See previous week Weekly Inter Market Analysis.

Original post from https://mystocksinvesting.com

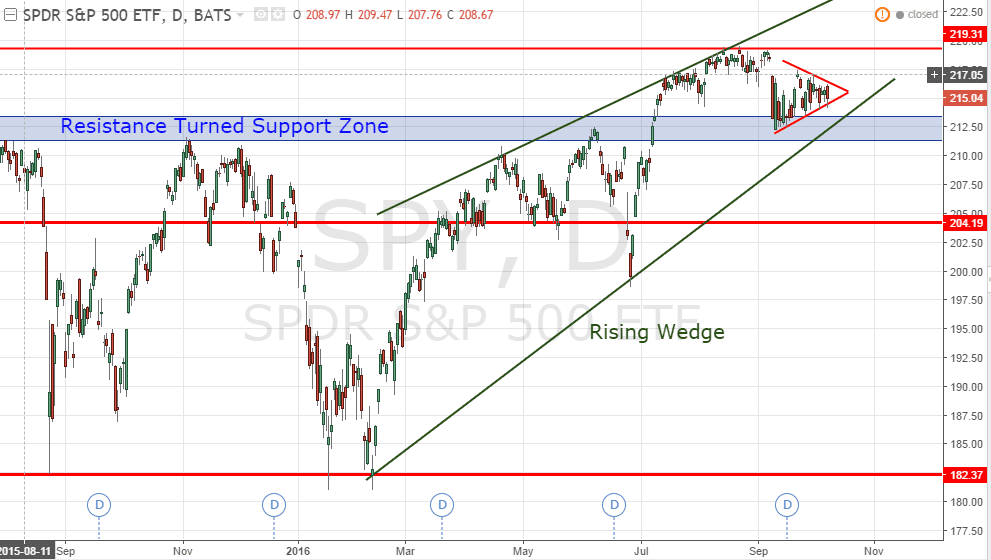

SPY (SPDR S&P500 ETF)

SPY is currently forming a symmetrical triangle in a big Rising Wedge pattern. Symmetrical Triangle is a consolidation pattern until breakout. Keep an eye on on key supports:

- Resistance turned support zone: 211-213

- Rising Wedge immediate support: about 210

- Previous Head and Shoulders neckline support: about 204.

- Rising Wedge next support: about 200

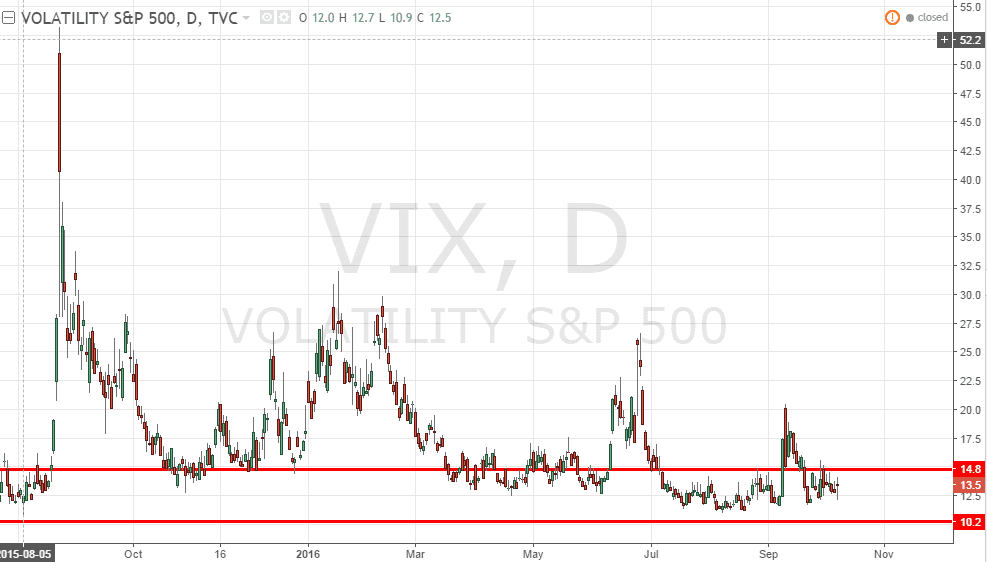

VIX

VIX still stays below 15 – a complacent zone.

