Synopsis: Estate planning transcends the act of writing a Will. It is an intricate process that ensures wealth transfer to loved ones with minimal tax burdens, reduced financial leakages, and the avoidance of potential family disputes. This seminar dives deep into the overlooked challenges in estate planning and offers solutions to navigate complex issues such as US Estate Duty on stocks and assets. Participants will also learn practical strategies for transferring income-generating property to beneficiaries seamlessly.

Key Takeaways:

1. Understanding Estate Planning Challenges: Explore overlooked pitfalls that can complicate wealth transfer and learn how to address them effectively.

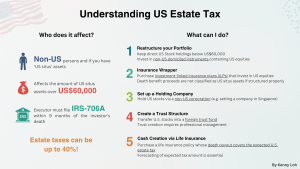

2. Demystifying US Estate Duty: Gain insights into how US Estate Duty impacts ownership of US stocks and assets.

3. Efficient Property Transfer Strategies: Learn actionable methods to transfer income-generating property to beneficiaries while minimizing hassle and ensuring tax efficiency.

Event Details

- Date & Time: 29th May 2025, 7.00pm – 9.00pm Thursday

- Registration starts at 6.30pm

- Location: JustCo Hong Leong Building

- 16 Raffles Quay #09-01 Singapore, Singapore 048581

- Fee: $10. Registration is required.