Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 716.79 to 702.62 (-1.98%) compared to last month’s update. The REIT index is still currently trading within a descending triangle with the pink lines showing the resistance and support. This is a medium-term consolidation pattern until the next big move (upside breakout or downside breakout). The REIT Index’s 700 support was tested 4 times for the past few months.

- Short-term direction: Sideways

- Medium-term direction: Sideways

- Long-term direction: Sideways

- Immediate Support at 700 (Descending Triangle support)

- Immediate Resistance is Descending Triangle Resistance & 200D SMA Dynamic Resistance (about 728))

1.5 years FTSE REIT Index Chart

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on July 3rd, 2023.

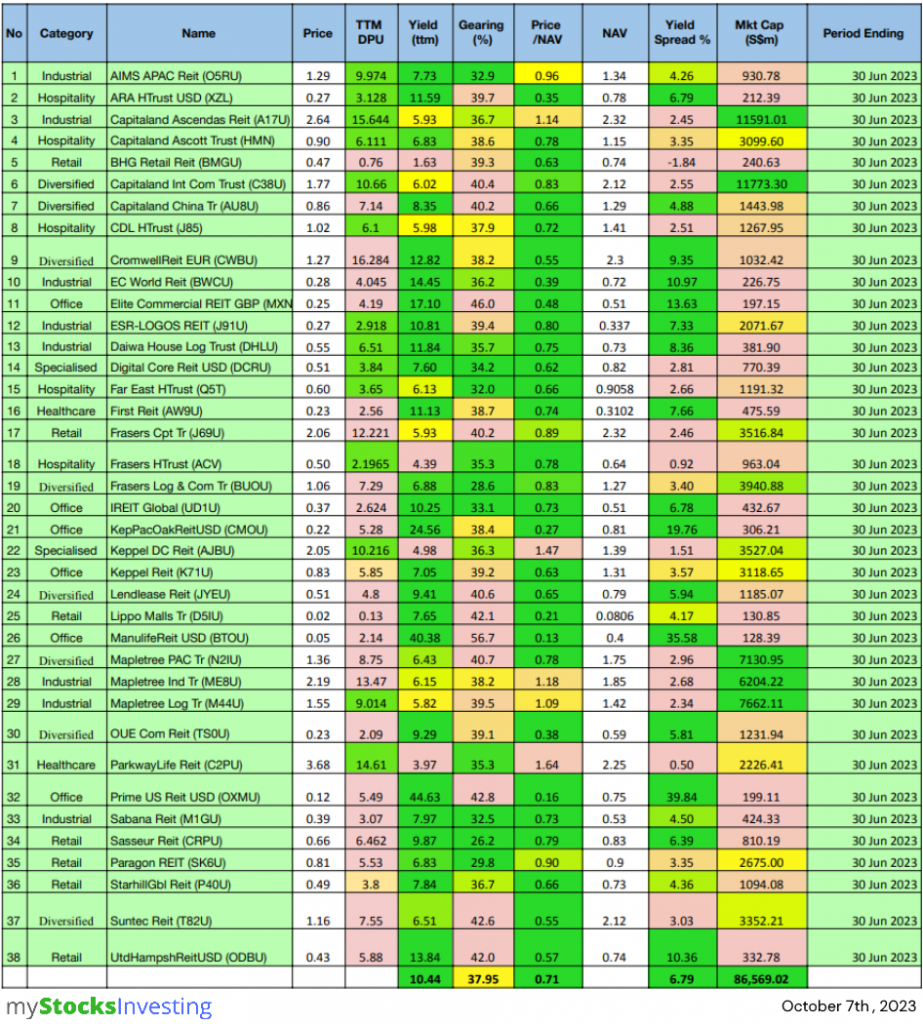

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- REITs highlighted in green are now updated with the latest Q2 2023 business updates/earnings. Otherwise Q1 2023 values are still used.

- I have introduced weighted average (weighted by market cap) to the financial ratios, in addition to the existing simple average ratios. This is another perspective where smaller market cap REITs do not disproportionately affect the average ratios.

Data from REITsavvy Screener. https://screener.reitsavvy.com/

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of August 11th, 2023. Notes:

- ESR-LOGOS REIT and Paragon REIT: Annualised yield, after taking into account switch to semi-annual distribution declaration. For Paragon REIT: calculated after converting from 13 months of distribution to 12 months.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.

Price/NAV Ratios Overview

- Price/NAV decreased to 0.78. (Weighted Average: 0.78)

- Decreased from 0.79 in July 2023.

- Singapore Overall REIT sector is undervalued now.

- Take note that NAV is adjusted upwards for some REITs due to pandemic recovery.

