Technical Analysis of FTSE ST REIT Index (FSTAS8670)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) broke out from the 10 years resistance at 875 with significant increase in trading volume. The REIT index is currently retracing from the high 941.77 to 895.14 (-4.95%). Next immediate support zone is between 870 to 875 for a healthy correction. Previous chart on FTSE ST REIT index can be found in the last post Singapore REIT Fundamental Comparison Table on July 1, 2019.

Based on the current chart pattern and and momentum, the sentiment is BULLISH and the trend for Singapore REIT direction is still UP. The recent selling can be a healthy correction before the REIT index can move higher.

Fundamental Analysis of 42 Singapore REITs

The following is the compilation of 42 REITs in Singapore with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. Added 3 new IPO (ARA US Hospitality Trust, Eagle Hospitality Trust and Prime US REIT) in this month table. Do take note that distribution yield for these 3 newly IPO are just a projection based on the IPO prospectus.

- Price/NAV decreases from 1.07 to 1.05 (Singapore Overall REIT sector is over value now).

- Distribution Yield increases from 6.22% to 6.37% (take note that this is lagging number). About 33.3% of Singapore REITs (14 out of 42) have Distribution Yield > 7%.

- Gearing Ratio at 34.7%. 24 out of 42 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: The current limit of gearing ratio for REITs listed in Singapore Stock Exchange is 45% but there is a consultation paper by SGX to review the potential increase to 50-55% limit.

- The most overvalue REIT is Parkway Life (Price/NAV = 1.63), followed by Keppel DC REIT (Price/NAV = 1.58), Ascendas REIT (Price/NAV = 1.50), Mapletree Industrial Trust (Price/NAV = 1.47), Mapletree Logistic Trust (Price/NAV = 1.30), Frasers Logistic & Industrial Trust (Price/NAV = 1.30), CapitaMall Trust (Price/NAV = 1.28) and Mapletree Commercial Trust (Price/NAV = 1.28)

- The most undervalue (base on NAV) is Fortune REIT (Price/NAV = 0.59), followed by OUE Comm REIT (Price/NAV = 0.75) and Far East Hospitality Trust (Price/NAV = 0.75).

- The Highest Distribution Yield (TTM) is Eagle HT (9.0%), followed by SoilBuild BizREIT (8.67%), Sasseur REIT (8.45%), EC World REIT (8.42%), Lippo Mall Indonesia Retail Trust (8.26%), First REIT (8.11%) ARA HT (8.04%).

- The Highest Gearing Ratio are ESR REIT (39%), Far East HTrust (39.8%) and OUE Comm REIT (39.3%) and SoilBuild BizREIT (39.4%)

- Top 5 REITs with biggest market capitalisation are Ascendas REIT ($9.56B), CapitaMall Trust ($9.63B), Capitaland Commercial Trust ($7.65B), Mapletree Commercial Trust ($5.88B) and Mapletree Logistic Trust ($5.52B)

- The bottom 3 REITs with smallest market capitalisation are BHG Retail REIT ($350M), Sabana REIT ($474M) and iREIT Global REIT ($499M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation

- 1 month decreases from 1.88450% to 1.88250%

- 3 month decreases from 2.00192% to 1.99783%

- 6 month decreases from 2.06017% to 2.05792%

- 12 month decreases from 2.18675% to 2.18500%

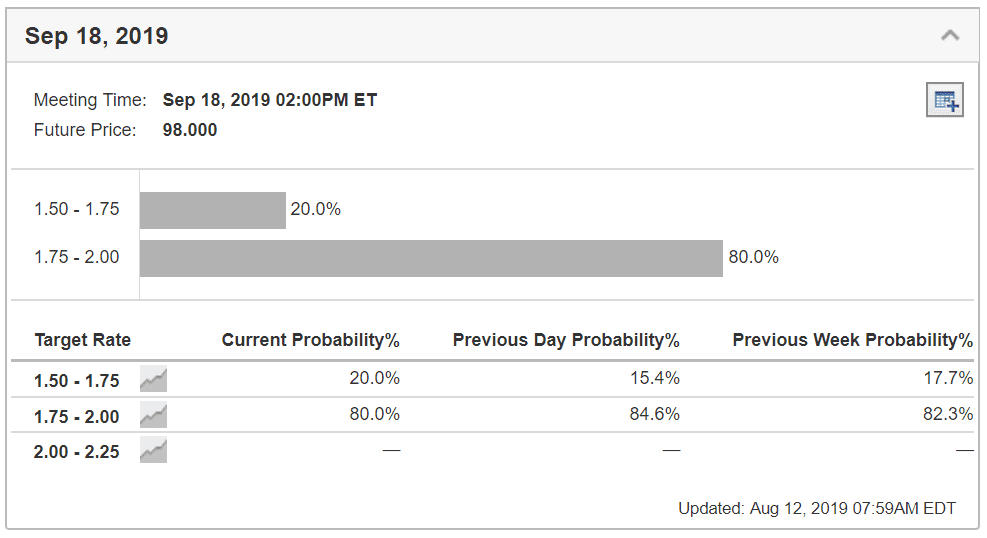

Based on current probability of Fed Rate Monitor, the probability of another 25 bps cut in Sept is 80%.

Summary

Fundamentally the whole Singapore REITs is over value now based on simple average on the Price/NAV. The big cap REITs are getting quite expensive and the distribution yield are still not so attractive currently although those REITs are going through minor correction now. Most of the DPU yield for big cap REIT is below 5% now. The yield spread between big cap and small cap REIT remains wide. This indicates value picks only in small and medium cap REITs.

Yield spread (reference to 10 year Singapore government bond of 1.735%) has widened from 4.205% to 4.635%. DPU yield for a number of small and mid-cap REITs are still very attractive (>7%) although price has started moving north. The risk premium remains attractive as compared to big cap REITs.

Technically, the REIT index is currently going through correction but still trading in a bullish up trend. This bullish sentiment may continue due to the 3 macro factors (1) low interest rate environment (2) potential relax of gearing ratio to 50-55% limit (3) TINA (There Is No Alternative) for other high yield asset classes. The positive sentiment may entice Singapore REITs to take on more debt to grow the current portfolio.

You can catch me at the coming Invest Fair 2019 as I will be sharing my view on the current Singapore REIT market. You can also catch me in between the break if you want to ask me any questions regarding Financial Planning or Investment. You can check out the registration detail here. Kenny Loh @ InvestFair2019

If you need an independent professional review on your current REIT portfolio and need any recommendation, you may engage me in the REIT portfolio Advisory. REITs Portfolio Advisory. https://mystocksinvesting.com/course/private-portfolio-review/