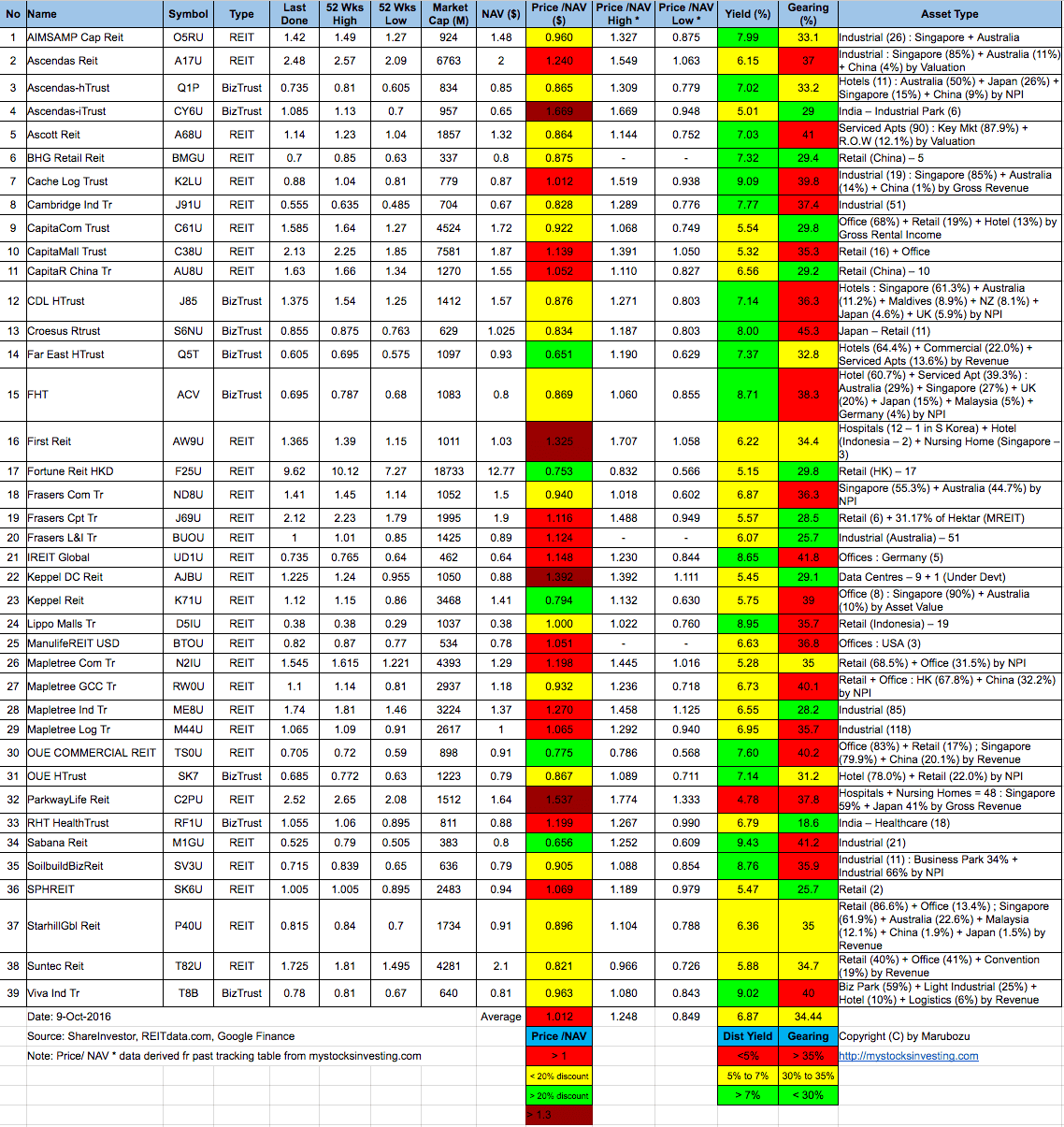

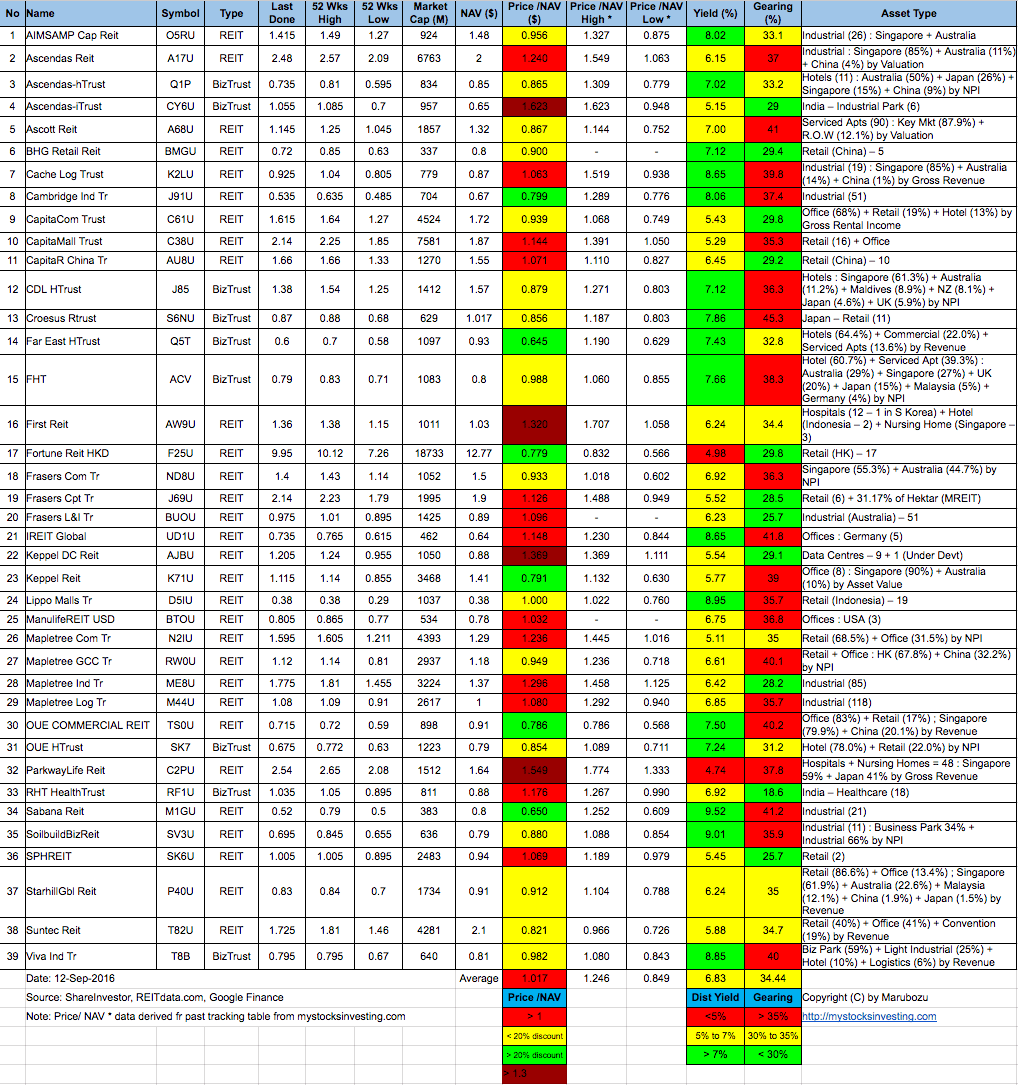

Singapore REIT Fundamental Analysis Comparison Table – 9 October 2016

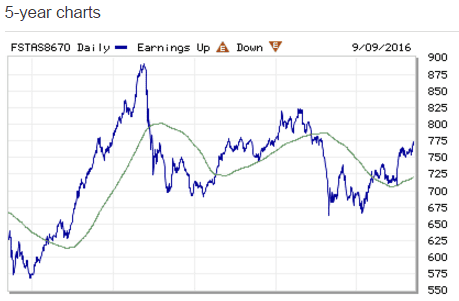

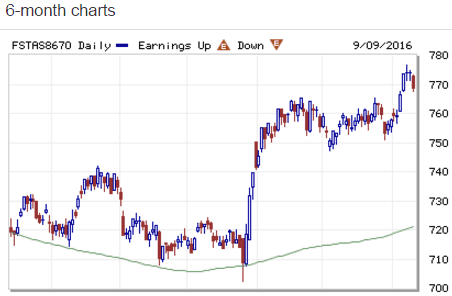

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreases from 768.70 to 764.77 (-0.51%) compare to last post on Singapore REIT Fundamental Comparison Table on Sept 12, 2016. The index is rejected at the declining trend line resistance and currently may be forming a right shoulders of a complicated Head and shoulders reversal pattern (i.e. 2 left shoulders). Base on chart pattern, upside is limited although the index is still in bullish territory. SGX S-REIT (REIT.SI) Index increases from 1183.53 to 1176.60 (-0.59%).

- Price/NAV decreases from 1.017 to 1.012 (Singapore Overall REIT sector is slightly over value now)

- Distribution Yield increases from 6.83% to 6.87% (take note that this is lagging number). Less than half of Singapore REITs (17 out of 39) have Distribution Yield > 7%. High yield REITs mainly from Hospitality Trust and small cap Industrial REIT. Selection of Singapore REITs have become much more important now because not all the high yield REITs has strong fundamental.

- Gearing Ratio remains at 34.44%. 20 out of 39 have Gearing Ratio more than 35%.

- Most overvalue is Ascendas iTrust (Price/NAV = 1.669), followed by Parkway Life (Price/NAV = 1.537) and Keppel DC REIT (Price/NAV = 1.392)

- Most undervalue (base on NAV) is Far East HTrust (Price/NAV = 0.651), followed by Sabana REIT (Price/NAV = 0.656) and Fortune REIT (Price/NAV = 0.753).

- Highest Distribution Yield is Sabana REIT (9.43%), followed by Cache Logistic Trust (9.09%) and Viva Industrial Trust (9.02%)

- Highest Gearing Ratio is Croesus Retail Trust (45.3%), iREIT Global (41.8%) and Sabana REIT (41.2%)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. To learn how to use the table and make investing decision, Sign up next REIT Investing Seminar here to learn how to choose a fundamentally strong REIT for long term investing for passive income generation.

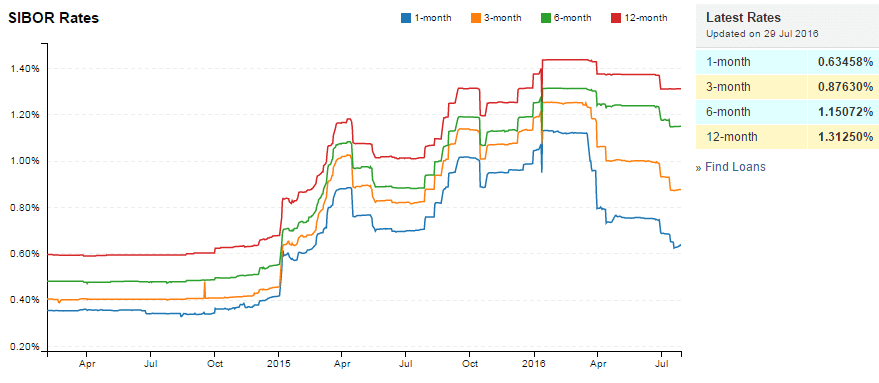

- Singapore Interest Rate remains at 0.38%.

- 1 month remains at 0.62233%

- 3 month increases from 0.87192% to 0.87242%

- 6 month decreases from 1.15071% to 1.14421%

- 12 month remains at 1.31183%

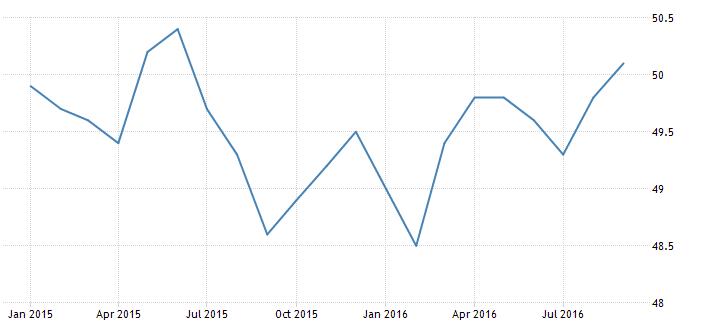

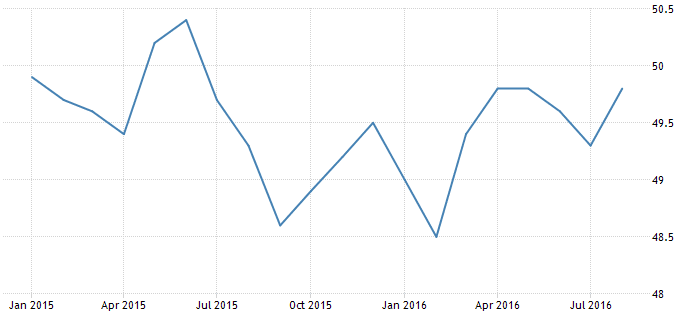

The Singapore Manufacturing PMI increased to 50.1 in September of 2016 from 49.8 in the previous month. The reading pointed to the expansion in the factory activity for the first time in 15 months, led by higher new orders, new exports, and output. Also, the electronics sector rose to 50.3 from 50.2 in August. Manufacturing PMI in Singapore averaged 50.03 from 2012 until 2016, reaching an all time high of 51.90 in October of 2014 and a record low of 48.30 in October of 2012. Manufacturing PMI in Singapore is reported by the Singapore Institute of Purchasing & Materials Management, SIPMM.

Singapore REITs in general is slightly over value now. Distribution yield for some Singapore REITs with bigger market capitalization is not very attractive. However, there are still opportunities in Singapore REITs with smaller market capitalization. Opportunities present in Hospitality sector as the valuation and yield is attractive but future DPU growth does not have good visibility.

Technically Singapore REITs sector is in bullish territory and on uptrend but facing immediate declining trend line resistance. Unlikely to see further upside in Singapore REIT sector due to the imminent potential interest hike end of the year after US Presidential Election.

Finally there is a REIT ETF launched in Singapore – PHILLIP SGX APAC DIVIDEND LEADERS REIT ETF. Check out Prospectus and Product Highlight Sheet here.

Original post from https://mystocksinvesting.com

Check out coming seminars at https://mystocksinvesting.com/events