Money and Me: Are S-REITs Still Worth the Climb?

17th Nov 2025

Industrial REITs are steady, yields are juicy, and rates are falling – so is now the moment to move?

Hosted by Michelle Martin, this episode breaks down why industrial S-REITs have held firm with strong occupancy and rental reversions.

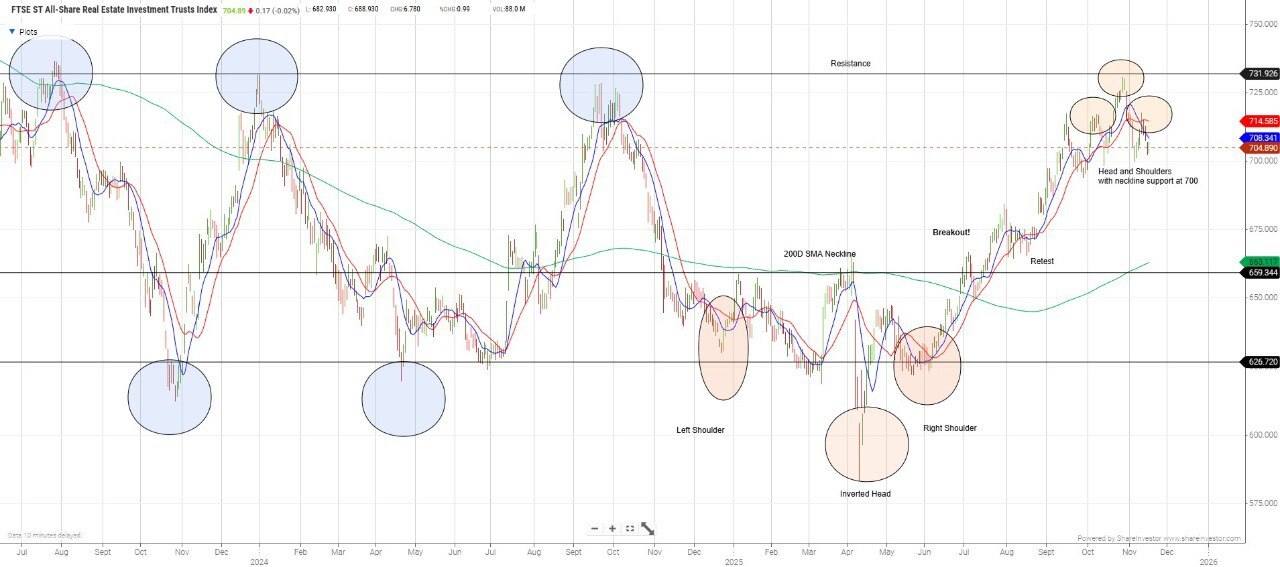

We explore how the wider S-REIT universe has staged a 2025 rebound on easing debt costs and a friendlier rate outlook.

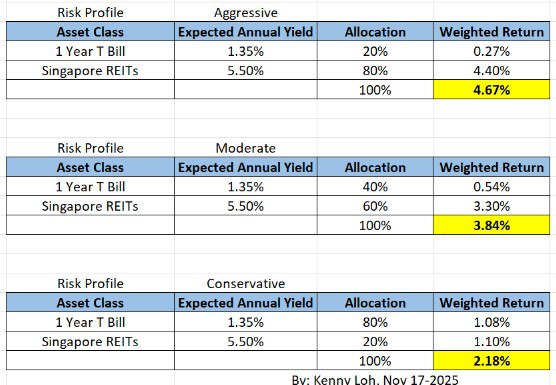

With T-bills slipping near 1.37 – 1.4%, Kenny Loh weighs in on whether REIT yields of 5 – 6% still offer real value.

Is this rally just a “rates are going down” trade – or the early innings of a broader re-rating?

Kenny also shares clear strategies for conservative investors navigating income, risk and timing.

Note: The above analysis are my own personal views and are NOT buy or sell recommendations. Investors who would like to leverage my extensive research and years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

Listen to his previous market outlook interviews here:

2025

- Money and Me: Are S-REITs Still Worth the Climb? (October 2025)

- Money and Me: S-REITs vs Banks – Is It Time to Rotate? (August 2025)

- Money and Me: Are S-REITs Still Worth the Risk in 2025? (July 2025)

- Money and Me: REITs Among Upcoming IPO’s and what you need to know (June 2025)

- Money and Me: S-REITs Bounce Back? China’s REIT Game-Changer and the hunt for yield of up to 8% (May 2025)

- Money and Me: How are S-REIT’s doing amidst the Tariffs Turnaround? (April 2025)

- 𝗠𝗼𝗻𝗲𝘆 𝗮𝗻𝗱 𝗠𝗲: 𝗦-𝗥𝗘𝗜𝗧𝘀 𝗥𝗮𝗹𝗹𝘆, 𝗧𝗿𝗲𝗮𝘀𝘂𝗿𝘆 𝗬𝗶𝗲𝗹𝗱𝘀 𝗗𝗿𝗼𝗽, 𝗮𝗻𝗱 𝗖𝗗𝗟’𝘀 𝗙𝗮𝗺𝗶𝗹𝘆 𝗗𝗿𝗮𝗺𝗮 (March 2025)

- Money and Me: CPF Special Account Closure, Retirement Planning, and Investment Strategies with Kenny Loh (February 2025)

- Money and Me: What is your T-Bill to S-REIT allocation? (January 2025)

2024

- Money and Me: Trump’s Second Term, Bitcoin, Tesla, AI, and Suntec REIT Mandatory Cash Offer (December 2024)

- Money and Me: Data Centered S-REITs; here is what you need to know (November 2024)

- Money and Me: Finding attractive S-REITs in a rate cutting environment (October 2024)

- Money and Me: What’s behind the S-REIT Rally? Fed Rate Cuts, and should Finfluencers be managed? (September 2024)

- Money and Me: Navigating S-REITs Amid Earnings Season and Potential US Rate Cuts (August 2024)

- Money and Me: Navigating Challenges for Mapletree REITs and REITs related to Changi Business Park

(June 2024) - Money and Me: Winners and Losers Among S-REITs, Frasers Property’s Profit Plunge, and the Impact of Sustained High Interest Rates (May 2024)

- Money and Me: Manulife US REIT where could it be heading? Are we at the tail end of the down cycle for S-Reits? (April 2024)

- Money and Me: Will more S-REIT’s suspend distributions? (March 2024)

- Money and Me: US Office Reits – the immediate outlook is bleak but there are opportunities for investors (February 2024)

- Money and Me: Why S-REIT investors are focused on valuations in 2024? (January 2024)

2023

- Money and Me: Can Manulife US REIT be saved? (December 2023)

- Money and Me: Finding bargains in the S-REITs sector today (November 2023)

- Money and Me: How a contrarian investor reads a sell-off (October 2023)

- Money and Me: Finding bargains in the S-REITs sector today (September 2023)

- Money and Me: S-REITs earning stars and landscape quakes (August 2023)

- Money and Me: 3 Singapore REITs to watch (July 2023)

- Money and Me: Are S-REITs in for a promising 2H2023? (June 2023)

- Money and Me: How might the expectations of an impending recession affect S-REITs? (May 2023)

- Money and Me: S-REITs’ 2023 1st quarter report card review (April 2023)

- Money and Me: S-REITs that will hold up well in an increasing interest rate environment (March 2023)

- Money and Me: Winners and losers of latest S-REITs earnings season (February 2023)

- Money and Me: S-REITs’ 2023 outlook (January 2023)

2022

- Money & Me: Is 2023 the year of recovery for S-REITs? (December 2022)

- Money & Me: What happens after the recent S-REIT crash? (November 2022)

- Money & Me: Further Interest Rate Hikes, FHT’s failed Privatization bid (September 2022)

- Money & Me: Q3 2022 SREIT winners (August 2022)

- Money and Me: REIT picking in an inflationary environment (July 2022)

- Money and Me: Are Hospitality REITs the clear way to play the reopening trade in Singapore? (June 2022)

- Money and Me: Can S-REITs maintain its upswing from Q1? (May 2022)

- Money & Me: The case for being bullish on S-REITs amid the Ukraine crisis (March 2022)

- Money & Me: Optimism for S-REIT’s given earnings signals and mapping the possibilities for shareholders in the Mapletree merger (February 2022)

- Money & Me: Mapletree merger, growth in commercial S-Reits and the potential return of Reit IPOs in 2022 (January 2022)

2021

- Money & Me: First Reit, CapitaLand, Daiwa, Digital Core Reit and the best of the S-Reit pivots (December 2021)

- Money and Me: VTL’s and hospitality and retail, a new Reit ETF and Making sense of offers for SPH (November 2021)

- Money and Me: Who benefits from the ESR – ARA Logos Logistics Trust merger? (October 2021)

- Money and Me: China’s Evergrande Group property and the spillover in the property market, breaking down what CapitaLand Invest means for the investor and global REITs to watch (September 2021)

- Money and Me: Are retail and hospitality aggressive plays given the pace of reopening? (August 2021)

- Money and Me: Which REITs have seen a limited impact on occupancy during COVID? (July 2021)

- Money and Me: An overview of the REIT performance (June 2021)

- Money and Me: S-REIT’s: which are most likely and which least likely to be affected by new social restrictions? (May 2021)

- Money and Me: What’s the link between bond yields and S-REITs? (April 2021)

2020

- Money and Me: REITS that did well in 2020 (December 2020)

- Money and Me: An overview of S-REITS, value rotations and REITS paying out higher dividends (November 2020)

- Money and Me: Yield Generating Asset Classes (October 2020)

- Money and Me: The REIT outlook within and beyond Singapore (August 2020)

- Money and Me: Ugly Duckling Earnings turning into Beautiful S- Reit swans? (July 2020)

- Money and Me: V for S-REITs? (June 2020)

- Money and Me: Will revenge spending help REITs? (May 2020)

- Money and Me: What REITs to Look out for? (April 2020)

- Money and Me: Crazy REIT Sales (March 2020)

Kenny Loh is an Associate Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair.

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement