21 February 2022

Money and Me: Optimism for S-REIT’s given earnings signals and mapping the possibilities for shareholders in the Mapletree merger

A conversation between Michelle Martin and Kenny Loh, REIT Specialist and Independent Financial Advisor that takes a look at the S-REITs earnings season — big and not-so-big winners — and what MCT shareholders can expect from the Mapletree merger to MNACT.

Timestamps

0:00 Intro

1:23 S-REITs Earnings Season: more than 50% of reported REITs reported an increase in DPU and NAV

2:11 The Impact of Interest Rate Hikes on S-REITs: Sell-off reaction is overblown, S-REITs are currently rebounding strongly

3:50 With Singapore reopening borders, will Hospitality and Retail Sectors deliver positive results?

5:16 Outlook on Industrial and Logistics REITs, restructuring to New Economy REITs

5:56 MCT and MNACT Merger: Are the terms fair to MCT and MNACT unitholders? Why I think the deal is beneficial to both MCT and MNACT unitholders alike.

8:55 Unitholders options regarding the MCT and MNACT Merger

MCT and MNACT Merger

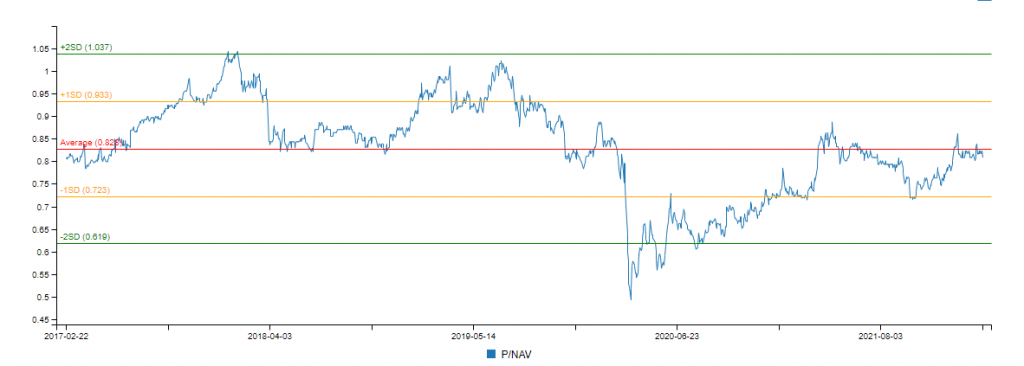

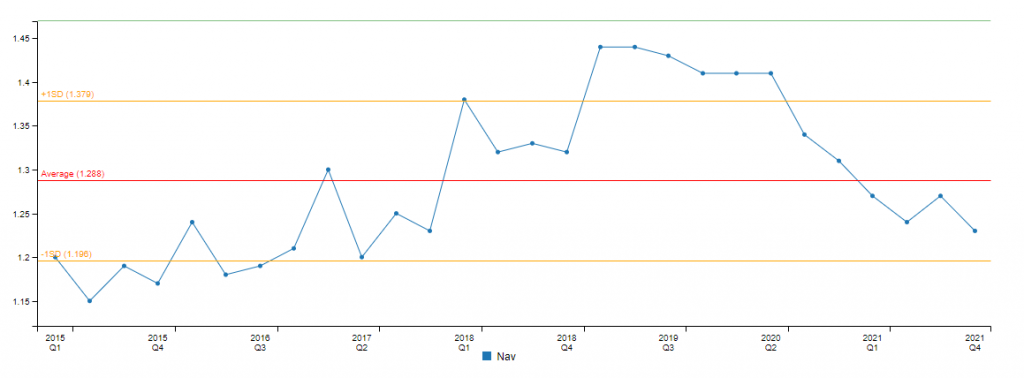

With a scheme consideration of $1.1949 per MNACT unit, and the current NAV/unit of $1.225, this would give a P/NAV offering of 0.975, which is close to the high in July 2019. Charts can be found on the StocksCafe REIT Screener.

REIT Course

Conducted by SGX Academy, I have recently launched a REIT course “Building a Diversified REIT Portfolio” happening on the 5th and 12 March 2022.

Course Syllabus:

- Introduction to REITs (what is a REIT, its business model, REITs vs Physical Properties etc.)

- The REIT Market and Macro Environment

- REIT Sectors and Geographical Distributions of properties

- Terminology and the various Financial and Fundamental Ratios of REITs

- Impact of COVID-19 on S-REITs (new!)

- SGX New Initiatives (ESG, Transparency Index)

- Where to obtain REIT-related Information

- How to select REITs for your Investment Portfolio

- Technical Analysis techniques to time your entry (and exit) in/out of the market

- Tools and Techniques to increase your returns on REITs

- How to build a Diversified REIT Portfolio

- Hands-on Case Studies

Read more by clicking on the links below. Limited Seats! Registration Closes 28th February 2022.

Listen to his previous market outlook interviews here:

2021

- Money & Me: Mapletree merger, growth in commercial S-Reits and the potential return of Reit IPOs in 2022 (January 2022)

- Money & Me: First Reit, CapitaLand, Daiwa, Digital Core Reit and the best of the S-Reit pivots (December 2021)

- Money and Me: VTL’s and hospitality and retail, a new Reit ETF and Making sense of offers for SPH (November 2021)

- Money and Me: Who benefits from the ESR – ARA Logos Logistics Trust merger? (October 2021)

- Money and Me: China’s Evergrande Group property and the spillover in the property market, breaking down what CapitaLand Invest means for the investor and global REITs to watch (September 2021)

- Money and Me: Are retail and hospitality aggressive plays given the pace of reopening? (August 2021)

- Money and Me: Which REITs have seen a limited impact on occupancy during COVID? (July 2021)

- Money and Me: An overview of the REIT performance (June 2021)

- Money and Me: S-REIT’s: which are most likely and which least likely to be affected by new social restrictions? (May 2021)

- Money and Me: What’s the link between bond yields and S-REITs? (April 2021)

2020

- Money and Me: REITS that did well in 2020 (December 2020)

- Money and Me: An overview of S-REITS, value rotations and REITS paying out higher dividends (November 2020)

- Money and Me: Yield Generating Asset Classes (October 2020)

- Money and Me: The REIT outlook within and beyond Singapore (August 2020)

- Money and Me: Ugly Duckling Earnings turning into Beautiful S- Reit swans? (July 2020)

- Money and Me: V for S-REITs? (June 2020)

- Money and Me: Will revenge spending help REITs? (May 2020)

- Money and Me: What REITs to Look out for? (April 2020)

- Money and Me: Crazy REIT Sales (March 2020)