SGX has just launched a new REIT index to track Singapore Real Estate Investment Trust (REIT) performance.

Brief introduction of SGX S-REIT Index:

The SGX S-REIT Index was established last year. It is a free-float, market capitalisation-weighted index that measures the performance of stocks operating within the REIT Sector. The 10 largest constituents of the SGX S-REIT Index account for 64.7% of the Index weights.

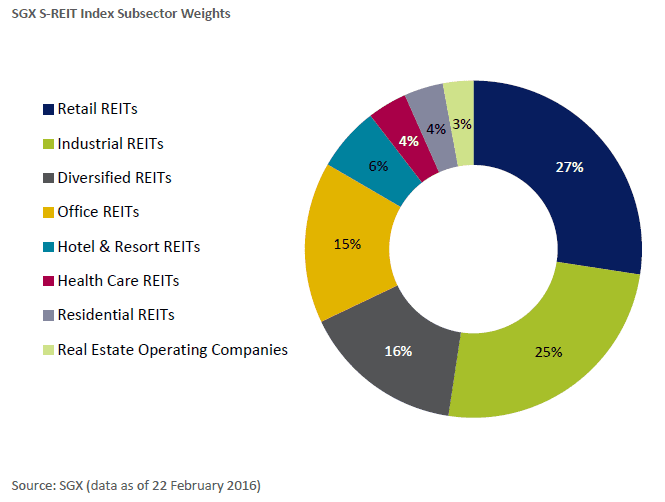

The Index is also diversified across types of property assets. The Global Industry Classification Standard (GICS®) is applied by SGX StockFacts to help define the different sectorial focus within the REIT sector. Retail REITs, which are made up of shopping malls, account for the largest index weights. CapitaLand Mall Trust, a retail REIT, was the first REIT to list in 2002, almost thirty years after Singapore’s first shopping centre became air-conditioned. The Retail REIT Sector spans businesses engaged in the acquisition, development, ownership, leasing, management and operation of shopping malls, outlet malls, neighbourhood and community shopping centres.

Constituents of the SGX S-REIT Index are diversified by property type in addition to location. More than half the trusts have property assets located outside Singapore, mostly around Asia. This includes countries such as China, Hong Kong, Vietnam, Japan, Indonesia, South Korea, Philippines and Malaysia.

SGX S-REIT Index Composition To be eligible for index inclusion, the industry group of the trust must be classified as a Real Estate Investment Trust by the Thomson Reuters Business Classification (TBRC). This means the SGX S-REIT Index is not solely made up of the REITs that are governed by the Collective Investment Scheme, but can include Business Trusts and Stapled Trusts, both of which are governed by the Business Trust Act.

SGX S-REIT Index consists of 32 SGX S-REIT Index constituents, 25 are REITs, five are Stapled Trusts and two are Business Trusts (Ascendas India Trust and Croesus Retail Trust). The 25 REITs make up 89.4% of the SGX S-REIT Index, while Stapled Trusts make up 7.7%, and Business Trusts comprise 2.9%. SGX S-REIT Index is rebalanced periodically.

REITs and Stapled Trust that are not currently included in the index:

- BHG Retail REIT

- Fortune REIT

- Keppel DC REIT

- Saizen REIT.

- Ascendas Hospitality Trust

Chart is not meaningful at the moment as there are no much data available.

At the point of writing, SGX S-REIT Index is at 1089.137.

FTSE ST Real Estate Investment Trust (FSTAS8670)

This FTSE ST Real Estate Investment Trust is a well established index which have been tracking Singapore REIT sectors for quite some times. There are total 33 index components in this FSTAS8670 index. However, it is not clear whether this index is derived from weighted market capitalisation. At the point of writing, FSTE ST Real Estate Investment Trust is at 713.71.

See Singapore REIT Fundamental Analysis Comparison Table

Find out How to Generate Passive Income through REIT Investing here.