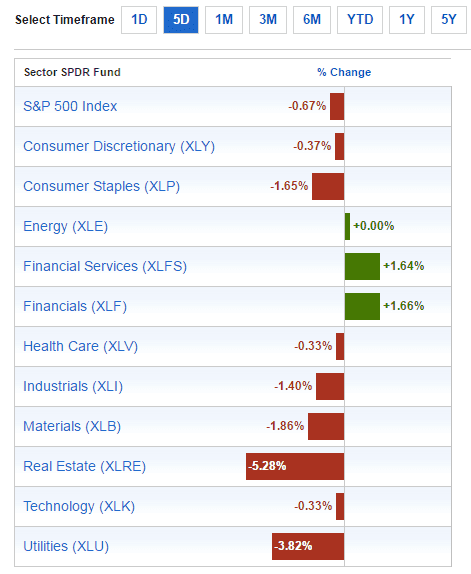

Sector Performance (SPDR Sector ETF)

- Best Sectors: Financials (XLF) +1.66%

- Worst Sector: Real Estate (XLRE) – 5.28%

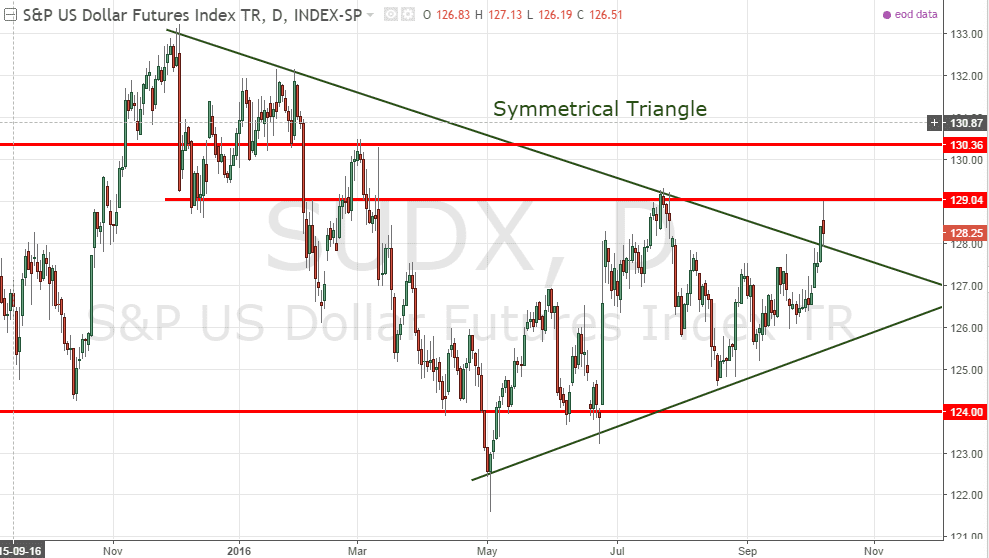

SUDX (S&P US Dollar Futures Index)

SUDX broke out from the Symmetrical Triangle but immediately rejected at the support turned resistance at about 129.04 with a shooting star. Still need to wait for the confirmation of the breakout. Next FOMC statement on Nov 1/2.

FXE (Currency Shares Euro ETF)

FXE is still trading sideway and range bound. Have to wait till next FOMC statement on Nov 1/2 before we can see the next big move.

XLE (SPDR Energy Sector ETF)

Uptrend channel redrawn. XLE moves above 69.31. Critical support at 64.74 which has been tested for 5 times.

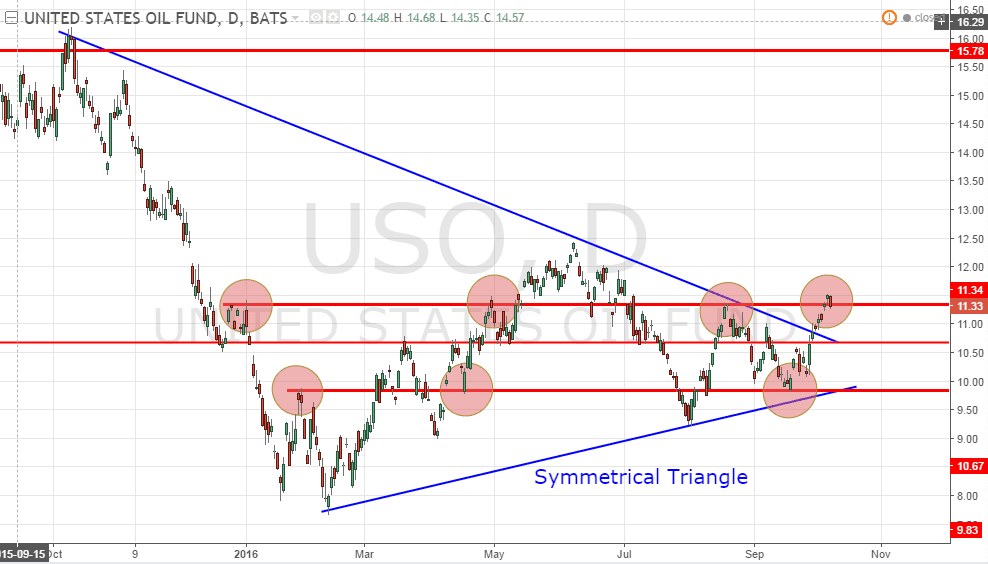

USO (United States Oil Fund)

USO broke out from Symmetrical Triangle but immediately rejected at the strong resistance with a Hanging Man with confirmation. Expect bearish reversal in the coming week.

