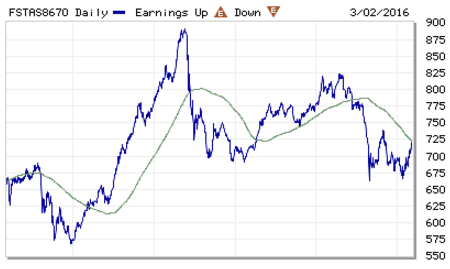

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increases from 688.7 to 720.26 (+4.58%) compare to last post on Singapore REIT Fundamental Comparison Table on Feb 1, 2016. The index is currently testing the 200D SMA resistance at about 722. The long term trend remains down as the index is trading below 200D SMA which is also sloping down. SGX S-REIT (REIT.SI) Index at 1100.295.

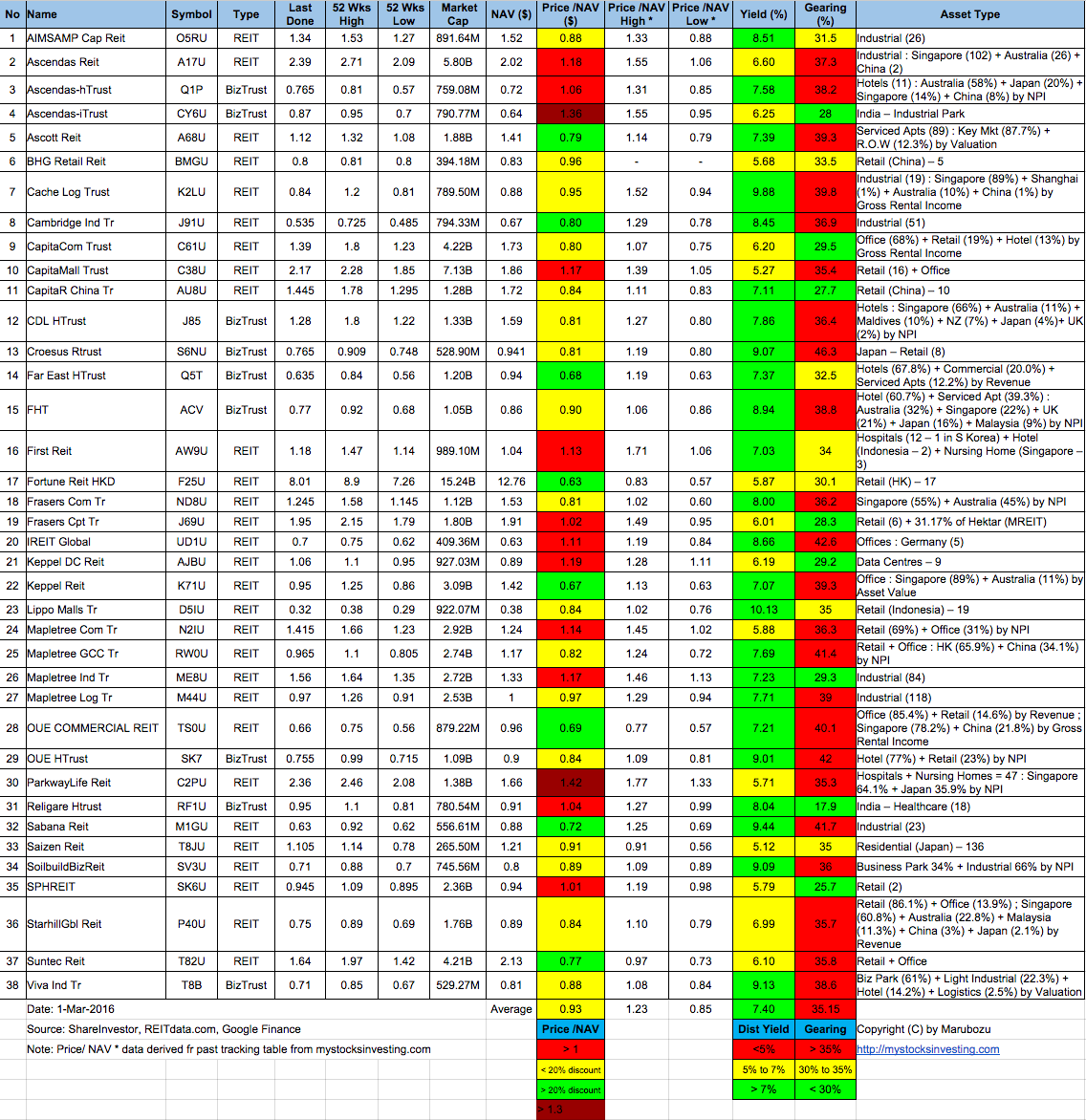

- Price/NAV increases from 0.91 to 0.93 (Singapore Overall REIT sector is under value now)

- Distribution Yield decreases from 7.60% to 7.40% (take note that this is lagging number). More than half of Singapore REITs (24 out of 38) have Distribution Yield > 7%. Current yield is attractive but dangerous to make investing decision purely base on the yield. Past performance does NOT equal to future performance.

- Gearing Ratio increases from 35.11% to 35.15%. 23 out of 37 have Gearing Ratio more than 35%.

- Most overvalue is Parkway Life (Price/NAV = 1.42), followed by Ascendas iTrust (Price/NAV = 1.36).

- Most undervalue (base on NAV) is Fortune REIT (Price/NAV = 0.61), followed by Keppel REIT (Price/NAV = 0.63), Far East HTrust (Price/NAV = 0.68) and OUE Commercial REIT (Price/NAV = 0.69).

- Higher Distribution Yield is Lippo Malls Trust (10.13%) followed by Cache Logistic Trust (9.88%)

- Highest Gearing Ratio is Croesus Retail Trust (46.3%) followed by iREIT Global (42.6%)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

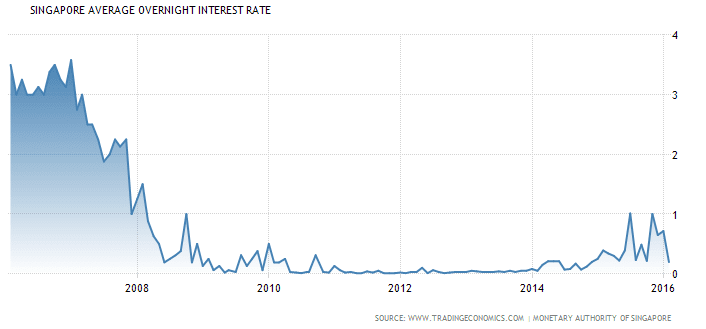

- Singapore Interest Rate decreases from 0.72% to 0.19%

- 1 month decreases from 1.13025% to 1.11950%

- 3 month decreases from 1.25300% to 1.25200%

- 6 month decreases from 1.31475% to 1.31300%

- 12 month remains at 1.43800%

Technically Singapore REITs sectors rebounded recently due to the attractive valuation and distribution yield. 20D and 50D SMA are already sloping up showing that Singapore REIT sector is on short term and medium term uptrend. If the index can break the 200D SMA resistance and stay above this long term trend, Singapore REIT sector is back to life and start uptrend again. Start picking up the fundamental strong REIT as these REITs provide faster capital appreciation when the uptrend starts in addition to the quarterly / half yearly distribution payout. Find out Which Singapore REIT to Buy and When is the Right Time to Buy in this coming Singapore REITs Investing class.