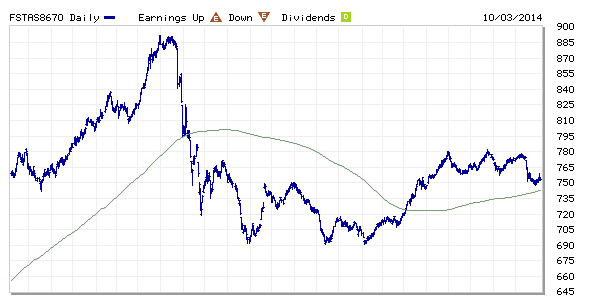

FTSE ST Real Estate Investment Trusts (FTSE ST REIT) Index changes from 775.28 to 753.55 compare to last post on Singapore REIT Fundamental Comparison Table on Sept 7, 2014. The index broke down from a Rectangle pattern but rebounded from the 200D SMA. However the index is currently trading below 20D and 50D SMA. Keep a close eye on the 200D SMA support between 740 and 750 because this is a bearish sign if the support is broken.

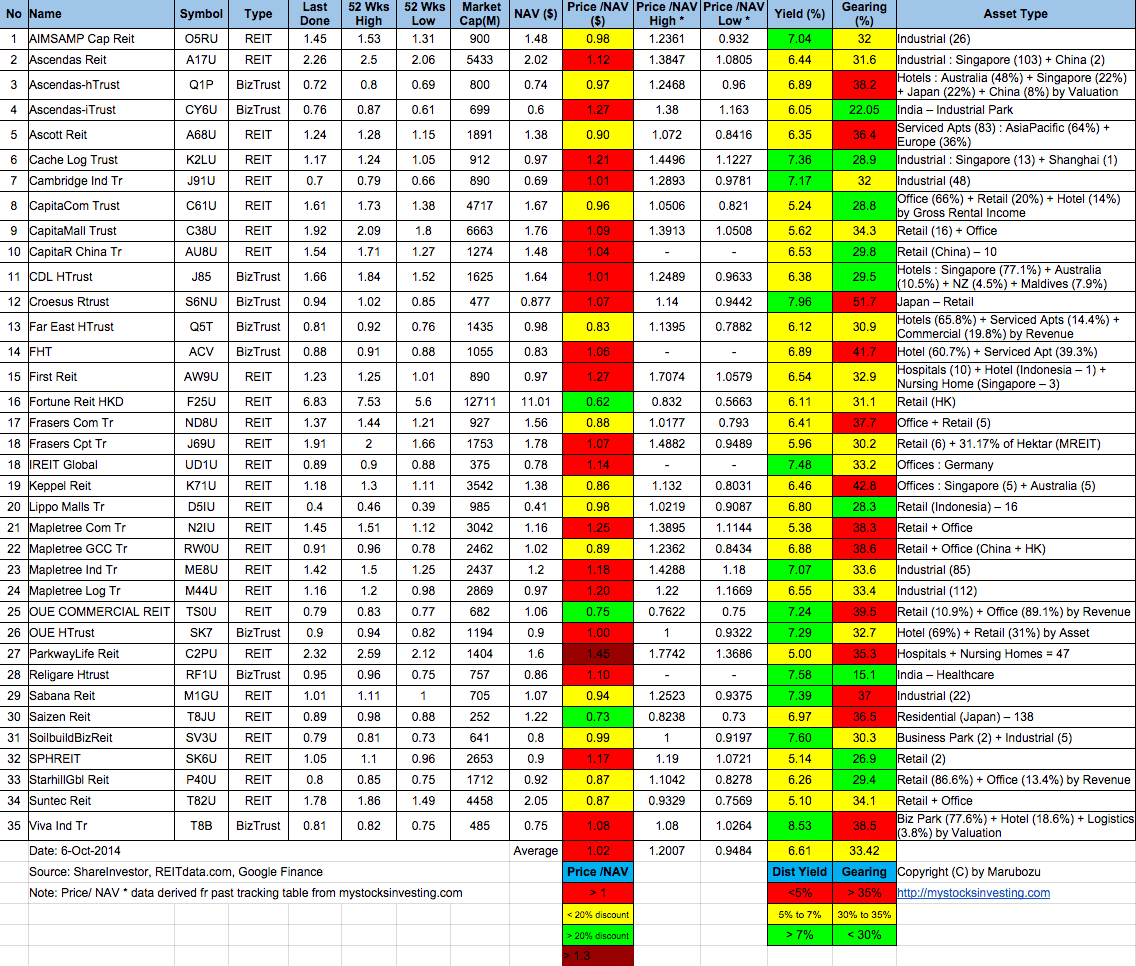

- Price/NAV decreases from 1.045 to 1.02 (slightly over value now)

- Distribution Yield increases from 6.46% to 6.61% (take note that this is lagging number, past DPU does not represent future DPU)

- Gearing Ratio remain at 33.42%

There are 35 Real Estate Investment Trust in Singapore as shown in the above table. Most people just purely choose the REIT with HIGH DIVIDEND and invest blindly without knowing what are the RISKS. If you want to learn how to pick the right REIT and invest to generate passive income safely, check out the very pragmatic and educational public seminar here “Investing in Singapore REIT“.

There is no free lunch in this world. Do NOT invest purely base on the tips! Please think critically why should people give you FREE tips to help you to make money? Invest in yourself with the right knowledge before throwing your hard earned money in the stock market.

CLICK here to register on How to Generate Dividend by Investing in Singapore REIT.

.