Lippo Malls Indonesia Retail Trust (LMIR) Fundamental and Technical Analysis

Lippo Malls Indonesia Retail Trust Fundamental Analysis

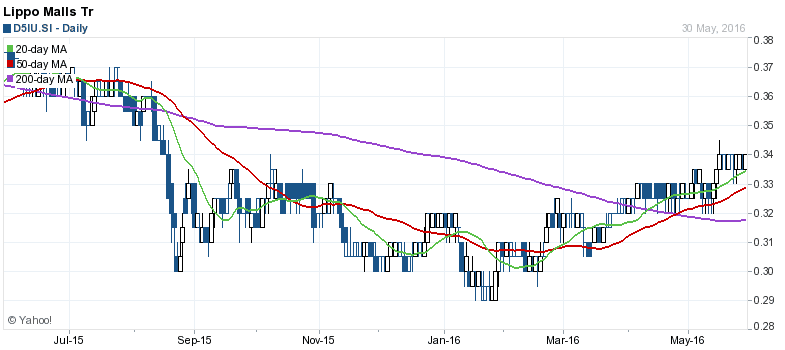

- Last Done Price = $0.34

- NAV = $0.38

- Price / NAV = 0.8947 (About 10% Discount)

- Price / NAV (High) = 1.0219

- Price / NAV (Low) = 0.7596

- Distribution Yield = 9.24% (base on DPU TTM)

- Gearing Ratio = 35.7%

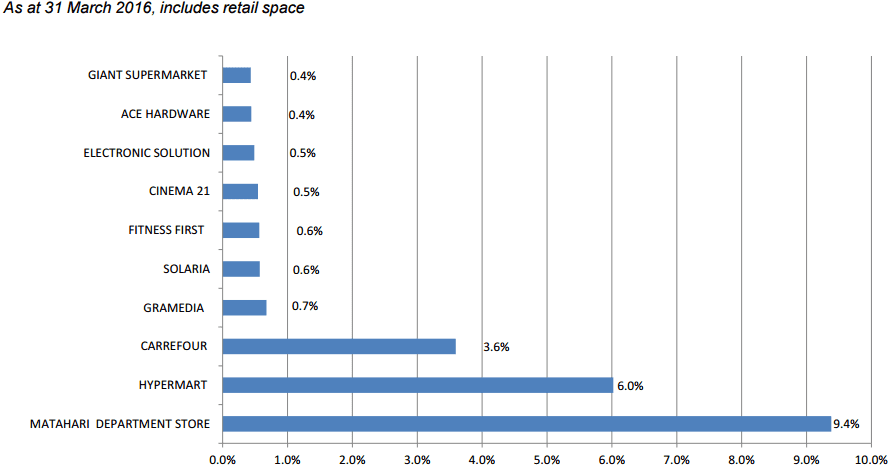

- Occupancy Rate = 93.9%

- WALE = 4.92 Years

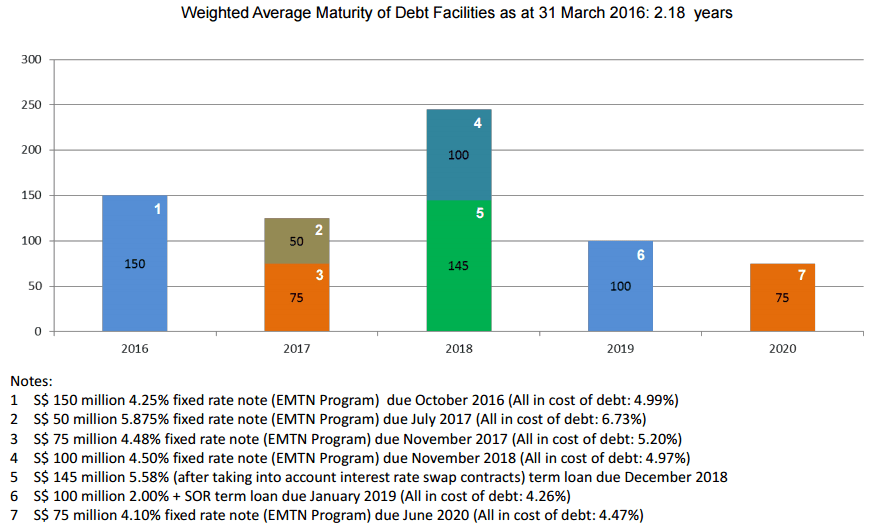

- WADB = 2.18 Years

See previous Lippo Mall Indonesia Retail Trust analysis here.

Lippo Malls Indonesia Retail Trust Price vs Yield Simulation

Lippo Malls Indonesia Retail Trust Technical Analysis

Lippo Malls Indonesia Retail Trust has moved above all the 3 moving averages and starting an uptrend.

See other Singapore REIT Comparison Table here.

See other Singapore REIT Charts here.

Check out How to Invest in Singapore REIT Course here.