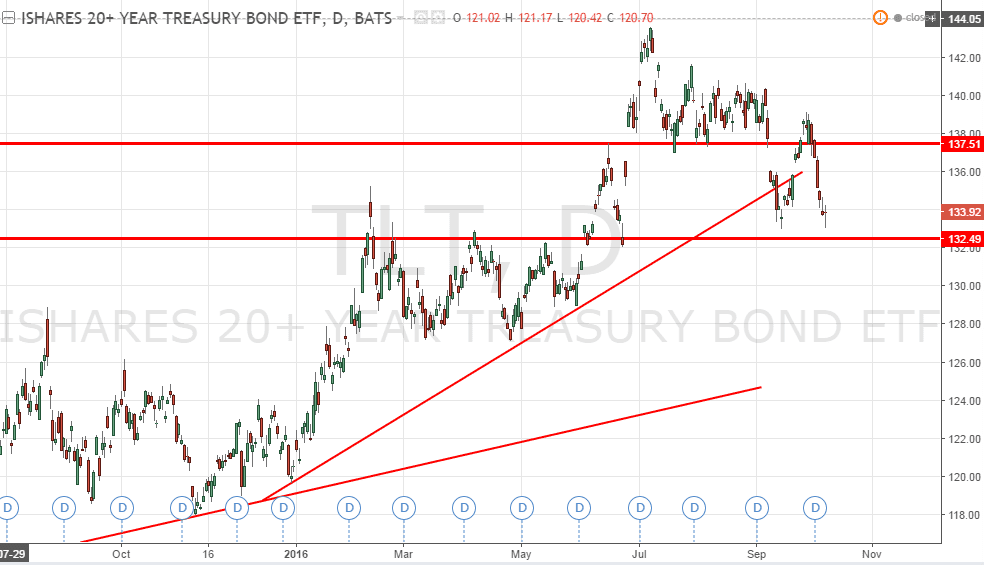

TLT (iShares 20+ Years Treasury Bond ETF)

TLT broke 137.51 support and currently just resting on the next support at 132.5 with a Doji, indicates a pause in the recent down trend. Very interesting to see the sell down in TLT when SPY is moving side way.

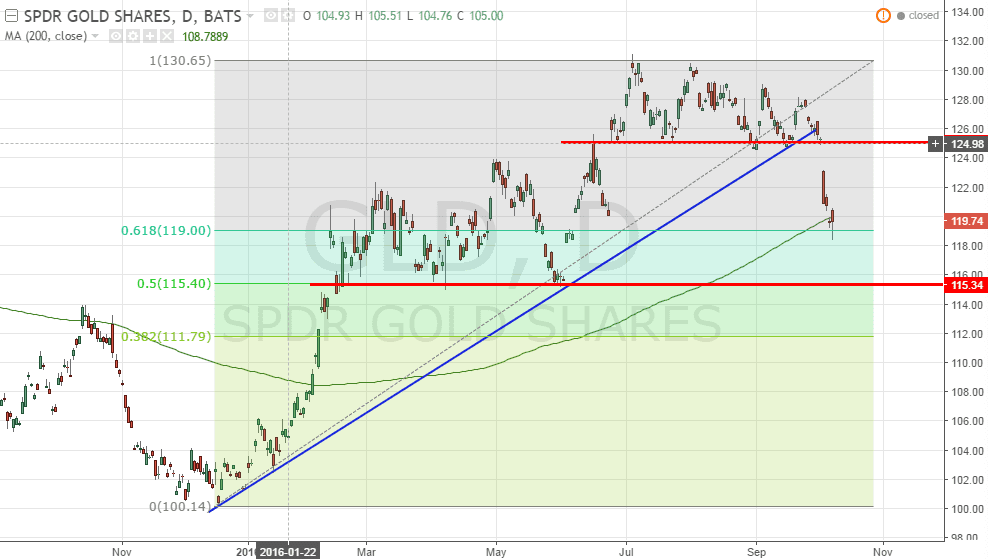

GLD (SPDR Gold Shares)

- GLD broke down from the support with a gap down. GLD is currently testing a 200D SMA support. Can this 200D SMA support hold? Take note that 200D SMA is still trending up.

- Fibonacci Retracement level redrawn for GLD. Currently GLD is also sitting on the 61.8% Fibonacci Retracement Support.

- Expect GLD to rebound from level.

Next Week Economic Calendar

Key events:

- FOMC Meeting Minutes on Oct 13 (Thursday)

- Crude Oil Inventory on Oct 14 (Friday)

- Janet Yellen speaks on Oct 15 (Saturday)