Singapore REIT Monthly Update (April 8th, 2023)

Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) increased from 734.05 to 747.06 (1.77%) compared to last month’s update. The REIT index is currently trading within a big symmetrical triangle with the red line resistance and blue line support.

- Short-term direction: Sideways

- Medium-term direction: Sideways

- Long-term direction Down (200D SMA is sloping down)

- Immediate Support at 720 (symmetrical triangle support)

- Immediate Resistance at 760 (200D SMA resistance).

2 years FTSE REIT Index Chart

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on March 5th, 2023.

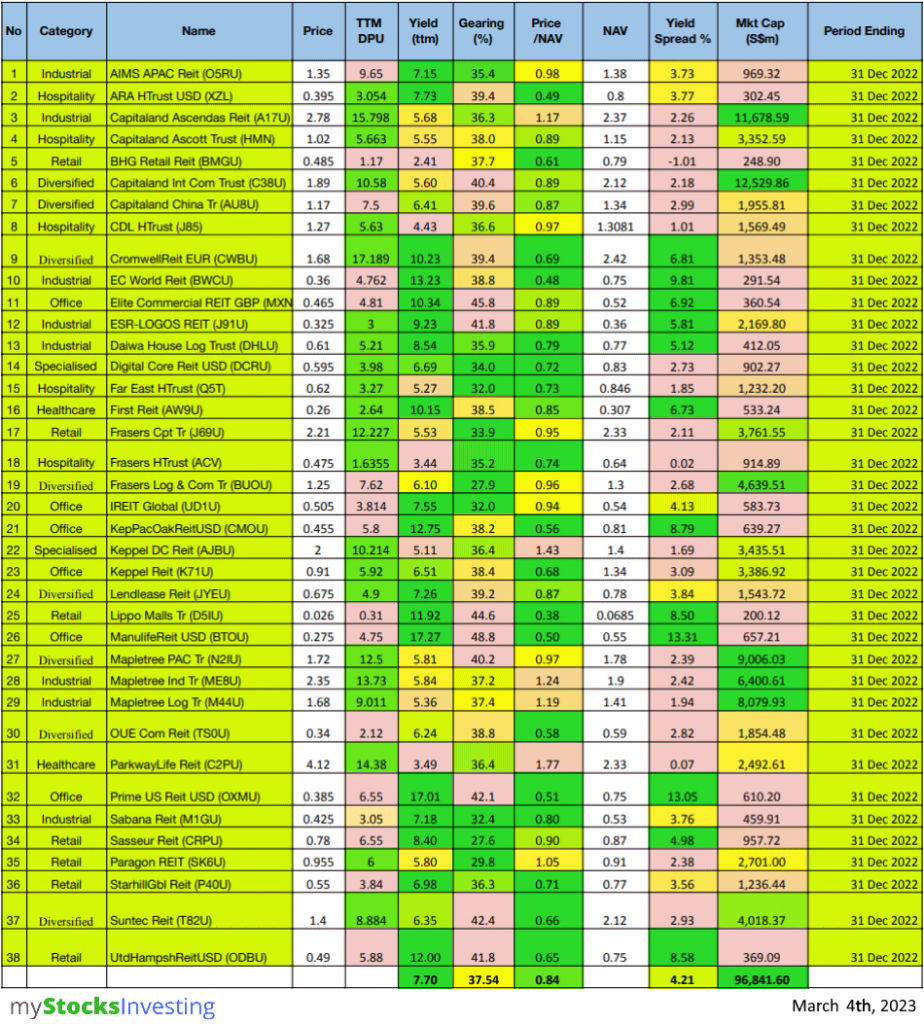

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower for more affected REITs.

- All REITs are now highlighted in yellow-green. All are now updated with the latest Q4 2022 business updates/earnings.

Data from StocksCafe REIT Screener. https://stocks.cafe/kenny/advanced

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of April 7th, 2023. Notes:

- Mapletree Pan Asia Commercial Trust: Annualised yield. MPACT has recently reverted to quarterly distribution.

- Paragon REIT: Annualised yield. Calculated after converting from 13 months of distribution to 12 months.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.

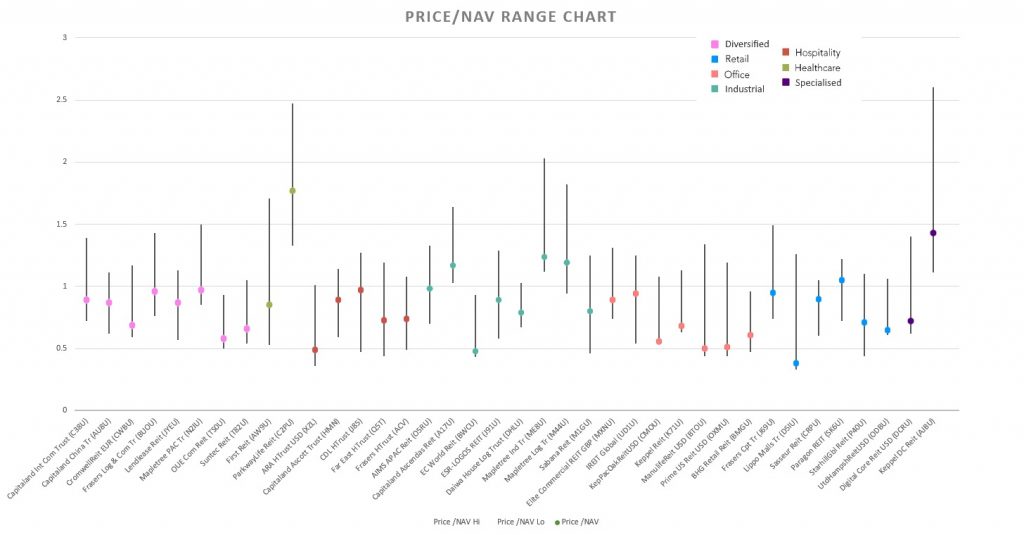

Price/NAV Ratios Overview

- Price/NAV decreased to 0.82.

- Decreased from 0.84 in March 2023.

- Singapore Overall REIT sector is undervalued now.

- Take note that NAV is adjusted upwards for some REITs due to pandemic recovery.

- Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 1.71)

- Keppel DC REIT (Price/NAV = 1.49)

- Mapletree Industrial Trust (Price/NAV = 1.25)

- Mapletree Logistics Trust (Price/NAV = 1.23)

- Capitaland Ascendas REIT (Price/NAV = 1.21)

- Paragon REIT (Price/NAV = 1.05)

- Only 8 REITs are overvalued now based on Price/NAV value.

- No change in the Top 6 compared to last 2 months.

- Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV=0.23)

- Manulife US REIT (Price/NAV = 0.38)

- EC World REIT (Price/NAV = 0.41)

- Prime US REIT (Price/NAV = 0.41)

- ARA US Hospitality Trust (Price/NAV = 0.45)

- Keppel Pacific Oak US REIT (Price/NAV = 0.48)

Distribution Yields Overview

- TTM Distribution Yield increased to 8.40%.

- Increased from 7.70% in March 2023.

- 17 of 40 Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

- 9 REITs have a ttm yield of over 10%!

- Highest Distribution Yield REITs (ttm)

- Manulife US REIT (22.62%)

- Prime US REIT (21.13%)

- Lippo Malls Indonesia Retail Trust (19.38%)

- EC World REIT (15.61%)

- Keppel Pacific Oak US REIT (15.06%)

- United Hampshire US REIT (12.65%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

- Yield Spread widened to 5.56%.

- Widened from 4.21% in March 2023.

Gearing Ratios Overview

- Gearing Ratio remained at 37.54%.

- Remained at 37.54% from March 2023.

- Gearing Ratios are updated quarterly. Since no REIT updated their Gearing Ratio, there is no change.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

- Manulife US REIT (48.8%)

- Elite Commercial Trust (45.8%)

- Lippo Malls Indonesia Retail Trust (44.6%)

- Suntec REIT (42.4%)

- Prime US REIT (42.1%)

- United Hampshire US REIT (41.8%)

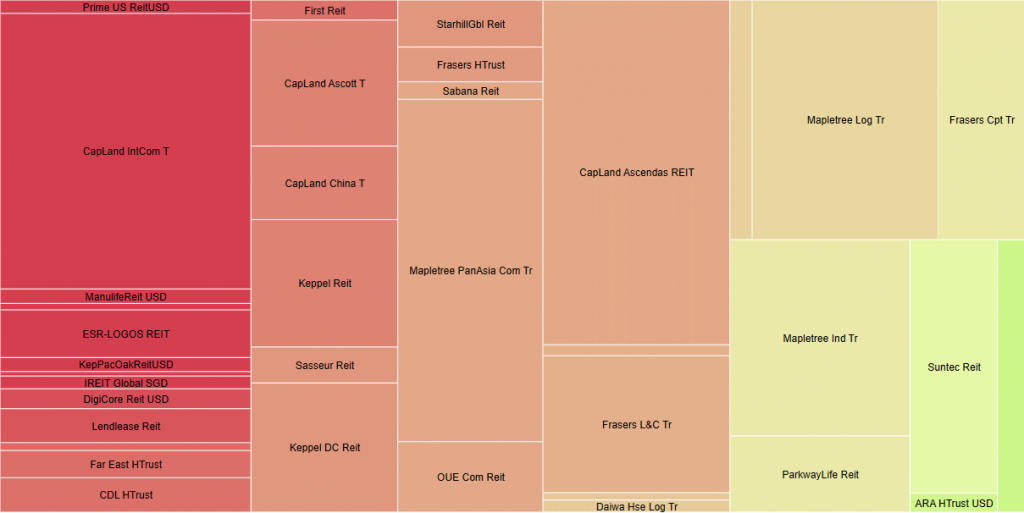

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation increased by 1.71% to S$98.50 Billion.

- Increased from S$96.84 Billion in March 2023.

- Biggest Market Capitalisation REITs:

- Capitaland Integrated Commercial Trust ($13.40B)

- Capitaland Ascendas REIT ($12.06B)

- Mapletree Pan Asia Commercial Trust ($9.48B)

- Mapletree Logistics Trust ($8.32B)

- Mapletree Industrial Trust ($6.48B)

- Frasers Logistics & Commercial Trust ($4.83B)

- No change in the rankings since September 2022.

- Smallest Market Capitalisation REITs:

- Lippo Malls Indonesia Retail Trust ($123M)

- BHG Retail Trust ($246M)

- EC World REIT ($247M)

- ARA Hospitality Trust ($272M)

- Elite Commercial REIT ($325M)

- United Hampshire REIT ($350M)

- No change in the rankings in the past month.

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, here’s a subsidised 2-day course with all you need to know about REITs and how to start investing in them.

Performance Summary of the Month in March 2023

(Source: https://stocks.cafe/kenny/advanced)

This round I think it’ll be worth showing the full 38 REITs and its performance in the past month, to see the difference between the large and small cap REIT’s performance.

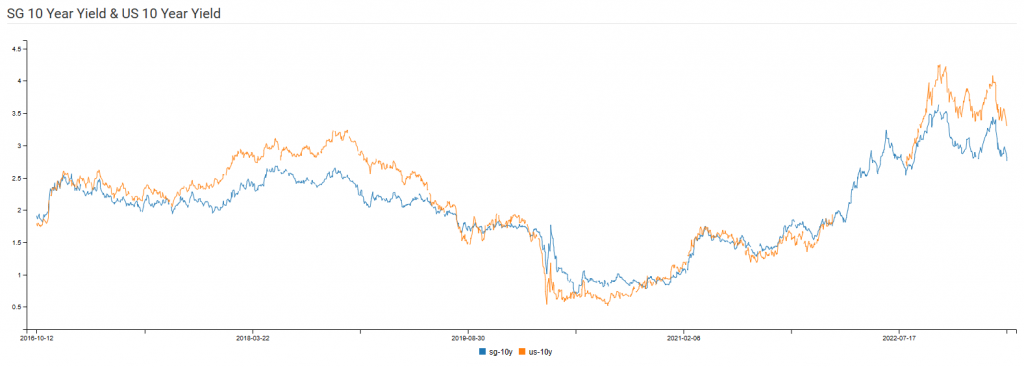

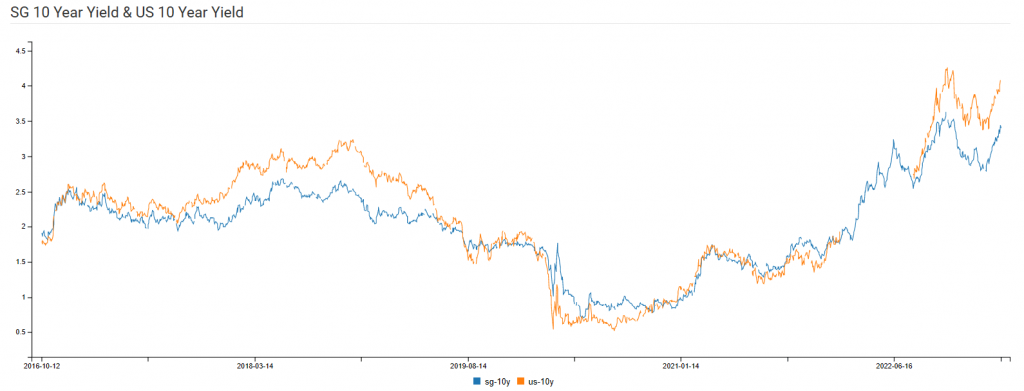

SG 10 Year & US 10 Year Government Bond Yield

- SG 10 Year: 2.78% (decreased from 3.42%)

- US 10 Year: 3.28% (decreased from 3.96%)

Major REIT News in March 2023

There has been no major REIT news in March 2023. Major REIT news generally include REIT takeovers and mergers, huge acquisitions, and events such as defaults and change of ownerships.

Summary

Fundamentally, the whole Singapore REITs landscape remains undervalued based on the average Price/NAV (at 0.82) value of the S-REITs, with a very attractive DPU yield of 8.40%! But this performance is with some caveats (see below).

There is a lot to talk about for this month’s performance. Large market cap REITs fared well this period, while small market cap REITs fared poorly in comparison. The worst performers include Lippo Malls Indonesia Retail Trust (-38.46% decline in market cap), Digital Core REIT (-20.87%), Manulife US REIT (-20.75%), Prime US REIT (-19.48%), and Keppel Pacific Oak REIT (-15.38%). The sole exception to this is Sabana REIT, with a 10.59% gain.

(Source: https://stocks.cafe/kenny/overview)

Yield spread (in reference to the 10-year Singapore government bond yield of 2.78% as of 6th April 2023) widened significantly from 4.21% to 5.56%. This is due to the average S-REIT yield increasing significantly from 7.70% to 8.40%, and the government bond yields decreasing in the past month. However, this is due to the small market cap REITs artificially inflating these numbers due to its performance, while large market cap REITs remained resilient, in fact with a slight positive performance. This is why despite the S-REIT overall market cap remained resilient, despite the drop in average Price/NAV values.

As mentioned above, with this drop in REIT prices for the small market cap REITs, this inflated the TTM Yields of these REITs. See the table below:

- Manulife US REIT (17.27% –> 22.62%)

- Prime US REIT (17.01% –> 21.13%)

- EC World REIT (13.23% –> 19.38%)

- Keppel Pacific Oak US REIT (12.75% –> (15.61%)

- United Hampshire REIT (12.00% –> 15.06%)

- Lippo Malls Indonesia Retail REIT (11.92% –> 12.65%)

Therefore, in light of these performance, let me repeat: yield should not be the only consideration for choosing a REIT! If you want, you can consult me on how to choose your REITs to invest in.

Technically, FTSE ST REIT Index is trading within a Symmetrical Triangle, which is a medium-term consolidation chart pattern. It is predicted the REIT index will be range bound for a while until the next breakout (probably until the next rate hike in May). Based on the most recent dot plot, US Fed will probably increase another 25 bps and interest rate will peak at 5.1%. The US Fed may start to cut interest rate at the end of 2023 / beginning of 2024 as there is 70% probability US enters into recession in 2023. The drop in 10 years risk free rate has given some indication that interest rate will be coming down in the very near future. Cutting interest rate will favorite the real estate and REITs sector.

Based on the current overall S-REIT P/NAV of 0.84 and current average DPU yield of 8.4%, the Singapore REITs sector is extremely attractive and possibly has bottomed. 2023 would be a cautiously bullish for S-REITs but investors have to be very selective with fundamentally strong S-REITs.

I will be speaking at the coming REITs Symposium on May 20-2023 with the topic of “Insight of Best Performing REITs”

I will be sharing the common characteristics of those REITs that investors should pay attention to. You can register the event at the following link.

See you physically at 2023 REITs Symposium!

Note: This above analysis is for my own personal research and it is NOT a buy or sell recommendation. Investors who would like to leverage my extensive research and years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

Kenny Loh is a Wealth Advisory Director and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair. You can join my Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement