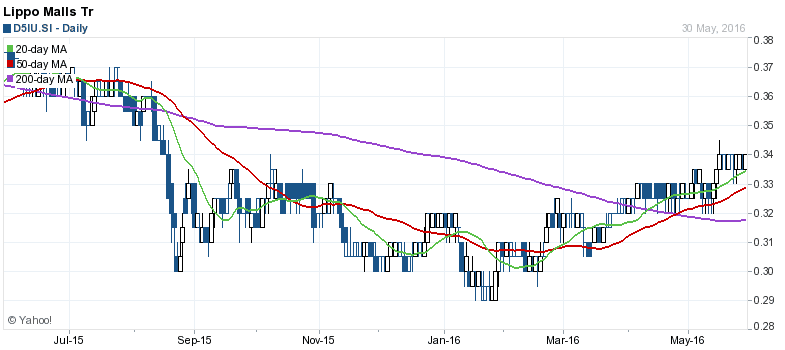

- Higher Distribution Yield is Lippo Malls Trust (9.91%) followed by Cache Logistic Trust (9.65%)

- Highest Gearing Ratio is Croesus Retail Trust (46.2%), iREIT Global (43.1%) and OUE Commercial Trust (40.5%)

- Note: Manulife US REIT is added.

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

Singapore Average Overnight Interest Rate

The benchmark interest rate in Singapore was last recorded at 0.23 percent. Interest Rate in Singapore averaged 1.67 percent from 1988 until 2016, reaching an all time high of 20 percent in January of 1990 and a record low of -0.75 percent in October of 1993. Interest Rate in Singapore is reported by the Monetary Authority of Singapore.

- Singapore Interest Rate increases from 0.13% to 0.23%

- 1 month increases 0.73701% to 0.75634%

- 3 month increases from 1.00000% to 1.00192%

- 6 month increases from 1.23521% to 1.23863%

- 12 month increases from 1.37163% to 1.37375%

Singapore Manufacturing PMI

The Singapore PMI was unchanged at 49.8 in May of 2016 from the previous month, posting its eleventh consecutive month of contraction. While new orders (49.7 from 49.8 in April) and employment (49.1 from 49.3) continued to fall, factory output increased for the first time in 11 months (50.1 from 49.9). Manufacturing PMI in Singapore averaged 50.13 from 2012 until 2015, reaching an all time high of 51.90 in October of 2014 and a record low of 48.30 in October of 2012. Manufacturing PMI in Singapore is reported by the Singapore Institute of Purchasing & Materials Management, SIPMM.

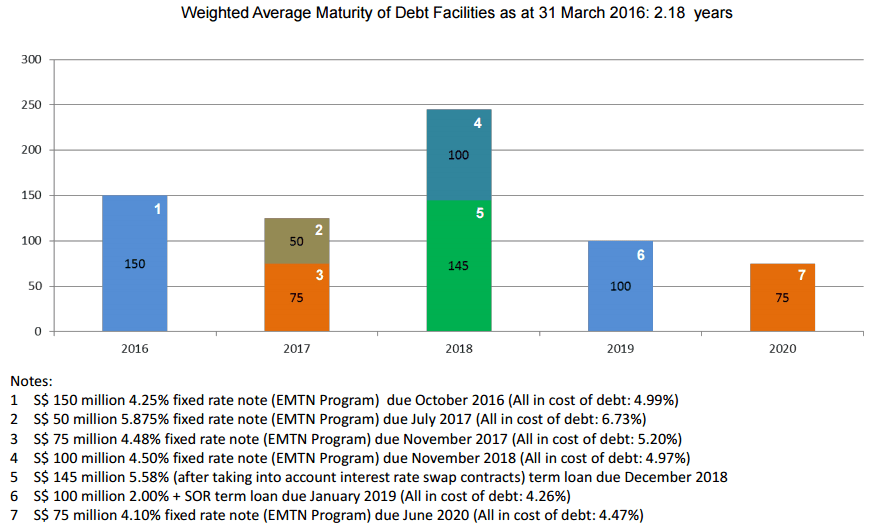

Fundamentally Singapore REITs in general, the valuation and distribution yields are still attractive The US Fed’s rate hike fear may be already priced in as it has been dragged for too long. Most REITs have already prepared for it by actively managing their debts. Technically Singapore REITs index is probably moving side way or down base on the chart patterns (Rectangle and Head & Shoulder). Healthcare and sub-urban retail malls are resilient but Industrial, Office and Hospitality sectors are facing headwinds. Find out Which Singapore REIT to Buy, Which Sectors to consider, and When is the Right Time to Buy in the next Singapore REITs Investing class.