Technical Analysis of FTSE ST REIT Index (FSTAS8670)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) continued the bullish rally raising from 832.03 to 842.91 (+1.31%) as compared to last post on Singapore REIT Fundamental Comparison Table on Feb 4, 2019.

The REIT index retraced and successfully tested the 820 resistance-turned-support to continue the uptrend. In addition, this bullish uptrend is supported by a strong volume. Based on the current chart pattern and trend analysis, the trend for Singapore REIT direction is UP! There is a chance for Singapore REIT index to test the immediate resistance at about 875 (the previous high in 2018) based on current market sentiment and bullish momentum. This represents another 4% upside potential from current level before the REIT index can reach the new high. All eyes will be on whether the Singapore REIT can break the all time high at about 890 back in May 2013.

Fundamental Analysis of 39 Singapore REITs

The following is the compilation of 39 REITs in Singapore with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. There are currently 39 REITs in Singapore after VIVA Industrial Trust merged into ESR REIT.

- Price/NAV maintains at 1.01 (Singapore Overall REIT sector is at fair value now).

- Distribution Yield decreases from 6.72% to 6.59% (take note that this is lagging number). About 35.9% of Singapore REITs (14 out of 39) have Distribution Yield > 7%.

- Gearing Ratio decreases slightly from 35% to 34.7%. 21 out of 39 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: The limit of gearing ratio for REITs listed in Singapore Stock Exchange is 45%.

- The most overvalue REIT is Parkway Life (Price/NAV = 1.54), followed by Keppel DC REIT (Price/NAV = 1.37), Mapletree Industrial Trust (Price/NAV = 1.36) and Ascendas REIT (Price/NAV = 1.37).

- The most undervalue (base on NAV) is Fortune REIT (Price/NAV = 0.58), followed by OUE Comm REIT (Price/NAV = 0.70), Lippo Mall Indonesia Retail Trust (Price/NAV = 0.72), Far East Hospitality Trust (Price/NAV = 0.74) and Sabana REIT (Price/NAV = 0.75).

- The Highest Distribution Yield (TTM) is Lippo Mall Indonesia Retail Trust (10.00%), followed by Keppel KBS US REIT (8.91%), SoilBuild BizREIT (8.88%), First REIT (8.35%), Cache Logistic Trust (8.20%), OUE Comm REIT (8.16%), EC World REIT (8.13%) and Cromwell European REIT (8.04%).

- The Highest Gearing Ratio are ESR REIT (41.9%), Far East HTrust (40.1%) and OUE Comm REIT (39.3%) and Mapletree NAC Trust (39%)

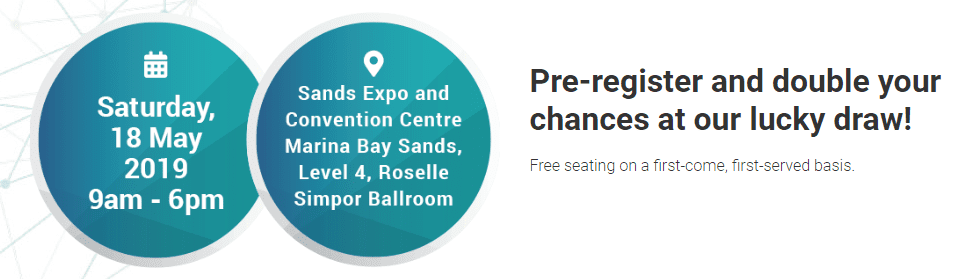

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

- 1 month increases from 1.77009% to 1.81742%

- 3 month increases from 1.88892% to 1.94558%

- 6 month increases from 1.94080% to 2.00083%

- 12 month increases from 2.12550% to 2.15373%

Based on current probability of Fed Rate Monitor, the US interest rate may stay at 2.5% for 2019.

Summary

Fundamentally the whole Singapore REITs is at fair value now. The yield spread between big cap and small cap REIT remains wide. This indicates there are many value picks left in medium and small cap REITs. As for big cap REIT, there are still room for further upside potential as the distribution yield is still comparatively attractive to other asset classes. For reference, 10-years risk free yield rate for latest Singapore Saving Bonds is 2.16%.

Yield spread (reference to 10 year Singapore government bond (2.24%) has tightened from 4.53% to 4.35%. DPU yield for a number of small and mid-cap REITs are still very attractive (>8%) at the moment. However, it is expected the next move would be on small and medium size REITs due to higher risk premium.

Technically, the REIT index is trading in a bullish uptrend but it is expected to have a short term pause before moving higher. Immediate support at 820 followed by 800. If Singapore REIT index can stay above 800-820 support zone for the next few months, it is a high possibility that the bullish trend may continue to break new high. Bear in mind that Singapore REIT has one of the highest dividend yield compared to other stocks in Singapore and also other stock markets in the region.

Relevant posts:

If you need an independent professional review on your current REIT portfolio and need any recommendation, you may engage me in the REIT portfolio Advisory. REITs Portfolio Advisory. https://mystocksinvesting.com/course/private-portfolio-review/