Technical Analysis of FTSE ST REIT Index (FSTAS8670)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) changes from 698.05 to 745.45 (+6.8%) compared to last month update. REIT Index has rebounded 26.42% as of May 15 closed after hitting the recent high of 776 (c.33% rebound from the bottom).

Currently the REIT index is going through a minor correction but still trading in a uptrend channel. Immediate support at about 740 (channel support) followed by 720 (previous resistance turned support)

The REIT index is testing the Immediate Resistance now at about 750 which is the 20D & 50D SMA dynamic resistance. As such, we have to keep a close eye in the next few days to see whether the uptrend is still in tact (if break the 20D & 50D SMA resistance) or the end of the uptrend (break the support at 720).

Previous chart on FTSE ST REIT index can be found in the last post Singapore REIT Fundamental Comparison Table on April 8, 2020.

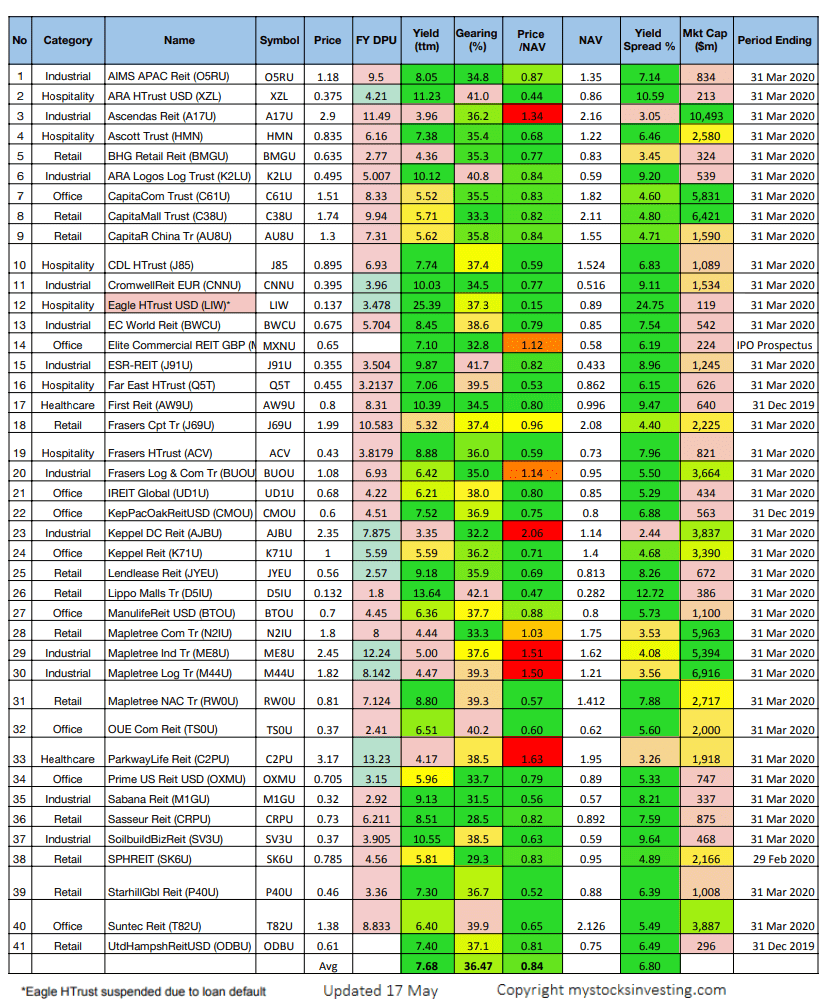

Fundamental Analysis of 40 Singapore REITs

The following is the compilation of 41 REITs in Singapore with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio. This gives investors a quick glance of which REITs are attractive enough to have an in-depth analysis. DPU Yield for Elite Commercial REIT, United Hampshire REIT are projections based on the IPO prospectus.

- Note 1: The Financial Ratio are based on past data and there are lagging indicators.

- Note 2: This REIT table takes into account the dividend cuts due to COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields.

- Noted 3: Distribution Yield, NAV, Gearing Ratio would probably be adjusted moving forward.

- Note 4: Historical Price/NAV High and Low information is available here.

- Note 5: Additional financial ratio such as WALE, WADM, All in Interest Cost, Interest Coverage Ratio, Unsecured Loan %, Fixed Interest %, Geographical location of the properties, etc have been compiled and updated monthly in Kenny’s Enhance REIT table.

- Note 6: Some REITs opted for semi-annual reporting.

- Note 7: MAS has raised the Gearing Limit from 45% to 50% on April 16. The implementation of Interest Coverage Ratio (ICR) > 2.5x has been deferred to Jan 1, 2022. See the announcement Higher Leverage Limit and Deferral of Interest Coverage Requirement by MAS.

- Price/NAV increased from 0.80 to 0.84 (Singapore Overall REIT sector is very undervalued now).

- Distribution Yield decreased from 9.64% to 7.68% (take note that this is lagging number). About 50% of Singapore REITs (21 out of 41) have Distribution Yield > 7%. Do note that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Gearing Ratio increased from 35.39% to 36.47%. 31 out of 42 have Gearing Ratio more than 35%. In general, Singapore REITs sector gearing ratio is healthy. Note: Gearing may be affected (ie. potential increase) as the valuation of the portfolio would be reduced.

- The most overvalued REITs are Keppel DC REIT (Price/NAV = 2.06), followed by Parkway Life (Price/NAV = 1.63), Mapletree Industrial Trust (Price/NAV = 1.51), Mapletree Logistic Trust (Price/NAV = 1.50) and Ascendas REIT (Price/NAV = 1.34).

- The most undervalued REITs (based on NAV) are Eagle Hospitality Trust* (Price/NAV =0.15), followed by Lippo Malls Indonesia Retail Trust (Price/NAV = 0.47), ARA Hospitality Trust (Price/NAV = 0.44), Far East HT (Price/NAV = 0.53) and Starhill Global (Price/NAV = 0.52)

- The Highest Distribution Yield (TTM) is Eagle Hospitality Trust* (25.39%) followed by Lippo Malls Indonesia Retail Trust (13.64%), ARA Hospitality Trust (11.23%) and Soilbuild Business Trust (10.55%). Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- The Highest Gearing Ratio REITs are Lippo Malls Trust (42.1%), ESR REIT (41.7%), ARA Hospitality Trust (41.0%) and ARA Logos Log Trust (40.8%) (previously Cache Log Trust).

- Top 5 REITs with biggest market capitalisation are Ascendas REIT ($10.49B), Mapletree Logistics Trust ($6.92B), CapitaMall Trust ($6.42B), Mapletree Commercial Trust ($5.96B) and Capitaland Commercial Trust ($5.83B)

- The bottom 3 REITs with smallest market capitalisation are Eagle Hospitality Trust ($119M), ARA Hospitality Trust ($213M) and Elite Commercial REIT ($224M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Workshop here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

*Eagle Hospitality Trust is currently suspended

Interest Rate Watch

- 1 month decreases from 0.99000% to 0.31500%

- 3 month decreases from 1.01000% to 0.62325%

- 6 month decreases from 1.77000% to 0.81225%

- 12 month decreases from 1.43887% to 1.26166%

Summary

Fundamentally the whole Singapore REITs is undervalued now based on simple average on the Price/NAV. The big cap REITs rebounded quickly after the huge REIT crash. Valuation are very attractive across all the REITs but do take note that NAV is lagging. NAV would probably be reduced caused by the devaluation of property value. We have seen the NAV of some REITs are adjusted downward from the latest earning release or business update.

The most impacted sectors are Hospitality and Retail Malls and we see huge sell down over the past few weeks. Keppel DC REIT, Parkway Life REIT, Ascendas REIT, Mapletree Logistic Trust and Mapletree Industrial Trust are holding well during this sell off.

Yield spread (reference to 10 year Singapore government bond of 0.71%) has reduced from 8.54% to 6.97%. The risk premium are very attractive to accumulate slowly in stages to lock in the current valuation and long term yield after the recovery.

Technically the REIT Index is currently trading at the critical juncture sandwiched between the critical resistance and support. Breaking anyone of the them will set the new direction of the REIT index in the next few days.

You can listen to my recent MoneyFM89.3 Radio Interview here for more insights.

I was invited by MAL Academy as guest speak on Facebook Live (Mandarin) to share Risk or Opportunity to hold REITs on May 19 (Tuesday) 8pm.

https://www.facebook.com/MALACADEMY

If you do not have any knowledge on REIT Investing, you can check out My next Singapore REIT investing course . https://mystocksinvesting.com/course/singapore-reits-investing/

If you do not have time to learn all the basic, or you want to kick start your REIT portfolio within 1 month, I can help you to construct a REIT portfolio with a fee. You can just sit back, relax and wait for the dividend to come it as I will be doing all the job in managing your REIT portfolio. For REIT Portfolio Consultation, please drop me an email marubozu@mystocksinvesting.com

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement