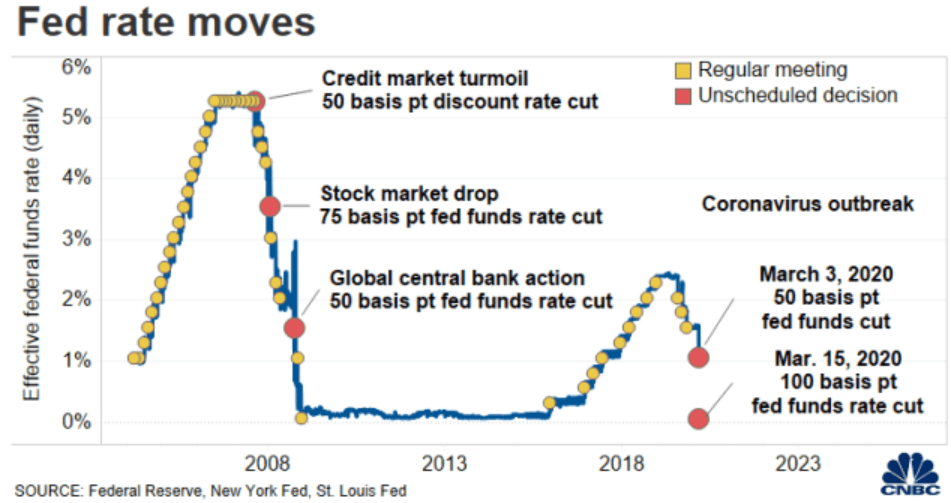

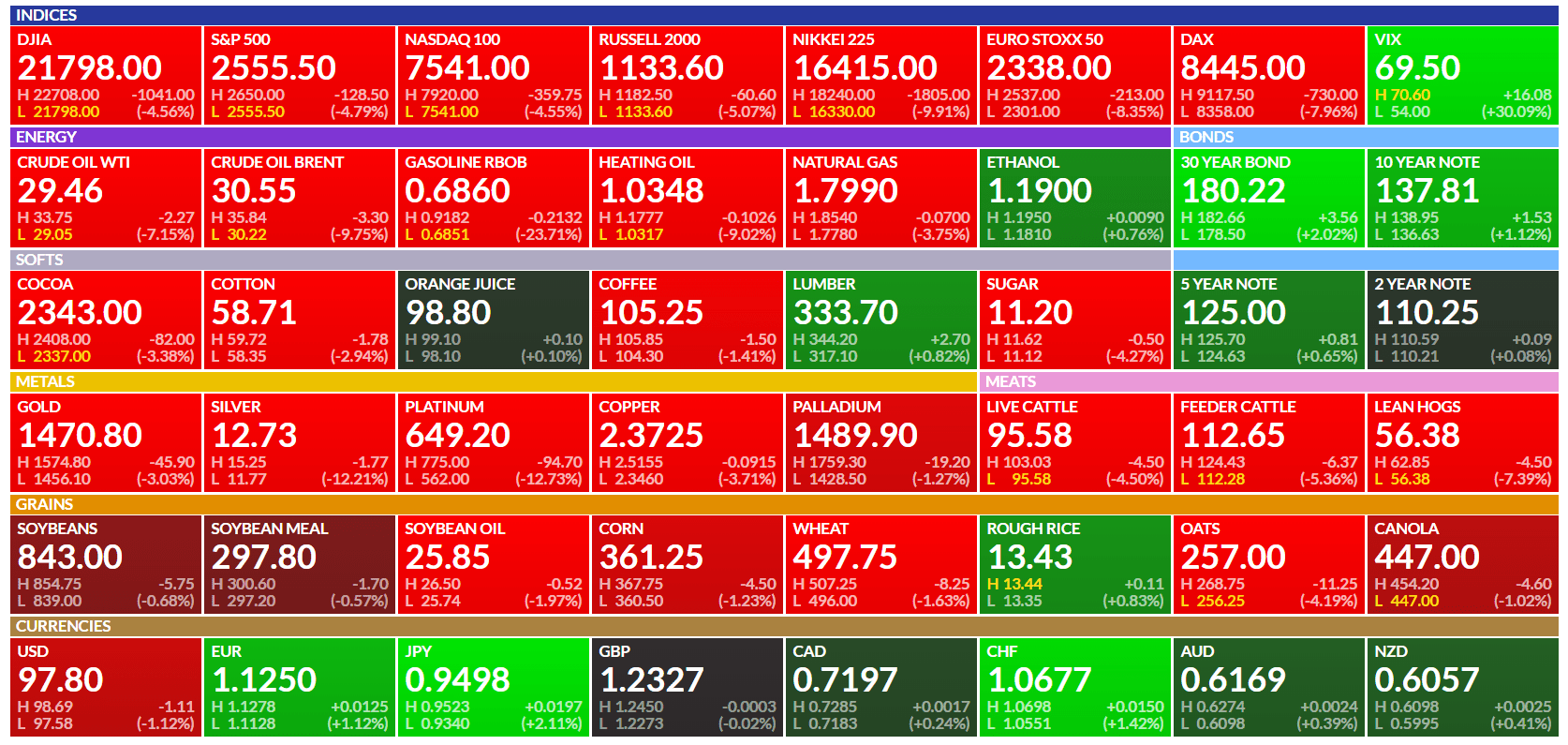

A historical crash event observed in Singapore REITs today! This crash was caused by another emergency interest rate cut of 100 bps by US Fed together with $700 Billion Quantitative Easing. The US interest rate now is 0-0.25%. The market interprets this as a very negative news because US Fed can’t even wait until Mar 18 after the FOMC meeting to make the rate cut announcement.

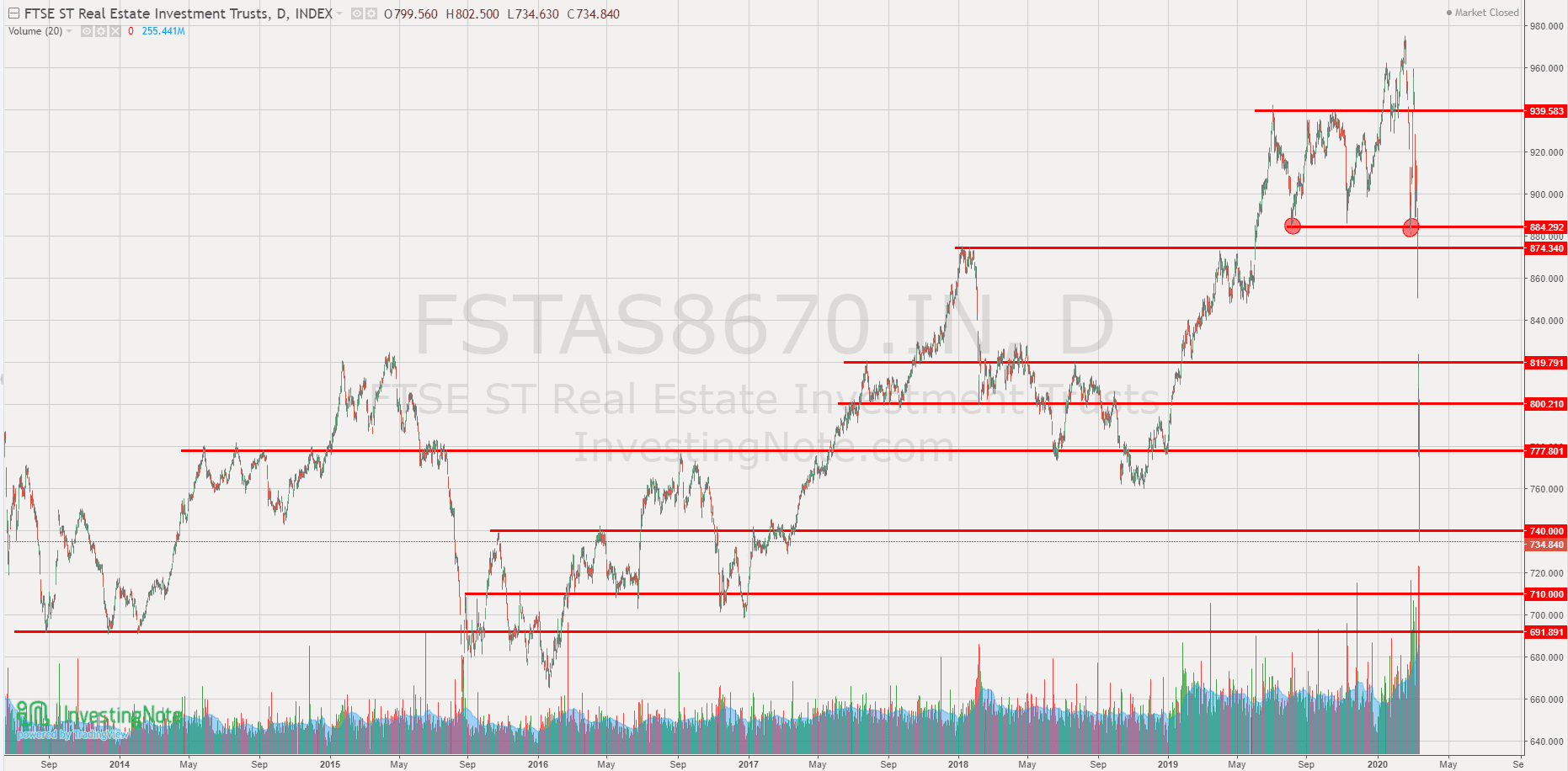

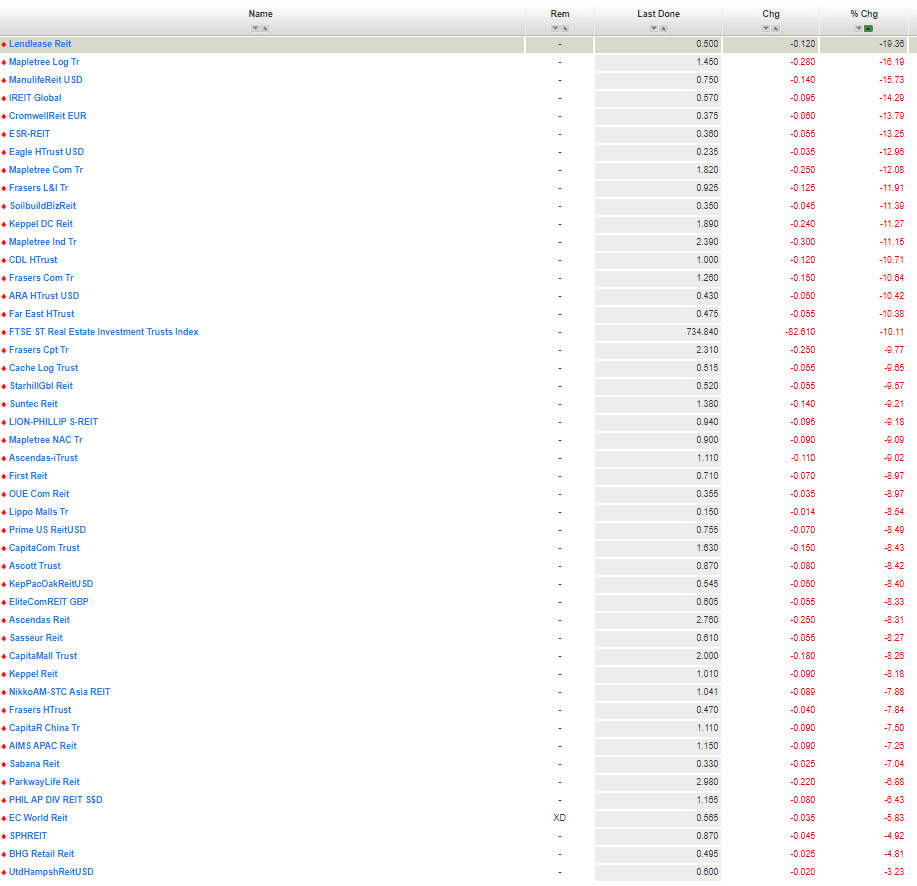

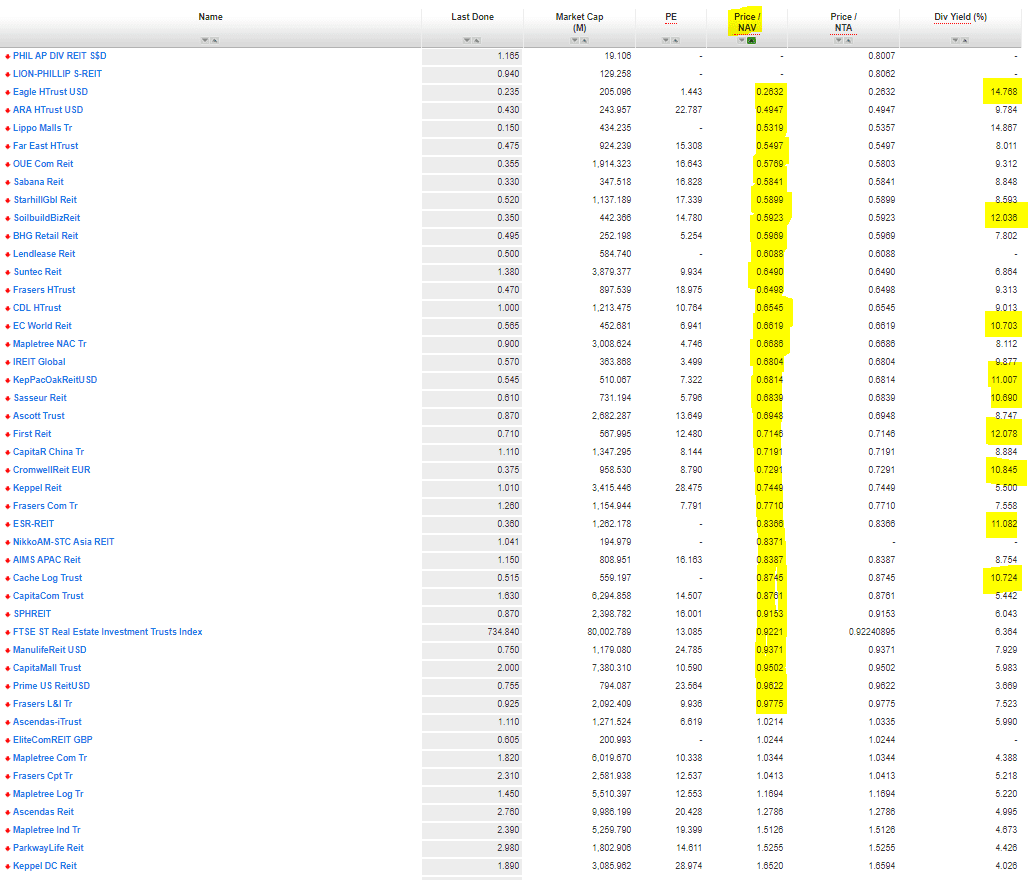

FTSE ST REIT Index drop 10.11% today.

Support & Resistance for FTSE ST REIT Index.

Blood bath Black Monday in Singapore REITs!

The valuation is Crazily Cheap! The sell off does not make any sense and the most probable explanation is Forced Selling due to Margin Calls.

If you are panicking or have great concerns on your current investment portfolio, it is advisable to seek independent professional’s help (advisory fee applied) to review your current financial situation and investment before next course of action (continue to hold, sell all, sell some, buy some, buy more, do nothing, don’t know when to sell, don’t know when to buy, what to buy, what to sell, etc). You may contact kennyloh@fapl.sg if you need any advice.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Sympsosium and Invest Fair. https://fa.com.sg/kennyloh/

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement