Money and Me: What happens after the recent S-REIT crash?

15 November 2022

Money and Me: Money and Me: S-REITs vs T-bills & SSBs. Who trumps?

Just recently, Singapore REITs experienced one of its biggest sell off in 20 years. In fact, latest numbers from the iEdge S-Reit Index also revealed more than 15% decline in total returns year-to-date!

But fret not, because on this episode of Money and Me, Dan Koh and Zia-ul Raushan invite Kenny Loh, REIT Specialist and Independent Financial Advisor who will be sharing more about what investors should be doing amid the S-REIT sell off and where he sees value in the real estate investment space.

Transcription:

Introduction

Singapore’s REITs and Property Trusts S-REITs Sector declined 7% in total returns. Latest numbers from the iEdge SREIT index also revealed that more than 15% decline in total returns year to date. S-REITs, which are traditionally seen as reliable income instruments, are starting to lose their appeal to investors. So against the backdrop of the recent SREIT sell-off, what should investors be doing? Today we ask Kenny Loh, REITs Specialist and Financial Advisor.

Q: Give us an overview of the current S-REIT market and how it has performed so far. (1:32)

It has been a rollercoaster for the past one or two months. Basically, if you look at the REIT Index itself, actually the capital it with a huge sell off of, 70% in September after breaking the support. If you look at index itself, the support level is about 790 – 800 level, and which has been holding very well for the past two years. Right after the sell off the REIT index itself reached the two year low of 660 points.

And after that the REIT index rebounded strongly with a gap out for the past two weeks of about 11%. That’s why you can see that more and less there is more or less V-shaped recovery. And today, uh, this morning, and when I look at the REIT index itself, basically the rebound momentum should continue.

Q: The US Fed’s recent delivery of its fourth consecutive 75 basis point rate hike and likely to further rate hikes in December by probably 0.5%, but we are still looking at that now. What do you make of this and how much of a pullback in share prices of as rates are you expecting? I mean, how do you see them responding to this news? (2:28)

I think at the present moment the REIT sector in Singapore has already priced in this rate hike. Based on last Friday, if you look at the inflation, inflation came in lower than expected, right?

That cause the huge rally on the US stocks itself. That’s why Monday the REIT index have a gap up and you can see the bullish moment coming in. So the present moment, actually yield spread is pretty wide. The selloff is really overdone.

If you compared to the price to book evaluation and also valuation you for the whole REIT sector itself, we are getting very close to the COVID crash level in March 2020. Which does not make sense because if you look at the macro environment and also the business environment, they are doing better than the covid crash because during Covid crash, everything locked down. The whole world economy has halted. And nobody knows what’s going on. At that point the sell-off is warranted and based on today’s valuation, it doesn’t make sense to me.

Q: S-REITs are commonly seen as a safe haven in periods of volatility and uncertainty. But recent weeks have shown that it has struggled to stand up against the aggressive arising interest rate environment, and a potential recession. So, Kenny, what should investors do now? Is it the right time to buy the dip and has S-REITs bottomed up? (4:14)

It is important to do ‘bottom fishing’. I’m currently doing bottom fishing for myself and also for my clients because at the end of the day, we are investing in REIT for it passive income for our retirements. So as long as an investor has not really achieved their passive income goal, probably maybe 10,000 per month, first of all, they have to sell a target first, as long as they have not met the goal, they can use this price weakness to continue to accumulate more because investing in REITs like investing in real estate.

If the price/book value is 0.8, which means that 20% discounted valuation, if you just think of it, its like a property on Orchard Road selling at 20% discount, right? While in the macro environment, rents are going up. And you look at it, the valuation continue goes up. The rental goes up. Now the market gives you a huge discount because of a fear in the market. It’s a good time to accumulate. Nothing to worry about it.

Past REIT Index chart (2 years). V-Shaped Rebound on the way?

Q: But that raises the question if we should be investing our cash into safer investment tools like T-Bills and SSBs, because SSBs current return rate over 10 years is 3.47% and for T-Bills about 4%. It is worthwhile taking the risk? (5:45)

There are pros and cons. T-Bills very sensitive to interest rate. It’s pretty short term. You’re talking about six months and one year. In the rising interest rate environment you can lock in th high interest rate, but how about six months later? The rates will go down. You also cannot liquidate a T-Bill easily. If you want to liquid it in between, you need to sell at the market, you may incur a loss. You will have to make sure to hold until maturity.

For SSBs, you can lock in for the next 10 years, around 3.4%, if I’m not mistaken. Redemption period is only one month. That’s why I’m using SSB for my emergency fund and you can lock in for the next 10 years.

But on another hand that you do not have an opportunity to participate in the capital application. Right. So that is a disadvantage on the, the SSB itself. Also if you have 200,000 now, based on the last allocation, I think that each individual investor have been allocated about 10,000.

Moving forward, I think the next month it’ll be even lower because interest rate is much higher than the last issue. But REITs itself, they are currently undervalued. Eventually there’ll be a mean reversion. When that happens, you can enjoy the high yields of 7.4% average! Even Blue Chip REITs give you 6% easily. And some of the overseas property REITs are currently having 14% ttm yield!

The Yield Spread is pretty high now. In short, invest in Singapore. This gives an investor a chance to really participate in the upside, at the same time to be rewarded 6-7% yield. At the same time, you are also getting paid, and the dividends are much higher than SSB yields.

Q: Based on the recent reporting season, how do you think S-REITs performed? Were there any surprises or shocks that stood out? (8:28)

No big surprises. I would say that if compared to year on year, DPU growth is 50-50, half of REITs are doing better compared to the past year, half of them slightly below expectations. More noticeable however are hospitality REITs. We stared off from a very low base and of course definitely they perform much better during this period and moving forward when China is going to reopen,

I think it’s pretty soon because they cannot lock down forever, and Chinese tourists, when they do start traveling Asia and Singapore should become one of the top destinatiosn for Chinese tourists.

The Hospitality and Retail Sectors in Singapore are then expected to do well.

Q: What about those in the industrial sectors for S-REITs? How do you see the sustainability of their profits in the long term? (9:38)

So far, based on the past earnings of performance, they are still giving good DPU. It’s quite stable. It’s not really a factor. And they are also able to pass some of the costs increases and/or inflation by rising the tenant rentals and also increasing service charges. So I would say that those industrial, which have a very strong sponsor and also have very good track records, they are able to weather through during this period from the performance we have seen so far.

I believe they are experienced enough to have all different tools to really navigate during the high interest rate and also high inflation period. So especially when it come to the hospitality sector, you can see that hotel rates are being adjusted every day. They are able to adjust it as quick as possible to really capitalize and pass the costs onto the guests. the.

Q: Are there any S-REITs that have the potential to withstand prolong economic shocks and thrive during high inflation? (10:46)

There are quite a number of REITs investors should be careful of. Especially those with high Gearing. Also, a weakening economy environment. Because once your economy environment weakens, potentially your future rental will be affected. That will affect your portfolio valuation. Because valuations are based on the discounted cashflow for the future, and that will decrease the REIT’s NAV, and thus Gearing Ratio increases.

If they have short Debt Maturity profiles, they’ll have to refinance at higher interest rates. Lenders look at your balance sheet to see whether you’re strong or not strong before they can decide what kind of interest they’ll provide you. At the same time, if their Interest Coverage Ratio (ICR) is low, That also indicates the weakness in terms of the cash flow generation. If they’re not able to generate enough cash flow to really pay off all the coupon rate or interest rate, the REIT will be in trouble. They have to either sell the current property (that will further decrease the DPU), or they have to issue additional rights.

It is also a bad time to issue rights, since the share price is very low. But if they issue the rights now, that will further depress the share price. REIT managers will try to avoid that.

Q: Which sectors look particularly attractive to you? (12:23)

Typically, I have 3 different themes to investing.

First theme: If an investor wants really stable, predictable REITs, just stay with the industrial sector because industrial sector is normally stable. But you still have to look at REITs with a lot of business parks. Because if the tenants are SMEs, with the recession period, you’ll have a tougher time navigating the recession period. But those big MNCs like those in the tech sector, with good cash flows, they can continue operations and pay rental. With blue chip industrial REITs, you should be able to have very stable dividends.

Second theme: Reopening play. I’m banking a lot on China. When China ends lock downs, and tourists come out, there’ll be the revenge spending and revenge traveling phenomenon again. We’ve done it before, right? So we cannot underestimate the spending power of all those China tourists. Certainly that will help in the hospitality sector. For the Hospitality sector, we have to stay with those hospitality REITs that have very wide exposure to China tourists.

Third theme: Third will be more on eCommerce, because eCommerce and also digitalization of the economy, you cannot run from it. The world is going through technology transformation. Everything will be digitalised. So data centres are another area I’m looking at for growth purposes.

Q: Now Kenny, moving on to overseas, Cromwell European REIT, IRETI Global and Elite Commercial REIT have suffered a brunt of risk off-sell off this year and is shared between 21.6% and 30.8% to date. In your opinion, do you think this sell-off was overdone and do they look attractive now? (14:25)

Yeah, REITs with overseas property looks very attractive to me now. But for Europe itself, there’s another element which is currency, right? Because if we are Singapore investors, if you are looking for the dividend payout in SGD itself, if you look at the Euro and the British Pound and their depreciation, that may be another reason why Singapore investors shun away from all these European REITs based on the currency of itself.

But if investors have not really invested in those countries yet, the yield is pretty attractive first thing. Second thing, the valuation is very cheap. And third thing, both Euro and the British Pound are very cheap. If you have a long term horizon, why not?

Invest and wait for the rebound of the currency and also rebound on the valuation. Eventually they’ll go back to the meanover the long term.

Q: How do you expect REITs to perform for 2023 and what Buy, Sell, Hold indications should we look out for? (15:46)

I have a cautiously bullish view on S-REITs themselves. I studied the past 10 years asset allocation returns of different asset classes. REITs used to perform very well for the past 10 years and whenever the prior year has a huge sell-off, the subsequent years for the S-REIT sectors you have a very strong rebound on the subsequent year. So, for me, basically I’m using this opportunity to lock in the Yield because the Yield is pretty high. At the same time, you are buying some REITs or property at a cheap revolution and just wait for it to recover. Do not really need to worry too much, and eventually properties are properties. Eventually the valuation goes up and also the rental income goes up. That will translate the growth in the future.

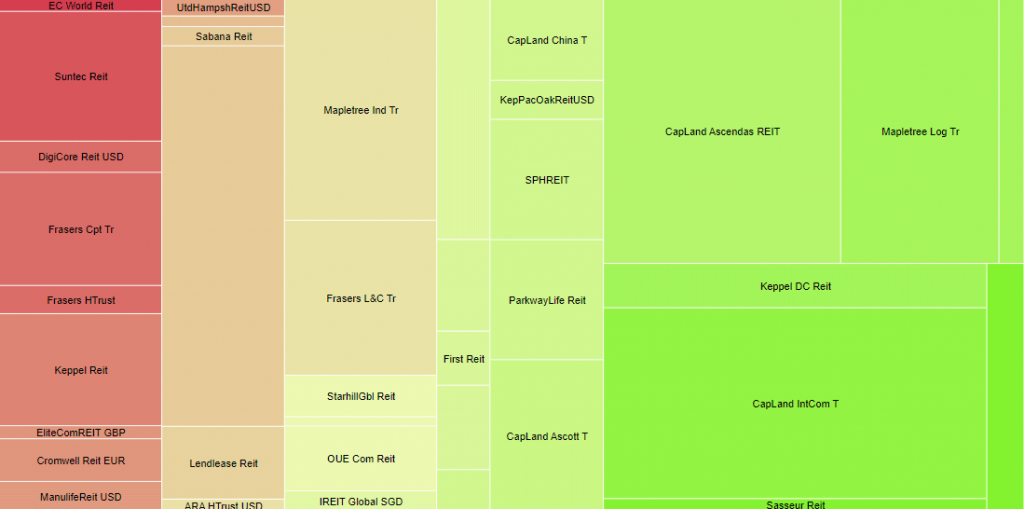

Historical Performances of each sector over the last 15 years.

How to Build a REIT Portfolio into a Retirement Plan? (SGX Academy Webinar)

Want to learn the fundamentals of what REITs are, and how can this asset class complement your investment portfolio? Why should you invest in this asset class with an average p.a. yield of 5-7% and $100 minimum investment amount? Tune in to learn how to kickstart/improve your REITs investing!

Date: 1st December (Thursday)

Time: 7pm – 830pm

Venue: Online

Listen to his previous market outlook interviews here:

2022

- Money & Me: Further Interest Rate Hikes, FHT’s failed Privatization bid (September 2022)

- Money & Me: Q3 2022 SREIT winners (August 2022)

- Money and Me: REIT picking in an inflationary environment (July 2022)

- Money and Me: Are Hospitality REITs the clear way to play the reopening trade in Singapore? (June 2022)

- Money and Me: Can S-REITs maintain its upswing from Q1? (May 2022)

- Money & Me: The case for being bullish on S-REITs amid the Ukraine crisis (March 2022)

- Money & Me: Optimism for S-REIT’s given earnings signals and mapping the possibilities for shareholders in the Mapletree merger (February 2022)

- Money & Me: Mapletree merger, growth in commercial S-Reits and the potential return of Reit IPOs in 2022 (January 2022)

2021

- Money & Me: First Reit, CapitaLand, Daiwa, Digital Core Reit and the best of the S-Reit pivots (December 2021)

- Money and Me: VTL’s and hospitality and retail, a new Reit ETF and Making sense of offers for SPH (November 2021)

- Money and Me: Who benefits from the ESR – ARA Logos Logistics Trust merger? (October 2021)

- Money and Me: China’s Evergrande Group property and the spillover in the property market, breaking down what CapitaLand Invest means for the investor and global REITs to watch (September 2021)

- Money and Me: Are retail and hospitality aggressive plays given the pace of reopening? (August 2021)

- Money and Me: Which REITs have seen a limited impact on occupancy during COVID? (July 2021)

- Money and Me: An overview of the REIT performance (June 2021)

- Money and Me: S-REIT’s: which are most likely and which least likely to be affected by new social restrictions? (May 2021)

- Money and Me: What’s the link between bond yields and S-REITs? (April 2021)

2020

- Money and Me: REITS that did well in 2020 (December 2020)

- Money and Me: An overview of S-REITS, value rotations and REITS paying out higher dividends (November 2020)

- Money and Me: Yield Generating Asset Classes (October 2020)

- Money and Me: The REIT outlook within and beyond Singapore (August 2020)

- Money and Me: Ugly Duckling Earnings turning into Beautiful S- Reit swans? (July 2020)

- Money and Me: V for S-REITs? (June 2020)

- Money and Me: Will revenge spending help REITs? (May 2020)

- Money and Me: What REITs to Look out for? (April 2020)

- Money and Me: Crazy REIT Sales (March 2020)

Kenny Loh is an Associate Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair.

You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement