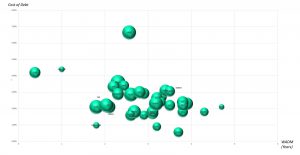

Bubble charts derived from August 7, 2017 Singapore REITs Fundamental Comparison Table. No significant movement compared to last Bubble Charts. The yield spread remains wide between big cap and small cap REITs. This means that value pick is at the small cap space if you know how to spot them. Please take not that we have to be very cautious in the selection as some of those REITs have declining DPU for past few quarters. You may want to check out how to spot those problematic REITs here.

Disclaimer: The analysis is for Author own use and NOT to be used as Buy / Sell recommendation. Get a proper training on “How to use this Singapore REIT Bubble Charts?” here.

Original Post from https://mystocksinvesting.com

These Bubble Charts are used to show the “relative” position compare to other Singapore REITs.

Two visual bubble charts to pick and avoid:

- Undervalue Singapore REITs with High Distribution Yield** (Value Pick)

- Overvalue Singapore REITs with High Gearing Ratio (Risk Avoidance)

** Distribution Yield are lagging.

Compared to previous Singapore REIT Bubble Charts here.

- If you prefer to DIY your REITs Portfolio by selecting the right REITs for long term investing, you may consider the practical hands on REITs Investing Course.

- If you do not have time to do all the analysis and monitor the stock market, there is a solution for you … REITs Portfolio Advisory. I will help you to build a Diversified REITs portfolio for you. I will do all the work by selecting fundamental strong REIT, time the entry, monitor the quarterly earning performance, sell the weak REITs, etc. https://mystocksinvesting.com/course/private-portfolio-review/

Also see other courses and seminars below.

Great ! Thanks for Sharing…