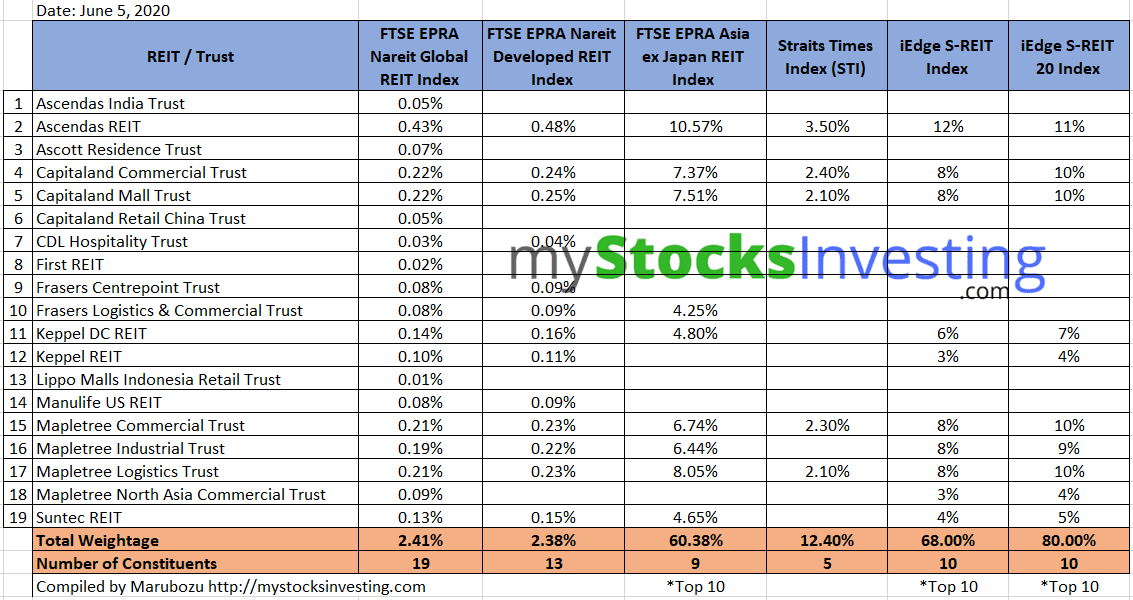

The objective to compile this table is to understand which Singapore REITs and what are the weightage in the key REIT index. This information is helpful to analyse the price movement of Individual REITs as ETFs and fund managers are using this information for portfolio construction and portfolio re-balancing. I used this information successfully to capture the strong V shape rebound of the REIT recently.

Key REIT Indices mentioned in the table: FTSE EPRA Nareit Global REIT Index, FTSE EPRA Nareit Developed REIT Index, FTSE EPRA Asia ex-Japan REIT Index, Straits Times Index (STI), iEdge S-REIT Index and iEdge S-REIT 20 Index.

Note: This table is for my own personal research and it is NOT a buy or sell recommendation. Investors who would like to leverage on my extensive research and years on REIT investing experience can approach me separately for REIT Portfolio Consultation.

My Next REIT Online Course is planned on July 18, 2020 (Saturday). Do take note that I only conduct REIT course for retail investors once a quarter as I am busying conducting training for Singapore Exchange (SGX) and Institute Banking and Finance (IBF) Singapore in addition to my financial advisory works.

You can find the registration detail here. https://mystocksinvesting.com/course/singapore-reits-investing/

Tq for the good compilation. I’d like to point out that in yr table above, Mapletree Industrial Trust (MINT) does not have a tick in the column for the STI. I believe MINT has been included into the Straits Times Index (STI) this week. This was reported on, if my memory serves me well, Thursday. -CK Lai-

Hi CK, thanks for highlighting.

The inclusion of MIT will effect on June 22, 2020.

That’s the reason why MIT is not included in this table.