- Most overvalued REITs (based on Price/NAV)

-

ParkwayLife Reit (C2PU) 1.67 Keppel DC Reit (AJBU) 1.53 Mapletree Ind Tr (ME8U) 1.21 Capitaland Ascendas Reit (A17U) 1.19 Mapletree Log Tr (M44U) 1.17 Paragon REIT (SK6U) 1.05 - Only 6 REITs are overvalued now based on Price/NAV value.

- No change in the Top 2 in the last 6 months.

-

- Most undervalued REITs (based on Price/NAV)

-

ManulifeReit USD (BTOU) 0.17 Lippo Malls Tr (D5IU) 0.24 Prime US Reit USD (OXMU) 0.26 KepPacOakReitUSD (CMOU) 0.35 EC World Reit (BWCU) 0.40 ARA HTrust USD (XZL) 0.45

-

Distribution Yields Overview

- TTM Distribution Yield increased to 9.44%. (Weighted Average is 6.42%)

- Increased from 8.93% in July 2023 (Weighted Average was 6.33%)

- 19 of 40 Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- 9 REITs have a ttm yield of over 10%!

- Highest Distribution Yield REITs (ttm)

-

ManulifeReit USD (BTOU) 49.48 Prime US Reit USD (OXMU) 28.59 KepPacOakReitUSD (CMOU) 18.53 EC World Reit (BWCU) 15.02 UtdHampshReitUSD (ODBU) 14.00 Elite Commercial REIT GBP (MXNU) 13.97 - Reminder that these yield numbers are based on current prices. This has caused Manulife US REIT and Prime US REIT’s ttm yields to be over 25%.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

-

- Yield Spread widened to 6.24%. (Weighted Average remains similar at 4.40%)

- Widened from 5.75% in July 2023. (Weighted Average was 4.39%)

Gearing Ratios Overview

- Gearing Ratio decreased to 37.80%. (Weighted Average: 38.30%)

- Decreased from 37.98% of July 2023. (Weighted Average: 38.37%)

- Gearing Ratios are updated quarterly. Most REITs have updated their Gearing Ratios.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

-

ManulifeReit USD (BTOU) 49.5 Elite Commercial REIT GBP (MXNU) 46.0 Prime US Reit USD (OXMU) 42.8 UtdHampshReitUSD (ODBU) 42.6 Suntec Reit (T82U) 42.6 Lippo Malls Tr (D5IU) 42.1

-

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation decreased by 0.24% to S$94.03 Billion.

- Decreased from S$94.26 Billion in July 2023.

- Biggest Market Capitalisation REITs (S$):

-

Capitaland Int Com Trust (C38U) 12837.55 Capitaland Ascendas Reit (A17U) 12073.97 Mapletree PAC Tr (N2IU) 8232.05 Mapletree Log Tr (M44U) 8205.87 Mapletree Ind Tr (ME8U) 6317.54 Frasers Log & Com Tr (BUOU) 4535.73 - No change in the rankings since September 2022.

-

- Smallest Market Capitalisation REITs (S$):

-

Lippo Malls Tr (D5IU) 146.24 ManulifeReit USD (BTOU) 230.60 EC World Reit (BWCU) 242.95 Elite Commercial REIT GBP (MXNU) 248.26 BHG Retail Reit (BMGU) 256.16 ARA HTrust USD (XZL) 269.37

-

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, here’s a subsidised 2-day course with all you need to know about REITs and how to start investing in them.

Top 20 Best Performers of July 2023

Source: https://screener.reitsavvy.com/

SG 10 Year & US 10 Year Government Bond Yield

- SG 10 Year: 3.05% (decreased from 3.08%)

- US 10 Year: 4.16% (increased from 3.81%)

Summary

Fundamentally, the whole Singapore REITs landscape remains extremely undervalued based on the average Price/NAV (at 0.78) value of the S-REITs, with a very attractive DPU yield of 9.44%! (Weighted average yield of 6.42%). Do take note that NAV and DPU are lagging numbers.

Performances over this month have been very mixed. There are poor performances by both large and small cap REITs, as well as good performances by both large and small cap REITs.

(Source: https://stocks.cafe/kenny/overview)

Weighted Average Yield spread (in reference to the 10-year Singapore government bond yield of 3.05% as of 11th August 2023) widened slightly from 4.39% to 4.40%.

Technically, FTSE ST REIT Index is still trading within a Descending Triangle, which is a medium-term consolidation chart pattern. It is predicted the REIT index will be range bound for a while until the next breakout. The US interest rate may have peaked in Q3, 2023 and probably start to come down in 1H 2024 based on the US Fed’s dot plot. At the current juncture, we will rely on the technical chart to provide us a guidance of the Singapore REITs on the 2H 2023 direction.

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement