APPLE (AAPL) Fundamental and Technical Analysis

For my team member.

- Current Price: $373.80

- Current PE: 17.82

Fundamental Analysis (base on FY10)

- Gross Margin: 39.38%

- Net Margin: 21.48%

- ROA: 22.8%

- ROE: 35.3%

- Current Ratio: 2.1

- Debt to Equity: Net Cash

- Cash Flow Growth Rate (1-3 Years) = 19.35%

- Cash Flow Growth Rate (4-10 Years) = 15% (capped)

- Beta = 1.34

- Discount Rate = 7%

- Discounted Cash Flow Model Intrinsic Value = $412.98

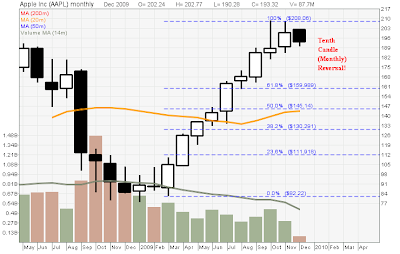

Technical Analysis

- Breakout from consolidation pattern and 52 weeks high resistance at $363.30.

- Apple stock price is trading above 20D, 50D and 200D MA.

- 20D crosses above 50D MA.

- Need to monitor whether Apple can stay above the Immediate Support (resistance turned support) at $363.30.

- 2nd support at about $342 (20D MA and also the resistance turned support).

- Since Apple stock is currently under value, can start accumulating when the stock pull back to the support level (provided support is not broken).

-Apple+Inc-740x480.png)

-Apple+Inc-740x480.png)

-Apple+Inc-740x480.png)